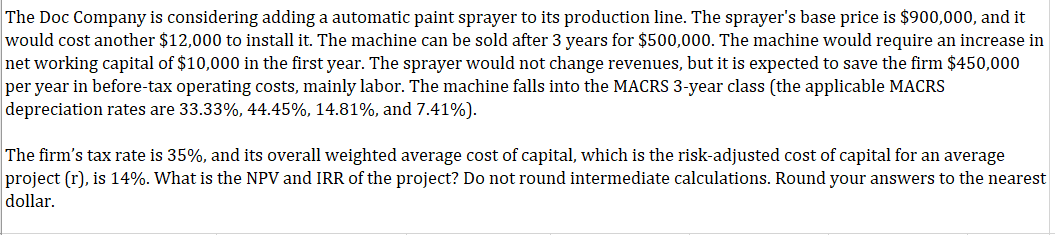

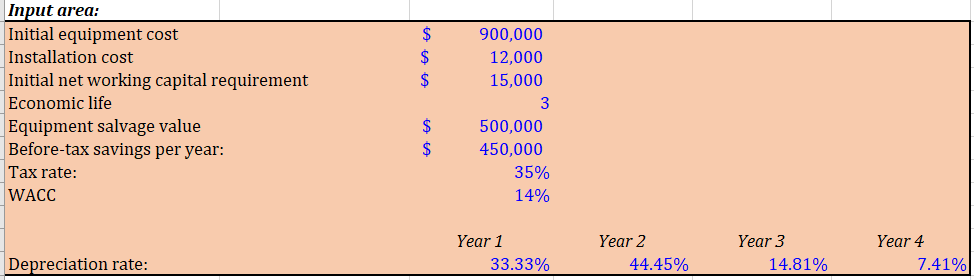

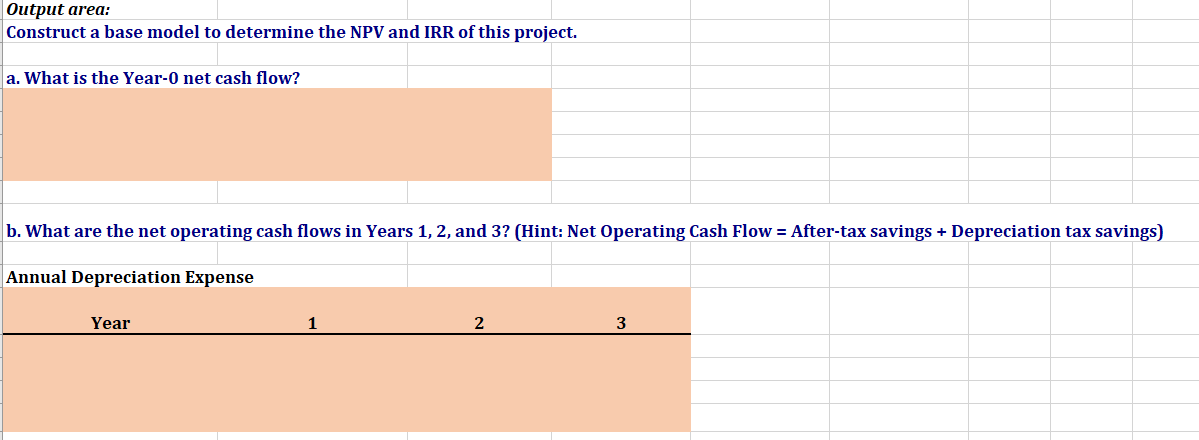

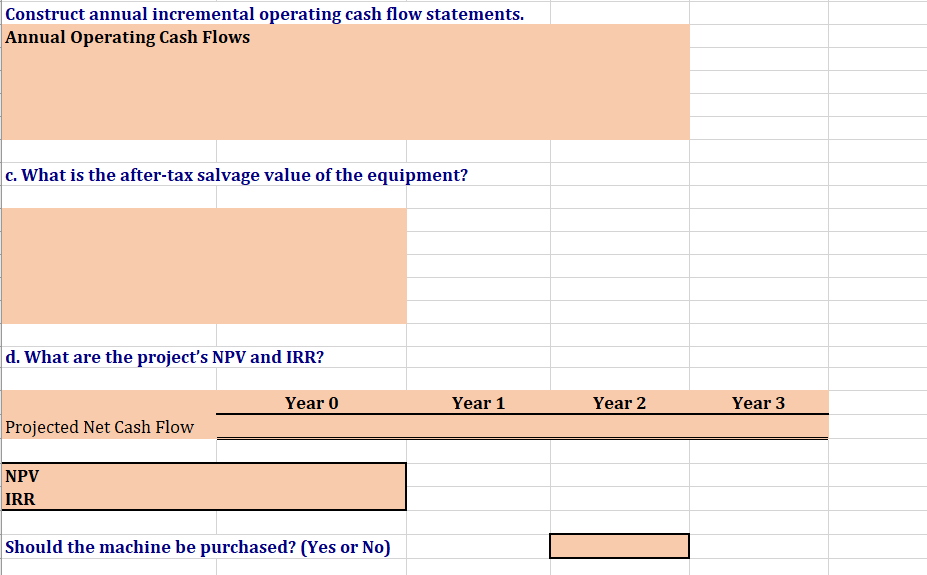

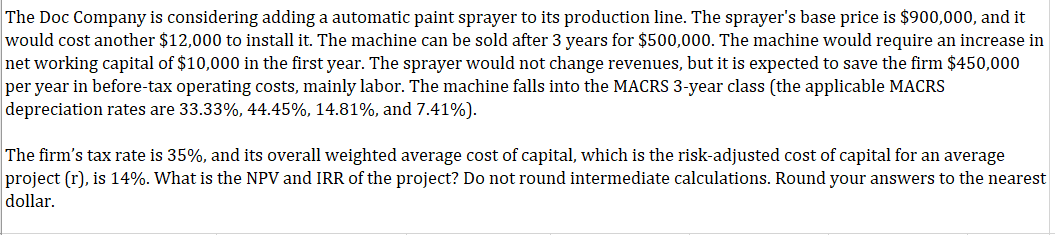

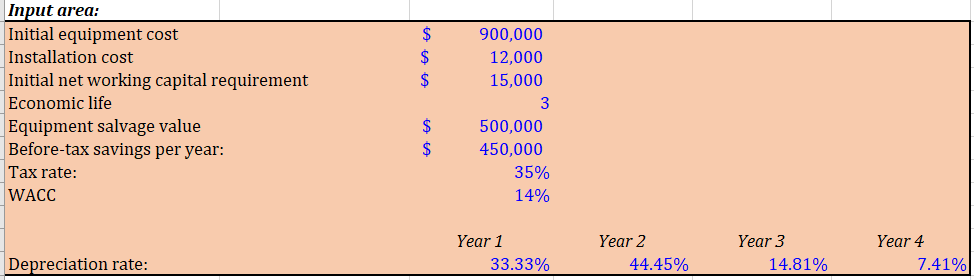

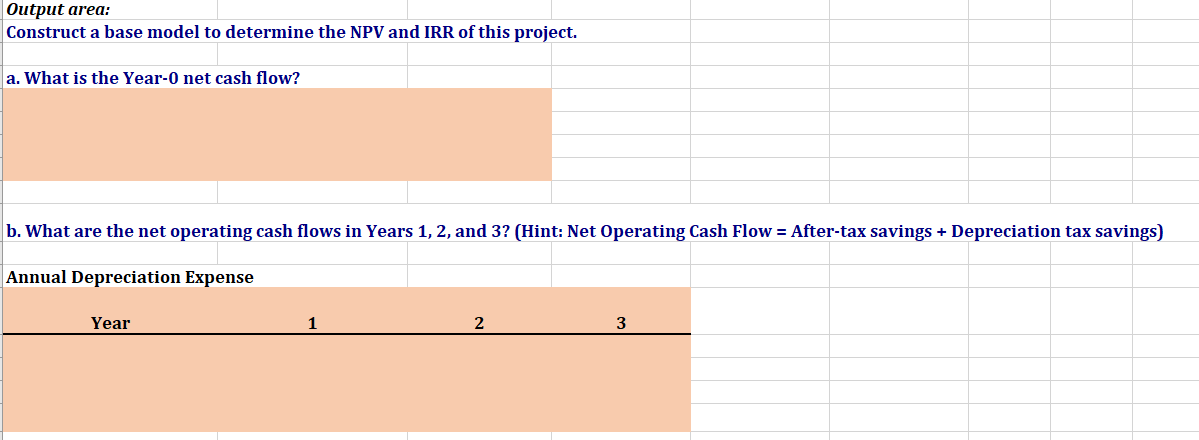

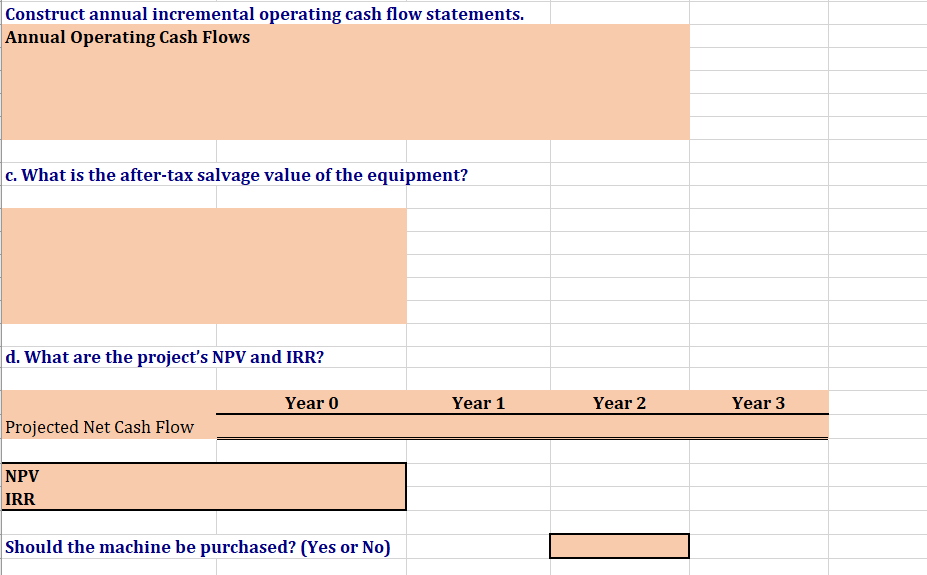

The Doc Company is considering adding a automatic paint sprayer to its production line. The sprayer's base price is $900,000, and it would cost another $12,000 to install it. The machine can be sold after 3 years for $500,000. The machine would require an increase in net working capital of $10,000 in the first year. The sprayer would not change revenues, but it is expected to save the firm $450,000 per year in before-tax operating costs, mainly labor. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%). The firm's tax rate is 35%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 14%. What is the NPV and IRR of the project? Do not round intermediate calculations. Round your answers to the nearest dollar. $ $ $ Input area: Initial equipment cost Installation cost Initial net working capital requirement Economic life Equipment salvage value