Answered step by step

Verified Expert Solution

Question

1 Approved Answer

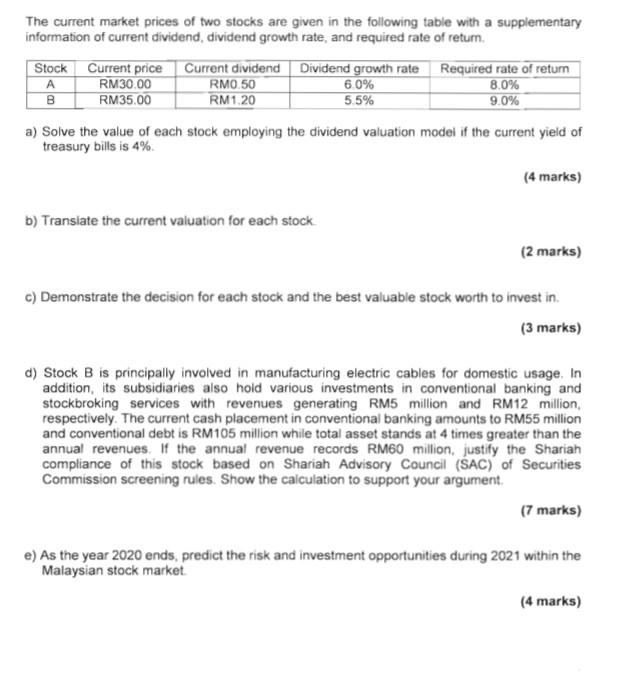

The current market prices of two stocks are given in the following table with a supplementary information of current dividend, dividend growth rate, and required

The current market prices of two stocks are given in the following table with a supplementary information of current dividend, dividend growth rate, and required rate of return. a) Solve the value of each stock employing the dividend valuation model if the current yield of treasury bills is 4%. (4 marks) b) Transiate the current valuation for each stock. (2 marks) c) Demonstrate the decision for each stock and the best valuable stock worth to invest in. (3 marks) d) Stock B is principally involved in manufacturing electric cables for domestic usage. In addition, its subsidiaries also hoid various investments in conventional banking and stockbroking services with revenues generating RM5 million and RM12 million, respectively. The current cash placement in conventional banking amounts to RM55 million and conventional debt is RM105 million while total asset stands at 4 times greater than the annual revenues. If the annual revenue records RM60 million, justify the Shariah compliance of this stock based on Shariah Advisory Council (SAC) of Securities Commission screening rules. Show the calculation to support your argument. (7 marks) e) As the year 2020 ends, predict the risk and investment opportunities during 2021 within the Malaysian stock market. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started