Answered step by step

Verified Expert Solution

Question

1 Approved Answer

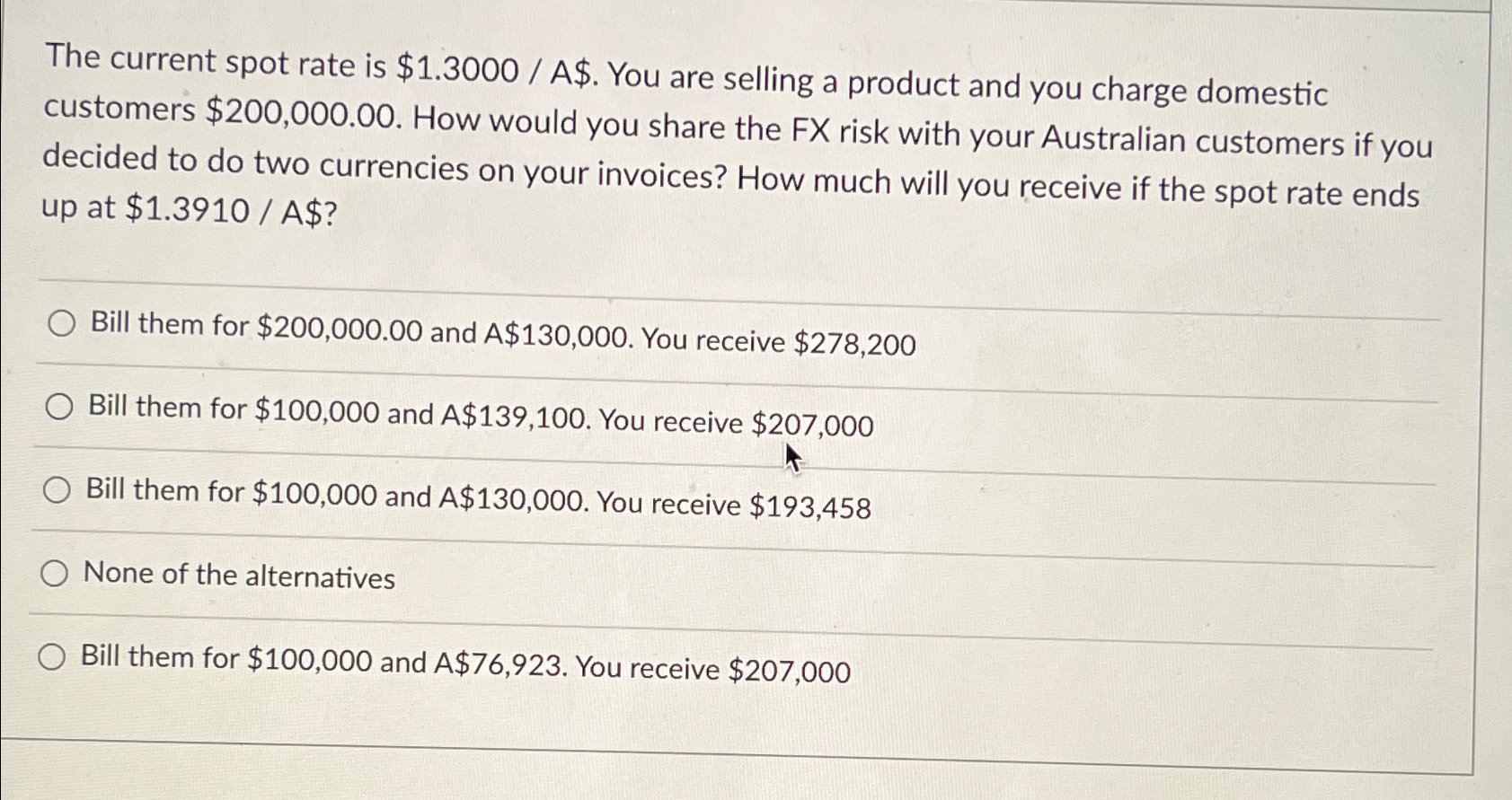

The current spot rate is $ 1 . 3 0 0 0 / A$ . You are selling a product and you charge domestic customers

The current spot rate is $ A$ You are selling a product and you charge domestic customers $ How would you share the FX risk with your Australian customers if you decided to do two currencies on your invoices? How much will you receive if the spot rate ends up at $ A $

Bill them for $ and $ You receive $

Bill them for $ and You receive $

Bill them for $ and $ You receive $

None of the alternatives

Bill them for $ and $ You receive $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started