Before-tax savings per year: Tax rate: WACC 900,000 12,000 15,000 3 500,000 450,000 35% 14% $ $ Year 1 33.33% Year 2 44.45% Year 3 14.81% Year 4 7.41% Depreciation rate: Output area: Construct a base model to determine the NPV and IRR of this project. a. What is the Year-O net cash flow? b. What are the net operating cash flows in Years 1, 2, and 3? (Hint: Net Operating Cash Flow = After-tax savings + Depreciation tax savings) Annual Depreciation Expense Year 1 2. 3 Construct annual incremental operating cash flow statements. Annual Operating Cash Flows c. What is the after-tax salvage value of the equipment? d. What are the project's NPV and IRR? Year 0 Year 1 Year 2 Year 3 Projected Net Cash Flow NPV IRR Should the machine be purchased? (Yes or No) The Doc Company is considering adding a automatic paint sprayer to its production line. The sprayer's base price is $900,000, and it would cost another $12,000 to install it. The machine can be sold after 3 years for $500,000. The machine would require an increase in net working capital of $10,000 in the first year. The sprayer would not change revenues, but it is expected to save the firm $450,000 per year in before-tax operating costs, mainly labor. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%). The firm's tax rate is 35%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 14%. What is the NPV and IRR of the project? Do not round intermediate calculations. Round your answers to the nearest dollar. $ $ $ Input area: Initial equipment cost Installation cost Initial net working capital requirement Economic life Equipment salvage value Before-tax savings per year: Tax rate: WACC 900,000 12,000 15,000 3 500,000 450,000 35% 14% $ $ Year 1 33.33% Year 2 44.45% Year 3 14.81% Year 4 7.41% Depreciation rate: Output area: Construct a base model to determine the NPV and IRR of this project. a. What is the Year-O net cash flow? b. What are the net operating cash flows in Years 1, 2, and 3? (Hint: Net Operating Cash Flow = After-tax savings + Depreciation tax savings) Annual Depreciation Expense Year 1 2. 3 Construct annual incremental operating cash flow statements. Annual Operating Cash Flows c. What is the after-tax salvage value of the equipment? d. What are the project's NPV and IRR? Year 0 Year 1 Year 2 Year 3 Projected Net Cash Flow NPV IRR Should the machine be purchased? (Yes or No)