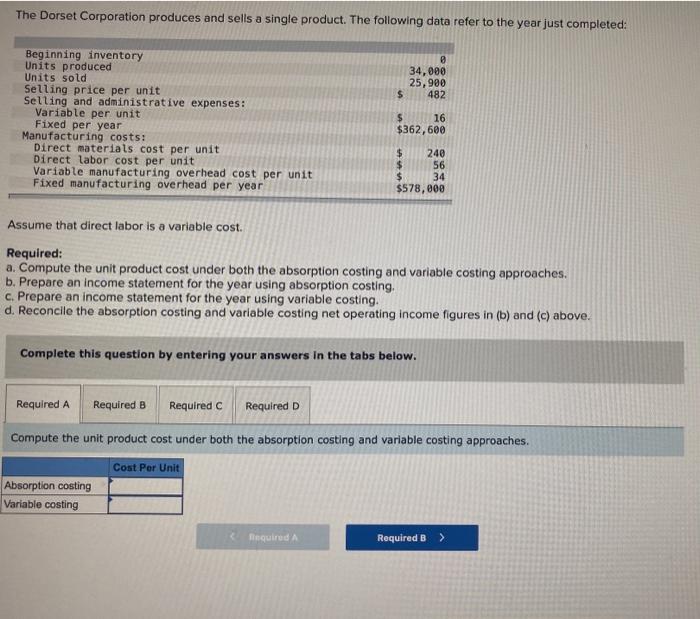

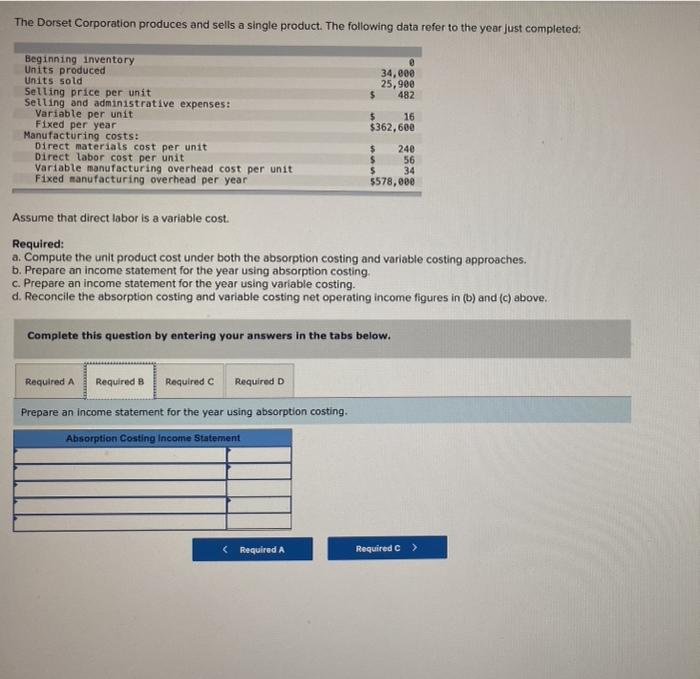

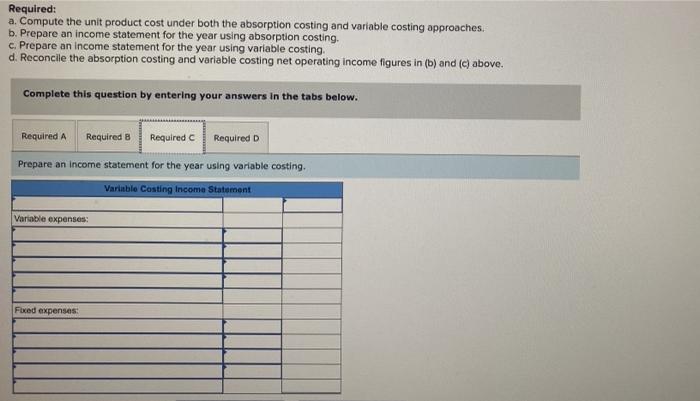

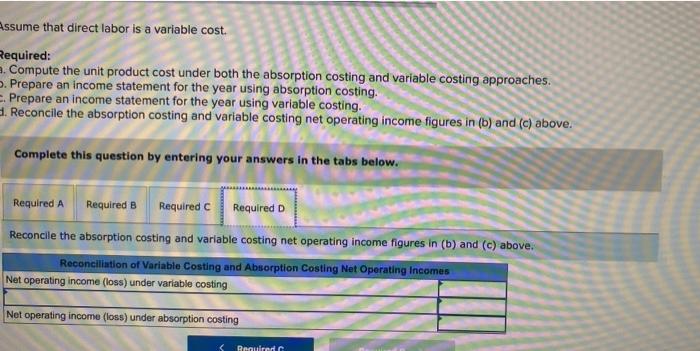

The Dorset Corporation produces and sells a single product. The following data refer to the year just completed: 34,000 25,900 482 $ Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed per year Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead per year $ 16 $362,600 $ 240 $ 56 $ 34 $578,000 Assume that direct labor is a variable cost. Required: a. Compute the unit product cost under both the absorption costing and variable costing approaches. b. Prepare an income statement for the year using absorption costing. c. Prepare an income statement for the year using variable costing. d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Compute the unit product cost under both the absorption costing and variable costing approaches. Cost Per Unit Absorption costing Variable costing equired A Required B > The Dorset Corporation produces and sells a single product. The following data refer to the year just completed: @ 34,000 25,900 $ 482 Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed per year Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead per year 16 5 $362,600 $ 240 $ 56 $ 34 5578,000 Assume that direct lobor is a variable cost. Required: a. Compute the unit product cost under both the absorption costing and variable costing approaches. b. Prepare an income statement for the year using absorption costing c. Prepare an income statement for the year using variable costing. d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Prepare an income statement for the year using absorption costing. Absorption Costing Income Statement Required: a. Compute the unit product cost under both the absorption costing and variable costing approaches. b. Prepare an income statement for the year using absorption costing. c. Prepare an income statement for the year using variable costing d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. Complete this question by entering your answers in the tabs below. Required a Required 8 Required cRequired D Prepare an income statement for the year using variable costing. Variable Casting Income Statement Variable expenses Fixed expenses Assume that direct labor is a variable cost. Required: Compute the unit product cost under both the absorption costing and variable costing approaches. . Prepare an income statement for the year using absorption costing. Prepare an income statement for the year using variable costing. . Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Net operating income (loss) under variable costing Net operating income (oss) under absorption costing Renuired