Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current answers are incorrect somehow. Please use the provided data and explain how to correctly calculate the following for part a: begin{tabular}{|c|c|} hline multicolumn{2}{|c|}{ZachIndustriesBalanceSheetDecember31,2015}

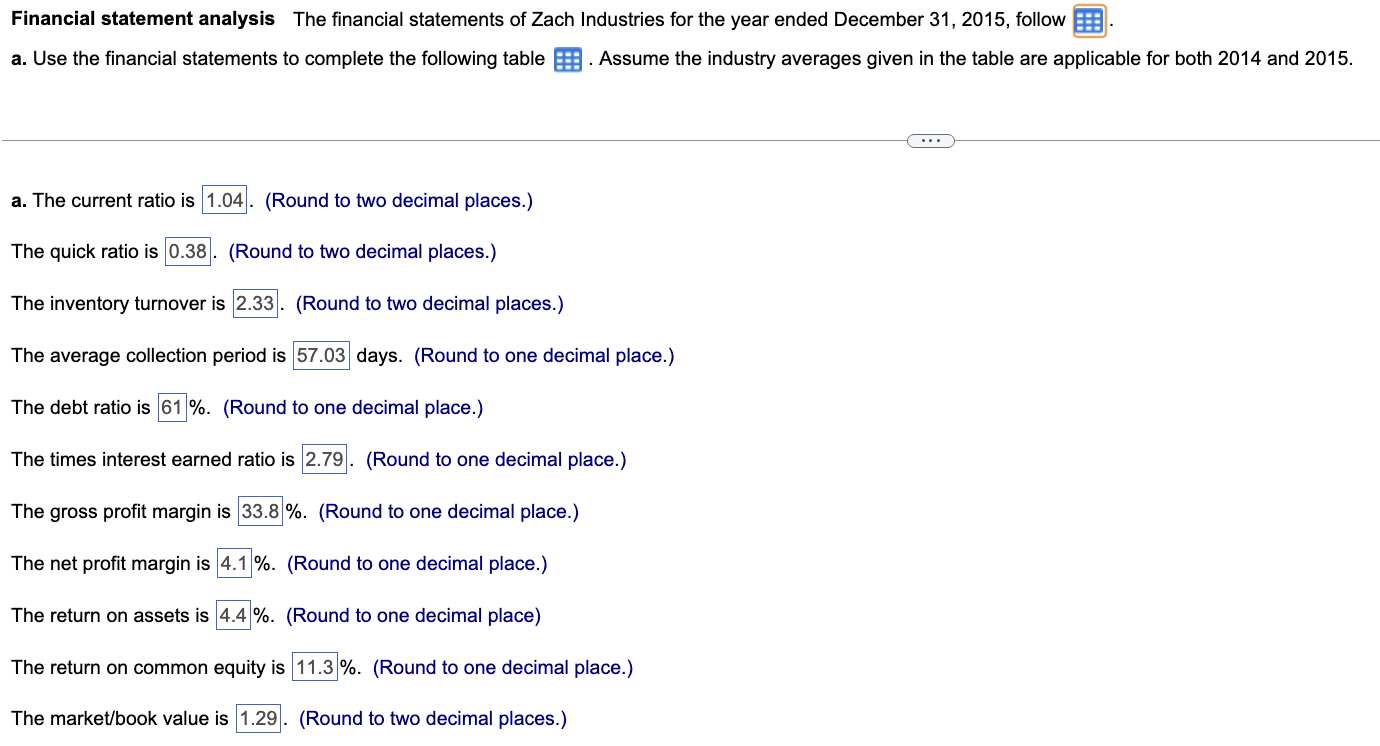

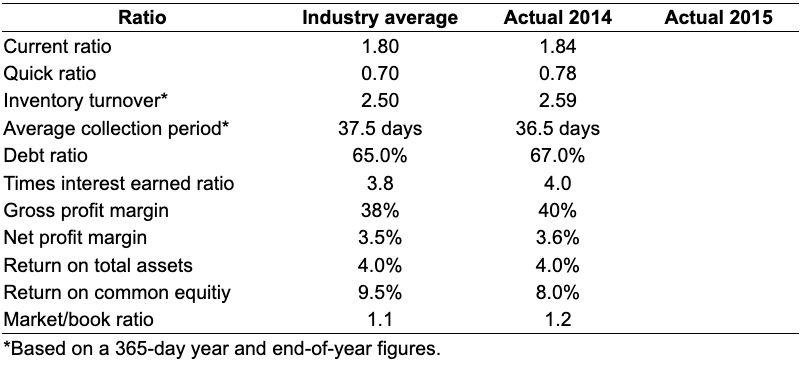

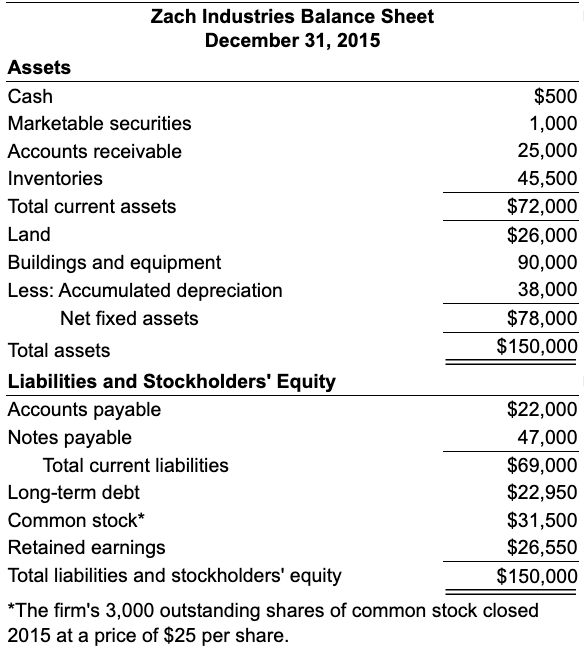

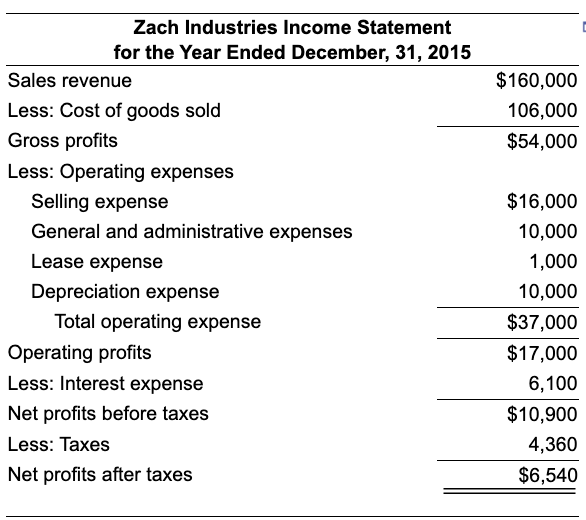

The current answers are incorrect somehow. Please use the provided data and explain how to correctly calculate the following for part a:

\begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ZachIndustriesBalanceSheetDecember31,2015} \\ \hline Assets & \\ \hline Cash & $500 \\ \hline Marketable securities & 1,000 \\ \hline Accounts receivable & 25,000 \\ \hline Inventories & 45,500 \\ \hline Total current assets & $72,000 \\ \hline Land & $26,000 \\ \hline Buildings and equipment & 90,000 \\ \hline Less: Accumulated depreciation & 38,000 \\ \hline Net fixed assets & $78,000 \\ \hline Total assets & $150,000 \\ \hline \multicolumn{2}{|l|}{ Liabilities and Stockholders' Equity } \\ \hline Accounts payable & $22,000 \\ \hline Notes payable & 47,000 \\ \hline Total current liabilities & $69,000 \\ \hline Long-term debt & $22,950 \\ \hline Common stock & $31,500 \\ \hline Retained earnings & $26,550 \\ \hline Total liabilities and stockholders' equity & $150,000 \\ \hline \end{tabular} Financial statement analysis The financial statements of Zach Industries for the