Answered step by step

Verified Expert Solution

Question

1 Approved Answer

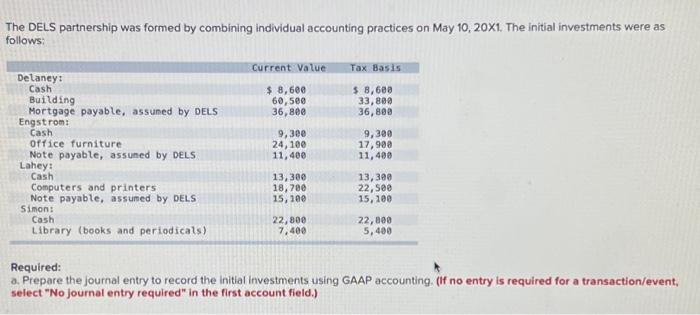

The DELS partnership was formed by combining individual accounting practices on May 10, 20X1. The initial investments were as follows: Delaney: Cash Building Mortgage payable,

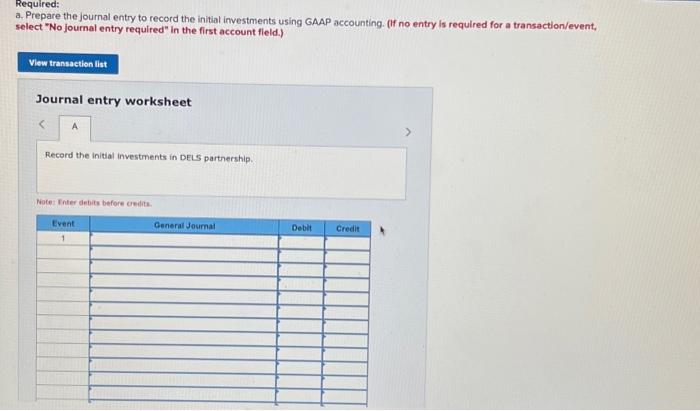

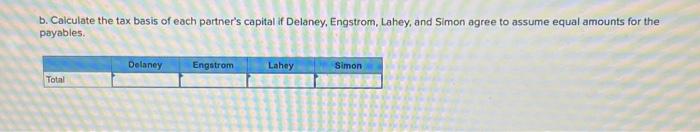

The DELS partnership was formed by combining individual accounting practices on May 10, 20X1. The initial investments were as follows: Delaney: Cash Building Mortgage payable, assumed by DELS Engstrom: Cash Office furniture Note payable, assumed by DELS Lahey: Cash Computers and printers Note payable, assumed by DELS Simon: Cash Library (books and periodicals) Current Value $ 8,600 60,500 36,800 9,300 24,100 11,400 13,300 18,700 15, 100 22,800 7,400 Tax Basis $ 8,600 33,800 36,800 9,300 17,900 11,400 13,300 22,500 15, 100 22,800 5,400 Required: a. Prepare the journal entry to record the initial investments using GAAP accounting. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started