Answered step by step

Verified Expert Solution

Question

1 Approved Answer

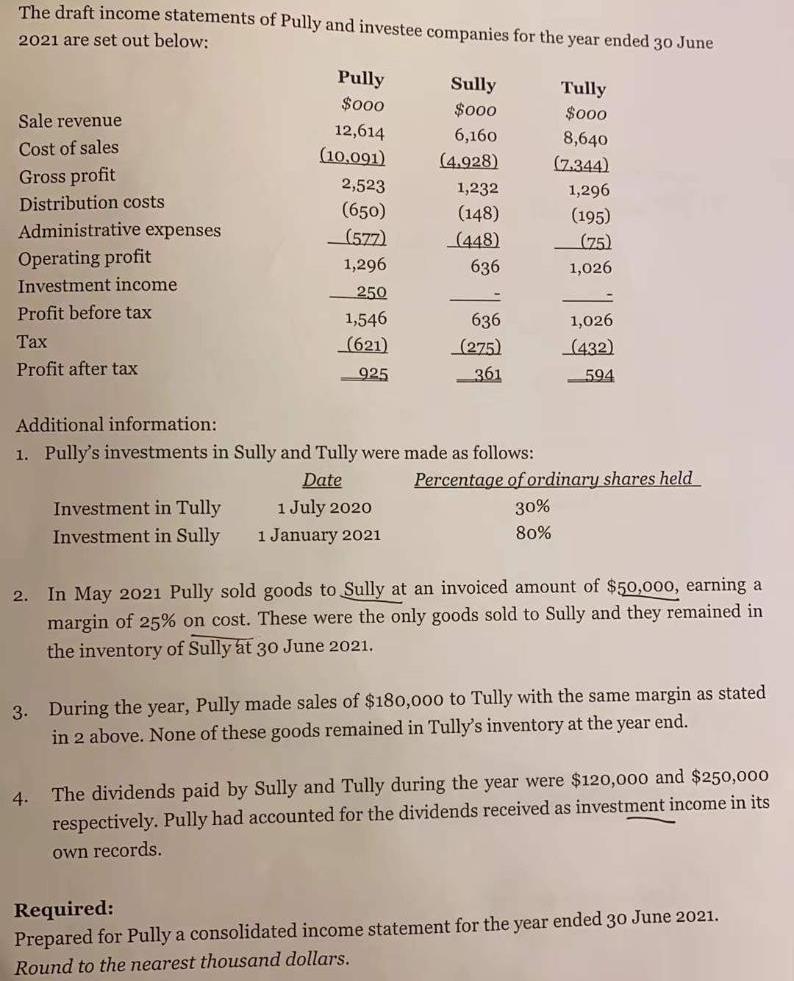

The draft income statements of Pully and investee companies for the year ended 30 June 2021 are set out below: Sale revenue Cost of

The draft income statements of Pully and investee companies for the year ended 30 June 2021 are set out below: Sale revenue Cost of sales Gross profit Distribution costs Administrative expenses Operating profit Investment income Profit before tax Tax Profit after tax Pully $000 Investment in Tully Investment in Sully 12,614 (10,091) 4. 2,523 (650) (577) 1,296 250 1,546 (621) 925 Sully $000 6,160 (4.928) 1,232 (148) (448) 636 Additional information: 1. Pully's investments in Sully and Tully were made as follows: Date 1 July 2020 1 January 2021 636 (275) 361 Tully $000 8,640 (7.344) 30% 80% 1,296 (195) (75) 1,026 1,026 (432) -594 Percentage of ordinary shares held 2. In May 2021 Pully sold goods to Sully at an invoiced amount of $50,000, earning a margin of 25% on cost. These were the only goods sold to Sully and they remained in the inventory of Sully at 30 June 2021. 3. During the year, Pully made sales of $180,000 to Tully with the same margin as stated in 2 above. None of these goods remained in Tully's inventory at the year end. The dividends paid by Sully and Tully during the year were $120,000 and $250,000 respectively. Pully had accounted for the dividends received as investment income in its own records. Required: Prepared for Pully a consolidated income statement for the year ended 30 June 2021. Round to the nearest thousand dollars.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated income statement For the year ended 30 June 2021 000 Sales revenue Cost of Sales Gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started