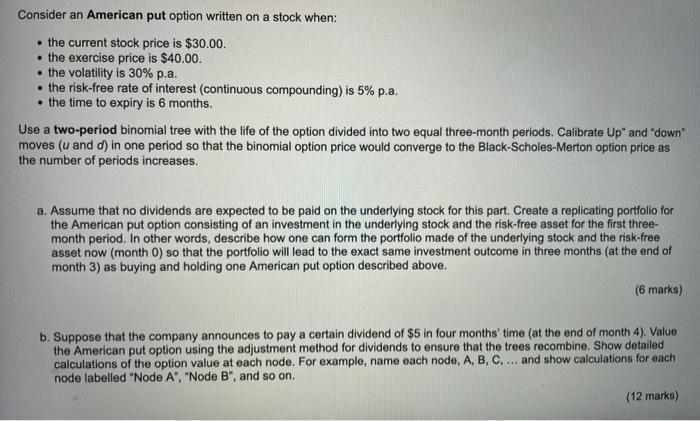

- the current stock price is $30.00. - the exercise price is $40.00. - the volatility is 30% p.a. - the risk-free rate of interest (continuous compounding) is 5% p.a. - the time to expiry is 6 months. Use a two-period binomial tree with the life of the option divided into two equal three-month periods. Calibrate Up" and "down" moves (u and d) in one period so that the binomial option price would converge to the Black-Scholes-Merton option price as the number of periods increases. a. Assume that no dividends are expected to be paid on the underlying stock for this part. Create a replicating portfolio for the American put option consisting of an investment in the underlying stock and the risk-free asset for the first threemonth period. In other words, describe how one can form the portfolio made of the underlying stock and the risk-free asset now (month 0 ) so that the portfolio will lead to the exact same investment outcome in three months (at the end of month 3) as buying and holding one American put option described above. (6 marks) b. Suppose that the company announces to pay a certain dividend of $5 in four months' time (at the end of month 4 ). Value the American put option using the adjustment method for dividends to ensure that the trees recombine. Show detailed calculations of the option value at each node. For example, name each node, A, B, C.... and show calculations for each node labelled "Node A", "Node B", and so on. (12 marks) - the current stock price is $30.00. - the exercise price is $40.00. - the volatility is 30% p.a. - the risk-free rate of interest (continuous compounding) is 5% p.a. - the time to expiry is 6 months. Use a two-period binomial tree with the life of the option divided into two equal three-month periods. Calibrate Up" and "down" moves (u and d) in one period so that the binomial option price would converge to the Black-Scholes-Merton option price as the number of periods increases. a. Assume that no dividends are expected to be paid on the underlying stock for this part. Create a replicating portfolio for the American put option consisting of an investment in the underlying stock and the risk-free asset for the first threemonth period. In other words, describe how one can form the portfolio made of the underlying stock and the risk-free asset now (month 0 ) so that the portfolio will lead to the exact same investment outcome in three months (at the end of month 3) as buying and holding one American put option described above. (6 marks) b. Suppose that the company announces to pay a certain dividend of $5 in four months' time (at the end of month 4 ). Value the American put option using the adjustment method for dividends to ensure that the trees recombine. Show detailed calculations of the option value at each node. For example, name each node, A, B, C.... and show calculations for each node labelled "Node A", "Node B", and so on. (12 marks)