Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the data is in the first picture where it talks about the useful life of five years. thsi is the only data that us given.

the data is in the first picture where it talks about the useful life of five years. thsi is the only data that us given.

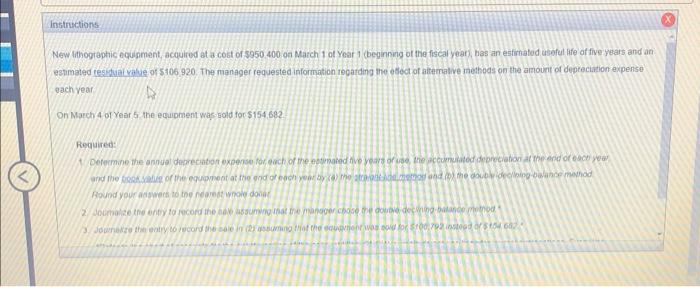

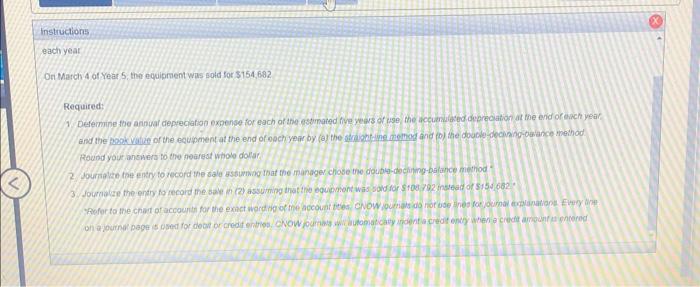

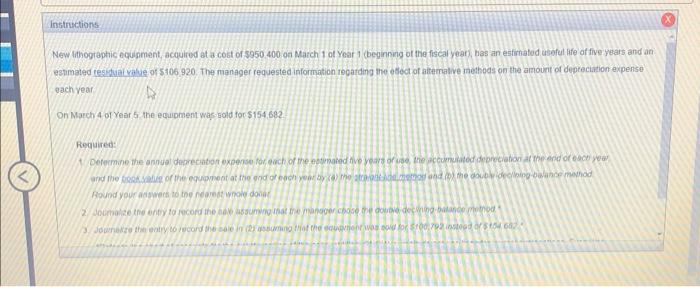

Instructions each year On March of Year 5. the equipment was sold for $154,682 Required: 1 Determine the annual depreciation expense for each of the estimated five years of use the course depreciation at the end of each year and the book of the equipment at the end of ooch year by te the one thod and the doucle dean-wance method Round your answers to the nearest Whole dollar 2 Journal entry to record the sale sung Thar the manager chose the double-dechow-balance method 3. Journace the entry to record the cent) assuming that the equipment was sold for Sto/92 instead of $154682 Refer to the chat of accounts for the exact word of the account NOW ou do not bones for our nation Every on our page for debitor credit to CNOW Wacanta credendo che amount tored Instructions New lithographic equipment, acquired at a cost of $950 400 on March 1 of Year 1 (beginning of the fiscal year), has an estimated useful life of five years and an estimated residual value of 106 920. The manager requested information regarding the effect of alterative methods on the amount of depreciation expenso each year On March 4 of Year 5 the equipment was sold for $154.682 Required: Determine the annual precio expach of the stated rivers of the accumulated depreciation and orechy and the of the eguament at the end of each year by me and the decling ban mod Round your wordt door 2 omale the only to record the main che double decide to 3. Jothey to record the lining of the Word Instructions each year On March of Year 5. the equipment was sold for $154,682 Required: 1 Determine the annual depreciation expense for each of the estimated five years of use the course depreciation at the end of each year and the book of the equipment at the end of ooch year by te the one thod and the doucle dean-wance method Round your answers to the nearest Whole dollar 2 Journal entry to record the sale sung Thar the manager chose the double-dechow-balance method 3. Journace the entry to record the cent) assuming that the equipment was sold for Sto/92 instead of $154682 Refer to the chat of accounts for the exact word of the account NOW ou do not bones for our nation Every on our page for debitor credit to CNOW Wacanta credendo che amount tored Instructions each year On March of Year 5. the equipment was sold for $154,682 Required: 1 Determine the annual depreciation expense for each of the estimated five years of use the course depreciation at the end of each year and the book of the equipment at the end of ooch year by te the one thod and the doucle dean-wance method Round your answers to the nearest Whole dollar 2 Journal entry to record the sale sung Thar the manager chose the double-dechow-balance method 3. Journace the entry to record the cent) assuming that the equipment was sold for Sto/92 instead of $154682 Refer to the chat of accounts for the exact word of the account NOW ou do not bones for our nation Every on our page for debitor credit to CNOW Wacanta credendo che amount tored Instructions Newlithographic equipment acquired at a cost of $950 400 on March 1 of Year 1 (beginning of the fiscal year), has an estimated useful life of five years and an estimated residual value of 106 920. The manager requested information regarding the effect of alternative methods on the amount of depreciation expenso each year On March 4 of Year 5 the equipment was sold for $154 682 Required: 1 Determine the annual precio expach of the estimated live years of the commune depreciation at the end of each your and the book of the equipment at the end of each yow by more and the goldenwance method Round your own tone antwol donar 2 om te only to record the name chose deg bod 3 Joweto try to record the sale in the assorto.72 stor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started