Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the direct or the indirect method to report the t Appendix 5A) Preparing the Statement of Cash Flows with Sale of Equipment (Indi Method) (P5-B)

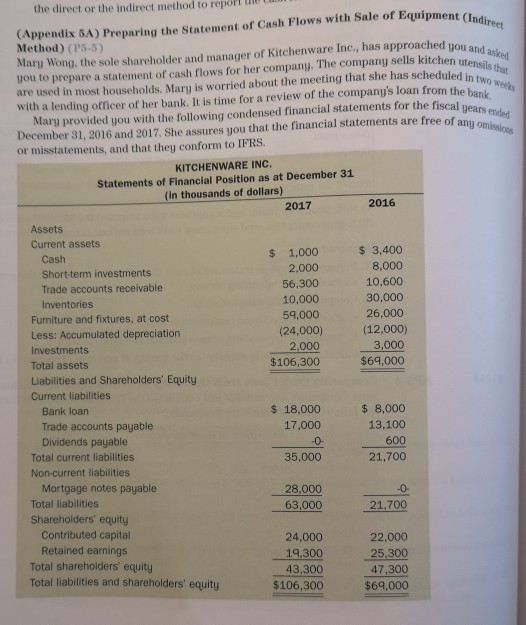

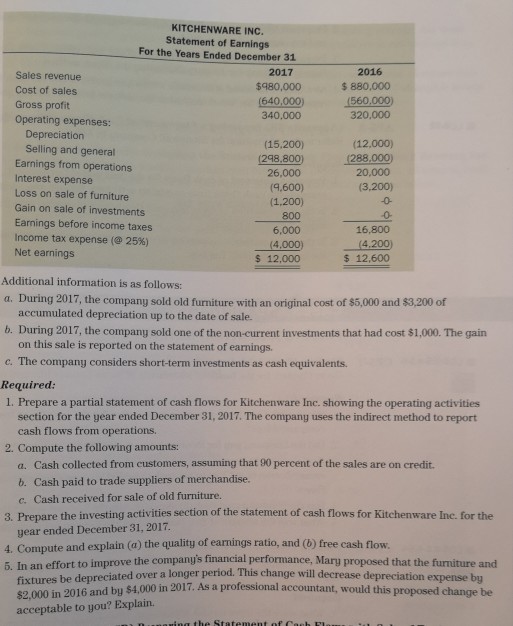

the direct or the indirect method to report the t Appendix 5A) Preparing the Statement of Cash Flows with Sale of Equipment (Indi Method) (P5-B) Mary Wong, the sole shareholder and manager of Kitchenware Inc, has approached you and you to prepare a statement of cash flows for her company. The company sells kitc are used in most households. Mary is worried about the meeting that she has scheduled in t with a lending officer of her bank. It is time for a review of the company's loan from the baW Mary provided you with the following condensed financial statements for the fiscal years y o ended December 31, 2016 and 2017. She assures you that the financial statements are free of an or misstatements, and that they conform to IFRS. KITCHENWARE INC. Statements of Financial Position as at December 31 (in thousands of dollars) 2017 2016 Assets Current assets $ 1,000 2.000 56,300 10,000 59,000 (24,000) 2.000 $106,300 $ 3,400 8,000 10,600 30,000 26,000 (12,000) Cash Shortterm investments Trade accounts receivable Inventories Furniture and fixtures, at cost Less: Accumulated depreciation Investments Total assets Liabilities and Shareholders' Equity Current liabilities $64,000 Bank loarn Trade accounts payable Dividends payable $ 18,000 17,000 8,000 13,100 600 21,700 Total current liabilities Non-current liabilities 35,000 Mortgage notes payable Total liabilities 28,000 63,000 21,700 Shareholders' equity Contributed capital Retained earnings Total shareholders' equity 24,000 19.300 43.300 $106,300 22,000 25,300 47,300 $69,000 Total liabilities and shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started