Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The discount factor for the Present Value of a dollar is .22668, the annuity it is 4.83323, for 20%, the factors are .16151 and 4.19247

The discount factor for the Present Value of a dollar is .22668, the annuity it is 4.83323, for 20%, the factors are .16151 and 4.19247 respectively

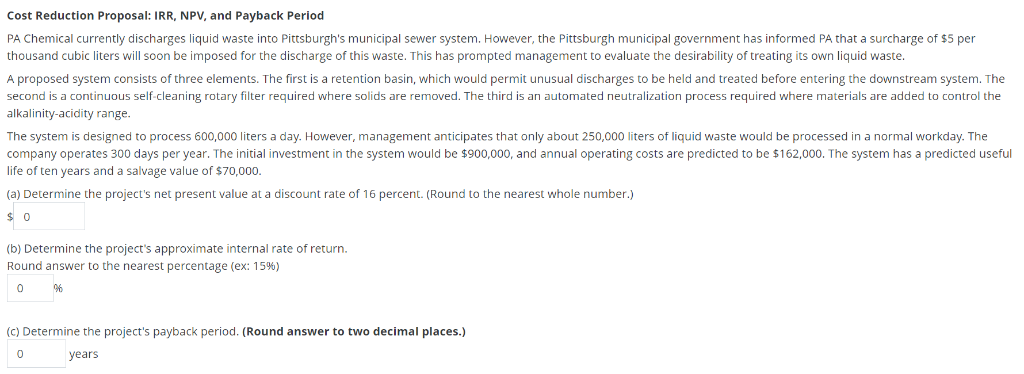

Cost Reduction Proposal: IRR, NPV, and Payback Period PA Chemical currently discharges liquid waste into Pittsburgh's municipal sewer system. However, the Pittsburgh municipal government has informed PA that a surcharge of $5 per thousand cubic liters will soon be imposed for the discharge of this waste. This has prompted management to evaluate the desirability of treating its own liquid waste. A proposed system consists of three elements. The first is a retention basin, which would permit unusual discharges to be held and treated before entering the downstream system. The second is a continuous self-cleaning rotary filter required where solids are removed. The third is an automated neutralization process required where materials are added to control the alkalinity-acidity range. The system is designed to process 600,000 liters a day. However, management anticipates that only about 250,000 liters f liquid waste would be processed in a normal workday. The company operates 300 days per year. The initial investment in the system would be $900,000, and annual operating costs are predicted to be $162,000. The system has a predicted useful life of ten years and a salvage value of $70,000 (a) Determine the project's net present value at discount rate of 16 percent. (Round to the nearest whole number.) 0 (b) Determine the project's approximate internal rate of return. Round answer to the nearest percentage (ex: 15%) 06 (c) Determine the project's payback period. (Round answer to two decimal places.) yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started