Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The division manager accept the proposal because it will produce an economic Requirements 1. Compute the effect on the operating income of the company as

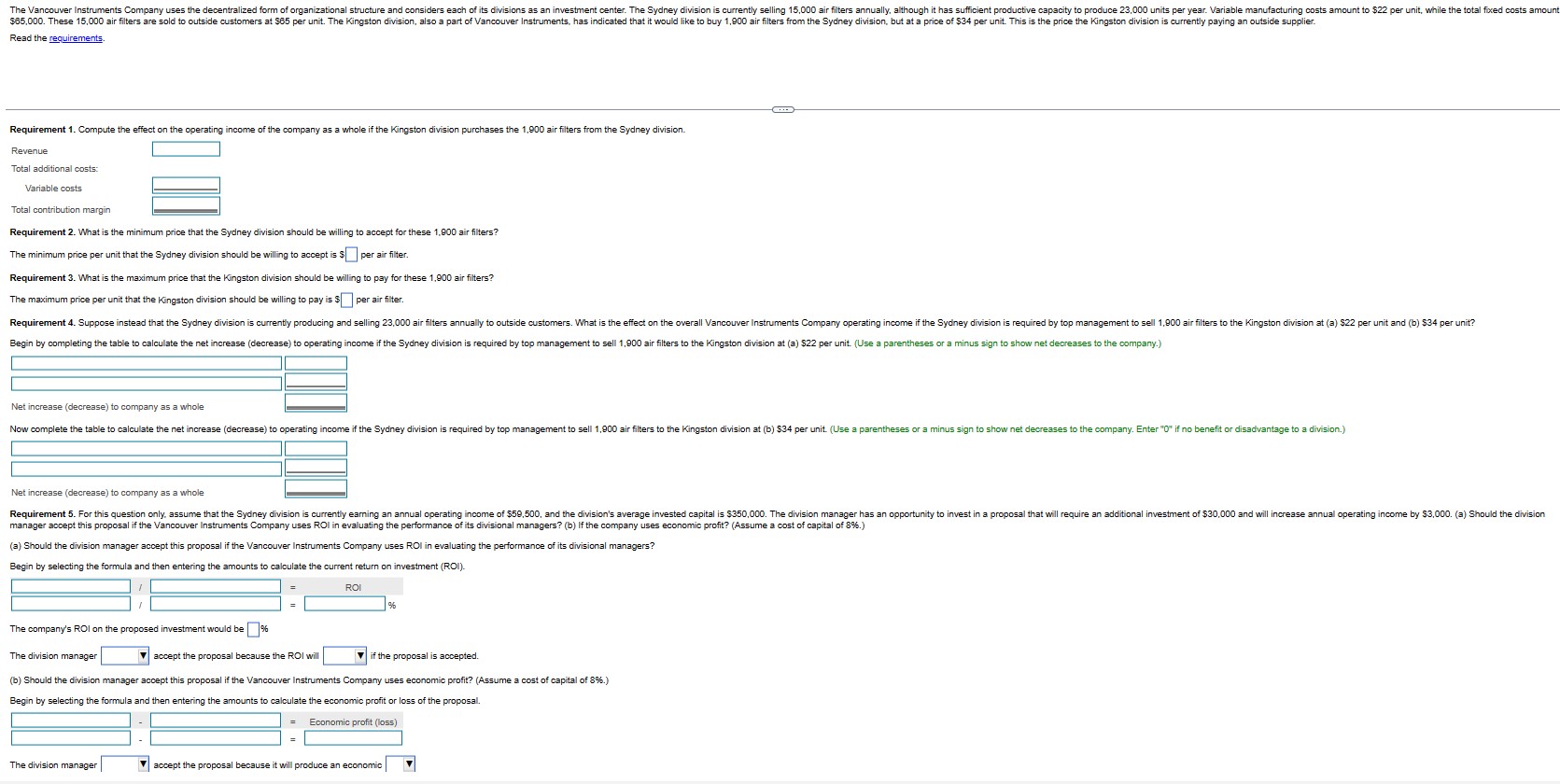

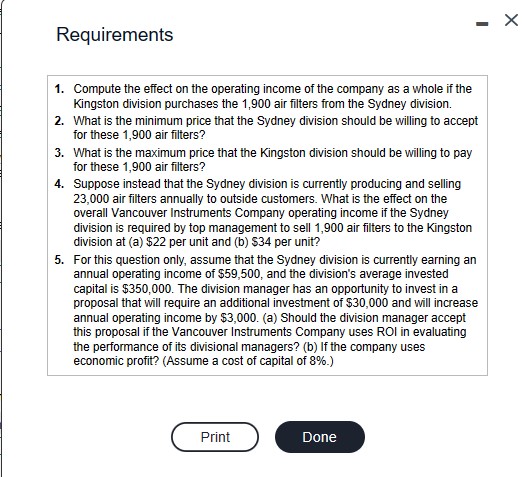

The division manager accept the proposal because it will produce an economic Requirements 1. Compute the effect on the operating income of the company as a whole if the Kingston division purchases the 1,900 air filters from the Sydney division. 2. What is the minimum price that the Sydney division should be willing to accept for these 1,900 air filters? 3. What is the maximum price that the Kingston division should be willing to pay for these 1,900 air filters? 4. Suppose instead that the Sydney division is currently producing and selling 23,000 air filters annually to outside customers. What is the effect on the overall Vancouver Instruments Company operating income if the Sydney division is required by top management to sell 1,900 air filters to the Kingston division at (a) \\$22 per unit and (b) \\( \\$ 34 \\) per unit? 5. For this question only, assume that the Sydney division is currently earning an annual operating income of \\( \\$ 59,500 \\), and the division's average invested capital is \\( \\$ 350,000 \\). The division manager has an opportunity to invest in a proposal that will require an additional investment of \\( \\$ 30,000 \\) and will increase annual operating income by \\( \\$ 3,000 \\). (a) Should the division manager accept this proposal if the Vancouver Instruments Company uses ROI in evaluating the performance of its divisional managers? (b) If the company uses economic profit? (Assume a cost of capital of \8.)

The division manager accept the proposal because it will produce an economic Requirements 1. Compute the effect on the operating income of the company as a whole if the Kingston division purchases the 1,900 air filters from the Sydney division. 2. What is the minimum price that the Sydney division should be willing to accept for these 1,900 air filters? 3. What is the maximum price that the Kingston division should be willing to pay for these 1,900 air filters? 4. Suppose instead that the Sydney division is currently producing and selling 23,000 air filters annually to outside customers. What is the effect on the overall Vancouver Instruments Company operating income if the Sydney division is required by top management to sell 1,900 air filters to the Kingston division at (a) \\$22 per unit and (b) \\( \\$ 34 \\) per unit? 5. For this question only, assume that the Sydney division is currently earning an annual operating income of \\( \\$ 59,500 \\), and the division's average invested capital is \\( \\$ 350,000 \\). The division manager has an opportunity to invest in a proposal that will require an additional investment of \\( \\$ 30,000 \\) and will increase annual operating income by \\( \\$ 3,000 \\). (a) Should the division manager accept this proposal if the Vancouver Instruments Company uses ROI in evaluating the performance of its divisional managers? (b) If the company uses economic profit? (Assume a cost of capital of \8.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started