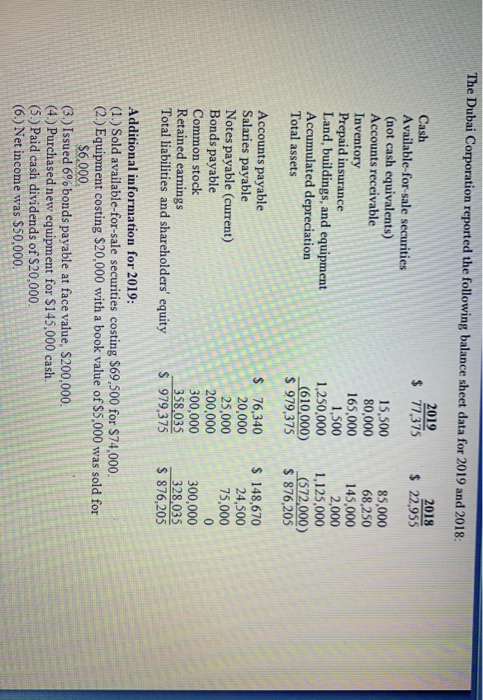

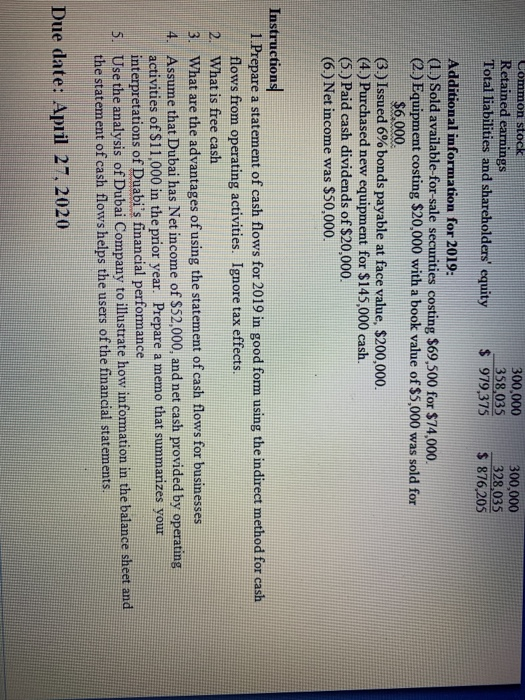

The Dubai Corporation reported the following balance sheet data for 2019 and 2018: $ 2019 77,375 2018 $ 22,955 Cash Available for sale securities (not cash equivalents) Accounts receivable Inventory Prepaid insurance Land, buildings, and equipment Accumulated depreciation Total assets 15,500 80,000 165,000 1,500 1,250,000 (610,000) $ 979,375 85,000 68,250 145,000 2,000 1,125,000 (572,000) $ 876,205 $ 148,670 24,500 75,000 Accounts payable Salaries payable Notes payable (current) Bonds payable Common stock Retained earings Total liabilities and shareholders' equity 25,000 200,000 300,000 358,035 $ 979,375 328,035 $ 876,205 Additional information for 2019: (1.) Sold available-for-sale securities costing $69,500 for $74,000. (2.) Equipment costing $20,000 with a book value of $5,000 was sold for $6,000. (3) Issued 6bonds payable at face value, $200,000. (4.) Purchased new equipment for $145,000 cash. (5.) Paid cash dividends of S20.000. (6.) Net income was $50,000. Common stock 300,000 300,000 Retained earnings 358,035 328,035 Total liabilities and shareholders' equity $ 979,375 $ 876,205 Additional information for 2019: (1.) Sold available for-sale securities costing $69,500 for $74,000. (2.) Equipment costing $20,000 with a book value of $5,000 was sold for $6.000 (3.) Issued 6% bonds payable at face value, $200,000. (4.) Purchased new equipment for $145,000 cash. (5.) Paid cash dividends of $20,000. (6.) Net income was $50,000. Instructions 1 Prepare a statement of cash flows for 2019 in good form using the indirect method for cash flows from operating activities. Ignore tax effects. What is free cash What are the advantages of using the statement of cash flows for businesses Assume that Dubai has Net income of $52,000, and net cash provided by operating activities of $11,000 in the prior year. Prepare a memo that summarizes your interpretations of Duabi's financial performance 5. Use the analysis of Dubai Company to illustrate how information in the balance sheet and the statement of cash flows helps the users of the financial statements. Due date: April 27, 2020