Answered step by step

Verified Expert Solution

Question

1 Approved Answer

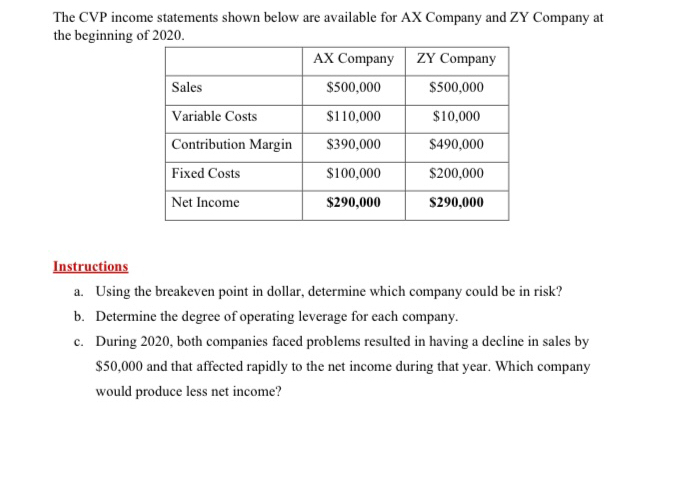

The CVP income statements shown below are available for AX Company and ZY Company at the beginning of 2020. AX Company ZY Company Sales

The CVP income statements shown below are available for AX Company and ZY Company at the beginning of 2020. AX Company ZY Company Sales $500,000 $500,000 Variable Costs $110,000 $10,000 Contribution Margin $390,000 $490,000 Fixed Costs $100,000 $200,000 Net Income $290,000 $290,000 Instructions a. Using the breakeven point in dollar, determine which company could be in risk? b. Determine the degree of operating leverage for each company. c. During 2020, both companies faced problems resulted in having a decline in sales by $50,000 and that affected rapidly to the net income during that year. Which company would produce less net income?

Step by Step Solution

★★★★★

3.23 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To determine which company could be at risk we need to calculate the breakeven point in dollars fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started