Answered step by step

Verified Expert Solution

Question

1 Approved Answer

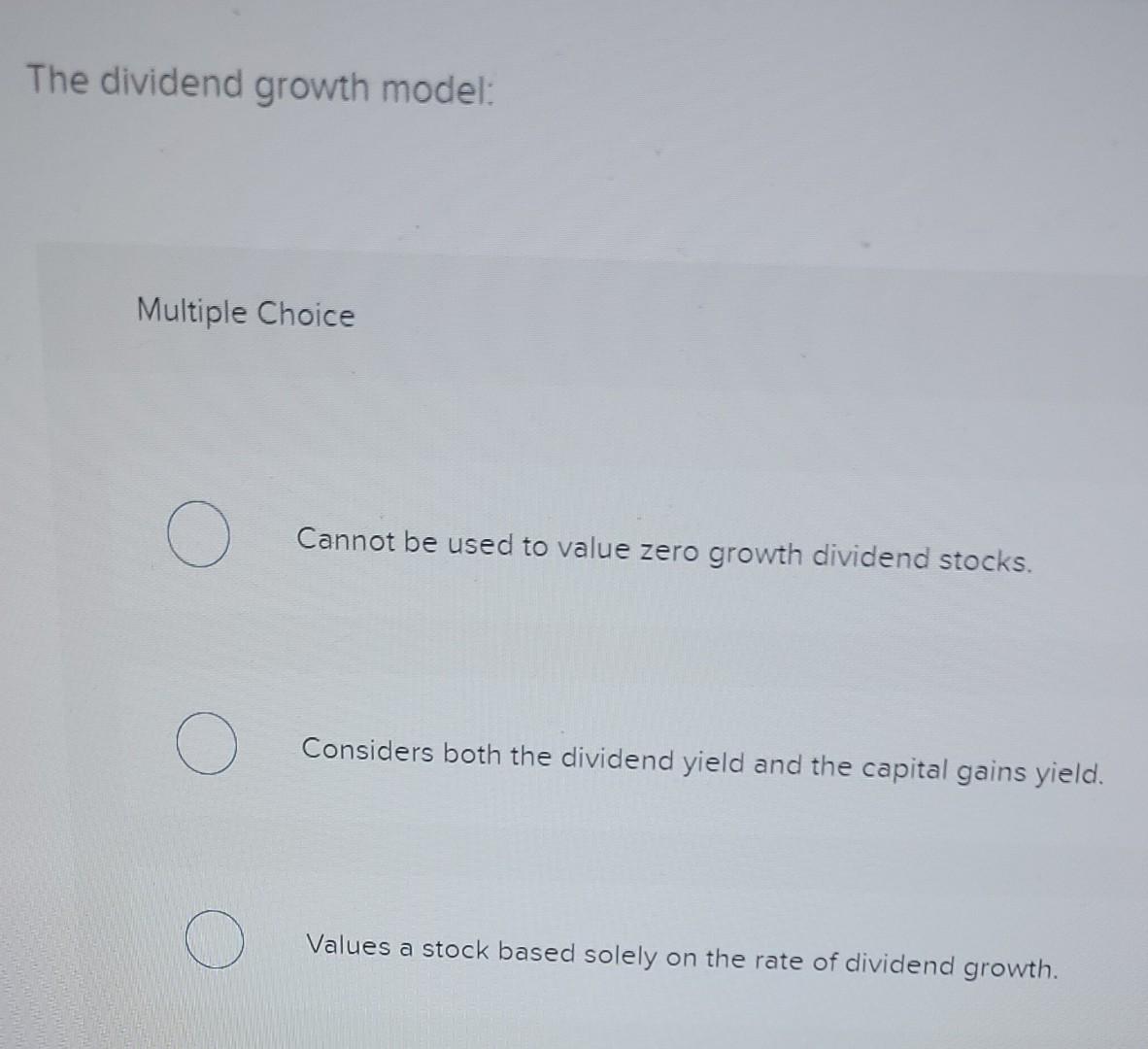

The dividend growth model: Multiple Choice Cannot be used to value zero growth dividend stocks. Considers both the dividend yield and the capital gains yield.

