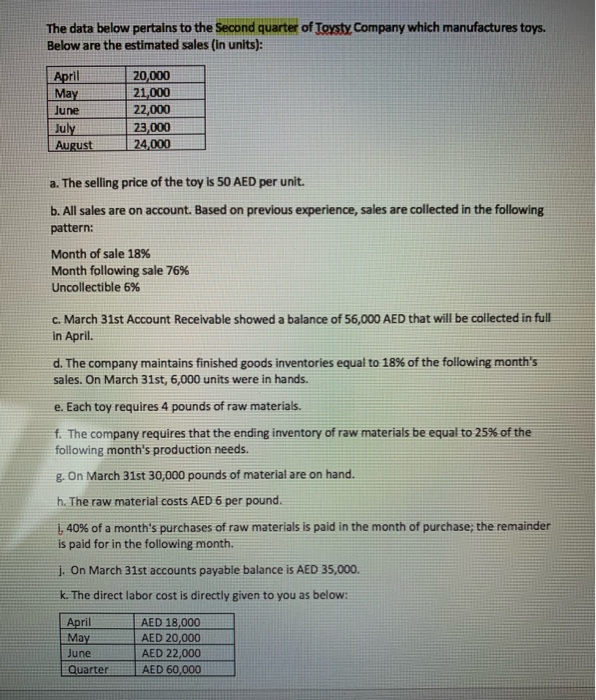

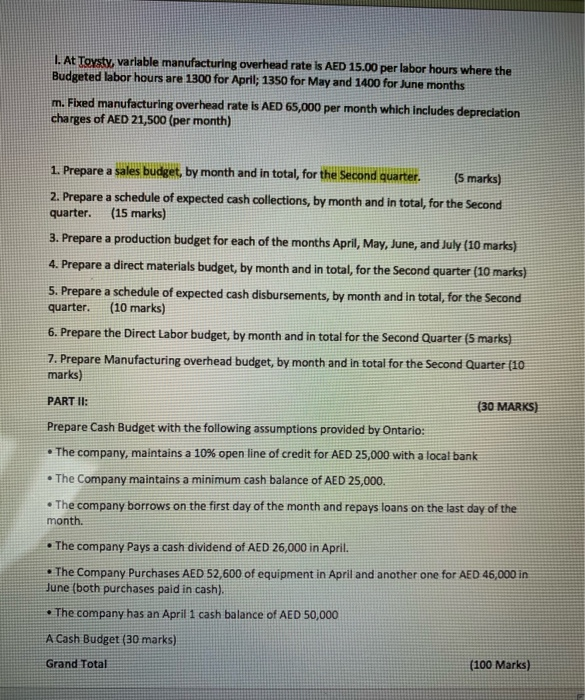

The data below pertains to the Second quarter of Toysty Company which manufactures toys. Below are the estimated sales (in units): April May une 20,000 21,000 22,000 23,000 24,000 July August a. The selling price of the toy is 50 AED per unit. b. All sales are on account. Based on previous experience, sales are collected in the following pattern: Month of sale 18% Month following sale 76% Uncollectible 6% c. March 31st Account Receivable showed a balance of 56,000 AED that will be collected in full in April. d. The company maintains finished goods inventories equal to 18% of the following month's sales. On March 31st, 6,000 units were in hands e. Each toy requires 4 pounds of raw materials. f. The company requires that the ending inventory of raw materials be equal to 25% of the following month's production needs. g. On March 31st 30,000 pounds of material are on hand. h. The raw material costs AED 6 per pound. 1, 40% of a month's purchases of raw materials is paid in the month of purchase; the remainder is paid for in the following month. j. On March 31st accounts payable balance is AED 35,000 k. The direct labor cost is directly given to you as below: April May June AED 18,000 AED 20,000 AED 22,000 AED 60,000 Quarter 1. At Toysty, variable manufacturing overhead rate is AED 15.00 per labor hours where the Budgeted labor hours are 1300 for April; 1350 for May and 1400 for June months m. Fixed manufacturing overhead rate is AED 65,000 per month which includes depreciation charges of AED 21,500 (per month) 1. Prepare a sales budget, by month and in total, for the Second quarter. (5 marks) 2. Prepare a schedule of expected cash collections, by month and in total, for the Second quarter. (15 marks) 3. Prepare a production budget for each of the months April, May, June, and July (10 marks) 4. Prepare a direct materials budget, by month and in total, for the Second quarter (10 marks) 5. Prepare a schedule of expected cash disbursements, by month and in total, for the Second quarter. (10 marks) 6. Prepare the Direct Labor budget, by month and in total for the Second Quarter (5 marks) 7. Prepare Manufacturing overhead budget, by month and in total for the Second Quarter (10 marks) PART II: (30 MARKS) Prepare Cash Budget with the following assumptions provided by Ontario: The company, maintains a 10% open line of credit for AED 25,000 with a local bank The Company maintains a minimum cash balance of AED 25,000 The company borrows on the first day of the month and repays loans on the last day of the month. The company Pays a cash dividend of AED 26,000 in April. The Company Purchases AED 52,600 of equipment in April and another one for AED 46,000 in June (both purchases paid in cash). The company has an April 1 cash balance of AED 50,000 A Cash Budget (30 marks) Grand Total (100 Marks)