Answered step by step

Verified Expert Solution

Question

1 Approved Answer

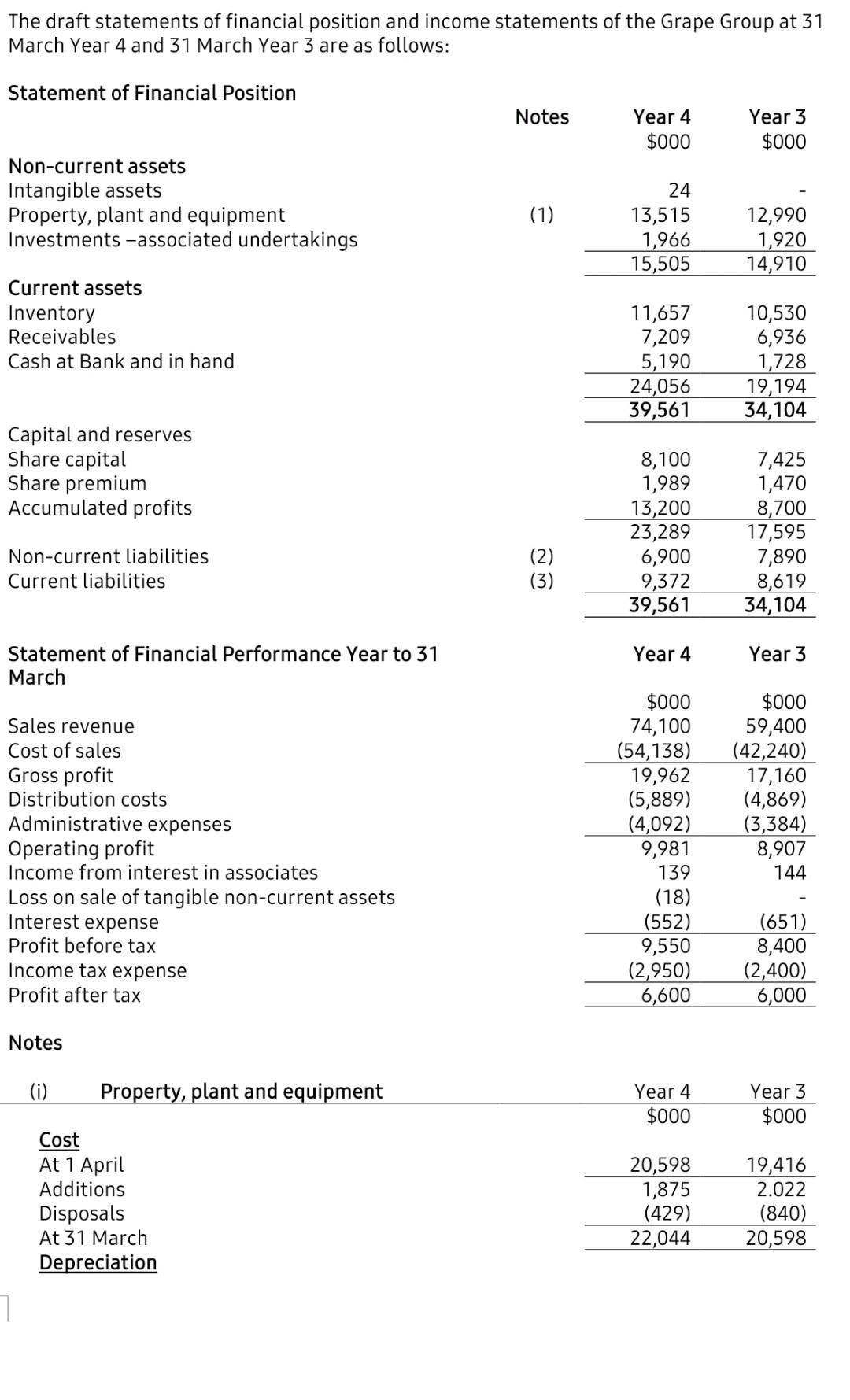

The draft statements of financial position and income statements of the Grape Group at 31 March Year 4 and 31 March Year 3 are as

