Answered step by step

Verified Expert Solution

Question

1 Approved Answer

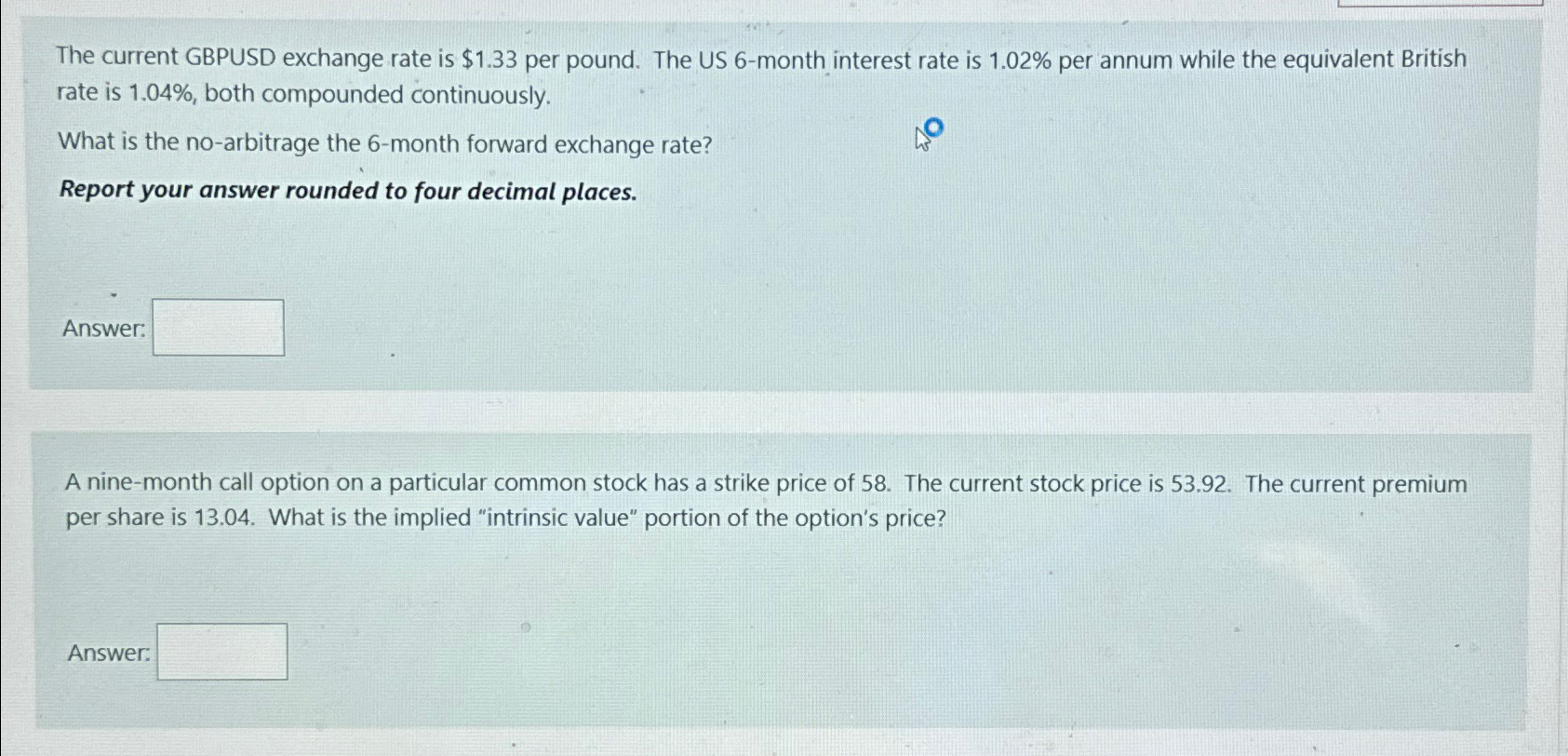

The current GBPUSD exchange rate is $ 1 . 3 3 per pound. The US 6 - month interest rate is 1 . 0 2

The current GBPUSD exchange rate is $ per pound. The US month interest rate is per annum while the equivalent British rate is both compounded continuously.

What is the noarbitrage the month forward exchange rate?

Report your answer rounded to four decimal places.

Answer:

A ninemonth call option on a particular common stock has a strike price of The current stock price is The current premium per share is What is the implied "intrinsic value" portion of the option's price?

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started