Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Dow Jones Industrial Average ( DJIA ) and the Standard & Poor's 5 0 0 ( S&P 5 0 0 ) indexes are used

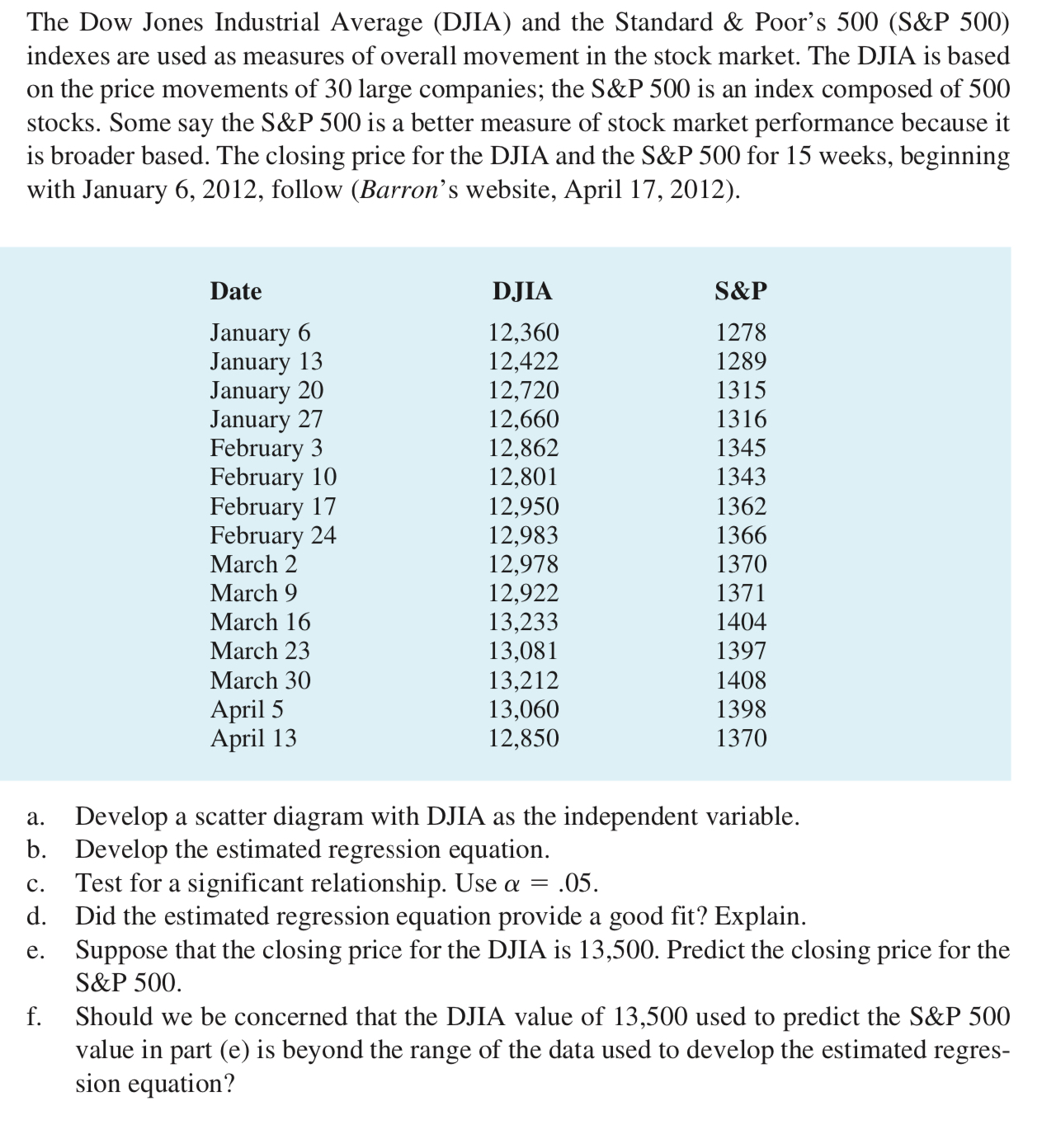

The Dow Jones Industrial Average DJIA and the Standard & Poor's S&P

indexes are used as measures of overall movement in the stock market. The DJIA is based

on the price movements of large companies; the S&P is an index composed of

stocks. Some say the S&P is a better measure of stock market performance because it

is broader based. The closing price for the DJIA and the S&P for weeks, beginning

with January follow Barrons website, April

a Develop a scatter diagram with DJIA as the independent variable.

b Develop the estimated regression equation.

c Test for a significant relationship. Use

d Did the estimated regression equation provide a good fit? Explain.

e Suppose that the closing price for the DJIA is Predict the closing price for the

S&P

f Should we be concerned that the DJIA value of used to predict the S&P

value in part e is beyond the range of the data used to develop the estimated regres

sion equation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started