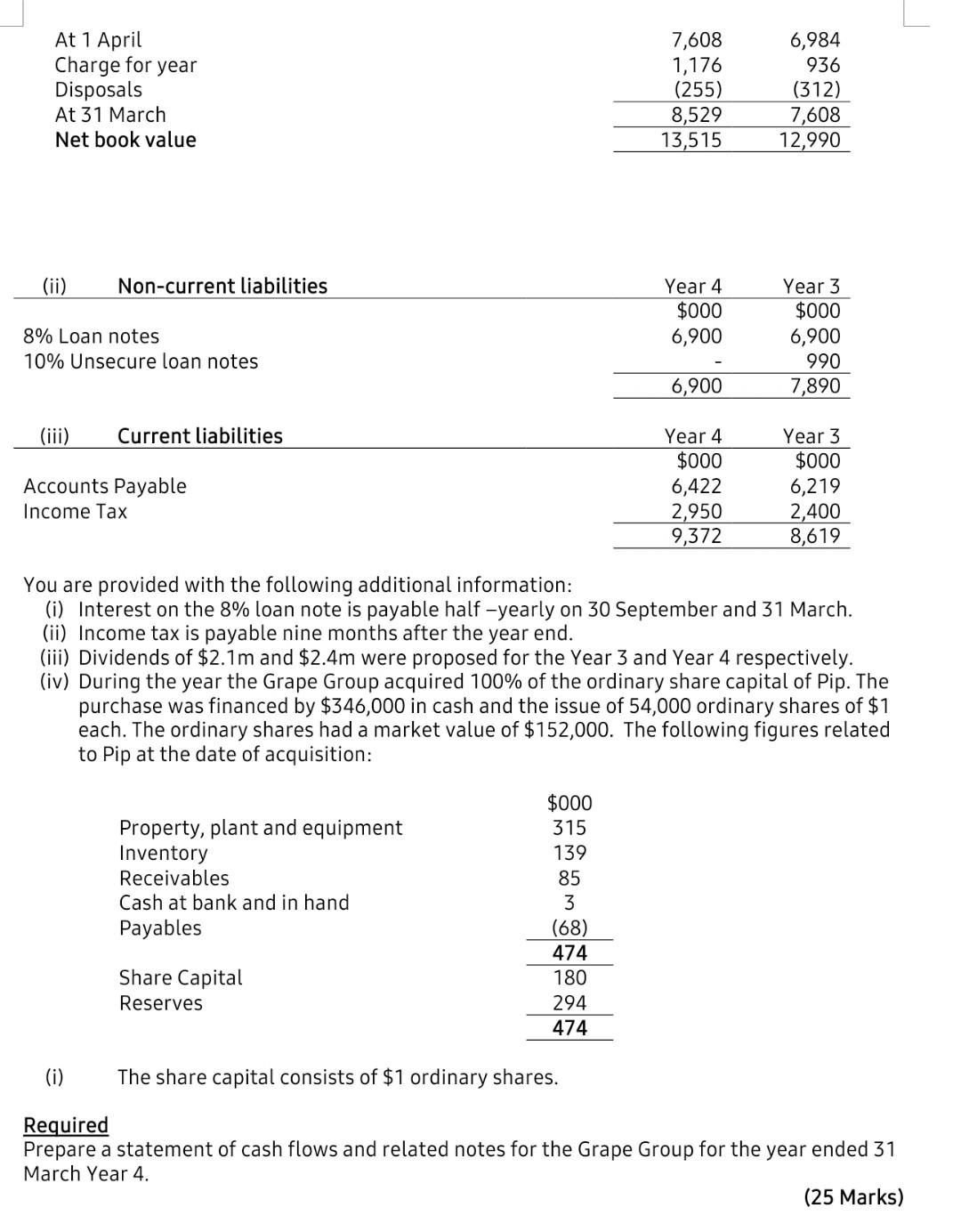

The draft statements of financial position and income statements of the Grape Group at 31 March Year 4 and 31 March Year 3 are as follows: Statement of Financial Position Notes Year 4 $000 Year 3 $000 Non-current assets Intangible assets Property, plant and equipment Investments -associated undertakings (1) 24 13,515 1,966 15,505 12,990 1,920 14,910 Current assets Inventory Receivables Cash at Bank and in hand 11,657 7,209 5,190 24,056 39,561 10,530 6,936 1,728 19,194 34,104 Capital and reserves Share capital Share premium Accumulated profits 8,100 1,989 13,200 23,289 6,900 9,372 39,561 7,425 1,470 8,700 17,595 7,890 8,619 34,104 Non-current liabilities Current liabilities g) Year 4 Year 3 Statement of Financial Performance Year to 31 March Sales revenue Cost of sales Gross profit Distribution costs Administrative expenses Operating profit Income from interest in associates Loss on sale of tangible non-current assets Interest expense Profit before tax Income tax expense Profit after tax $000 74,100 (54,138) 19,962 (5,889) (4,092) 9,981 139 (18) (552) 9,550 (2,950) 6,600 $000 59,400 (42,240) 17,160 (4,869) (3,384) 8,907 144 (651) 8,400 (2,400) 6,000 Notes (i) Property, plant and equipment Year 4 $000 Year 3 $000 Cost At 1 April Additions Disposals At 31 March Depreciation 20,598 1,875 (429) 22,044 19,416 2.022 (840) 20,598 At 1 April Charge for year Disposals At 31 March Net book value 7,608 1,176 (255) 8,529 13,515 6,984 936 (312) 7,608 12,990 (ii) Non-current liabilities Year 4 $000 6,900 8% Loan notes 10% Unsecure loan notes Year 3 $000 6,900 990 7,890 6,900 (iii) Current liabilities Accounts Payable Income Tax Year 4 $000 6,422 2,950 9,372 Year 3 $000 6,219 2,400 8,619 You are provided with the following additional information: (i) Interest on the 8% loan note is payable half -yearly on 30 September and 31 March. (ii) Income tax is payable nine months after the year end. (iii) Dividends of $2.1m and $2.4m were proposed for the Year 3 and Year 4 respectively. (iv) During the year the Grape Group acquired 100% of the ordinary share capital of Pip. The purchase was financed by $346,000 in cash and the issue of 54,000 ordinary shares of $1 each. The ordinary shares had a market value of $152,000. The following figures related to Pip at the date of acquisition: Property, plant and equipment Inventory Receivables Cash at bank and in hand Payables $000 315 139 85 3 (68) 474 180 294 474 Share Capital Reserves (i) The share capital consists of $1 ordinary shares. Required Prepare a statement of cash flows and related notes for the Grape Group for the year ended 31 March Year 4. (25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started