year ended December 31,2015 , follow a. Use the financial statements to complete the following table . Assume the industry averages given in the table are applicable for both 2014 and 2015. a. The current ratio is 1.04 . (Round to two decimal places.) The quick ratio is (Round to two decimal places.) The inventory turnover is (Round to two decimal places.) The average collection period is days. (Round to one decimal place.) The debt ratio is \%. (Round to one decimal place.) The times interest earned ratio is (Round to one decimal place.) The gross profit margin is \%. (Round to one decimal place.) The net profit margin is \%. (Round to one decimal place.) The return on assets is 4.4%. (Round to one decimal place) The return on common equity is \%. (Round to one decimal place.) The market/book value is (Round to two decimal places.) *Based on a 365-day year and end-of-year figures. \begin{tabular}{lr} \hline \multicolumn{2}{c}{ZachIndustriesIncomeStatementfortheYearEndedDecember,31,2015} \\ \hline Sales revenue & $160,000 \\ Less: Cost of goods sold & 106,000 \\ Gross profits & $54,000 \\ Less: Operating expenses & \\ Selling expense & $16,000 \\ General and administrative expenses & 10,000 \\ Lease expense & 1,000 \\ Depreciation expense & 10,000 \\ Total operating expense & $37,000 \\ Operating profits & $17,000 \\ Less: Interest expense & 6,100 \\ Net profits before taxes & $10,900 \\ Less: Taxes & 4,360 \\ Net profits after taxes & $6,540 \\ & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started