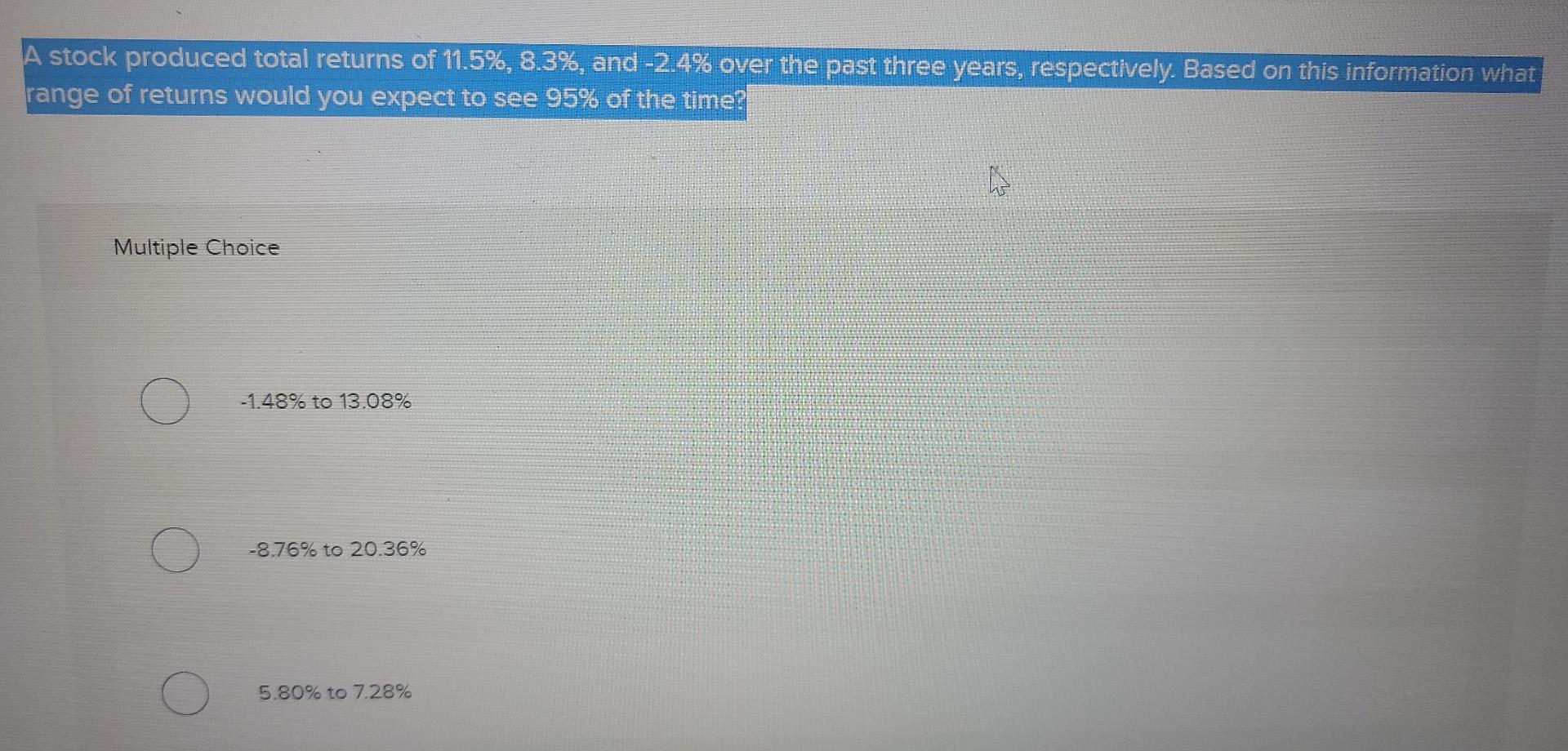

The dividend growth model: Multiple Choice Cannot be used to value zero growth dividend stocks. Considers both the dividend yield and the capital gains yield. Values a stock based solely on the rate of dividend growth. Is independent of an investor's required rate of return. Can be used to value all common stocks. A stock produced total returns of 11.5%, 8.3%, and -2.4% over the past three years, respectively. Based on this information what range of returns would you expect to see 95% of the time? Multiple Choice -1.48% to 13.08% -8.76% to 20.36% 5.80% to 7.28% -16.04% to 27.64% O -26.40% to 14.80%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started