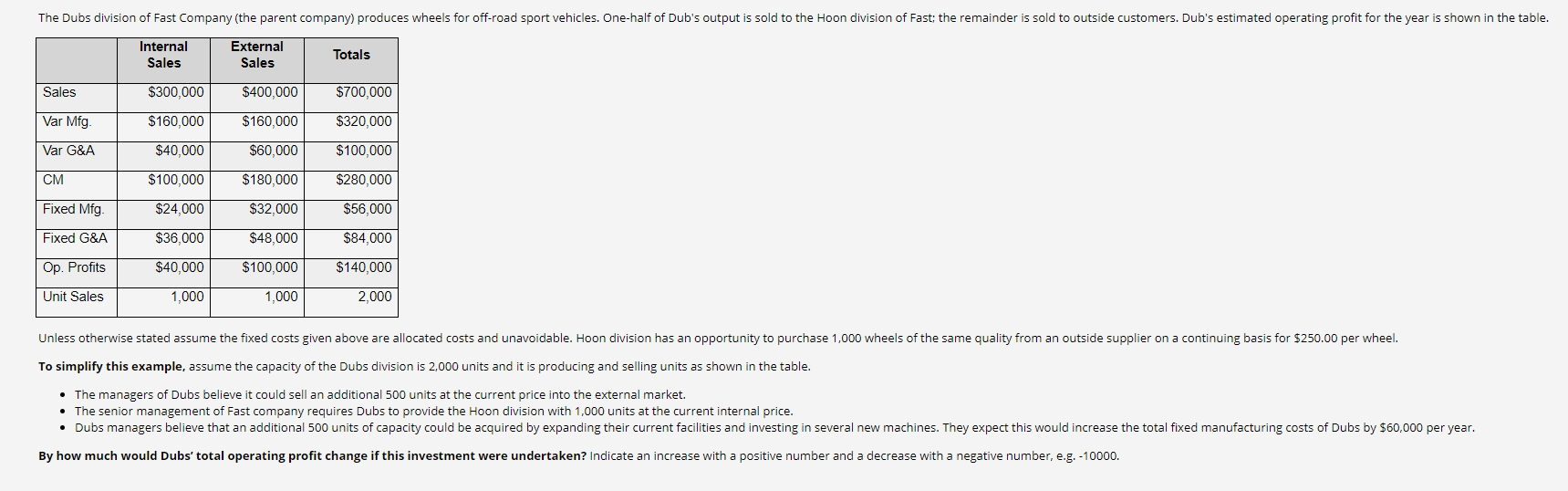

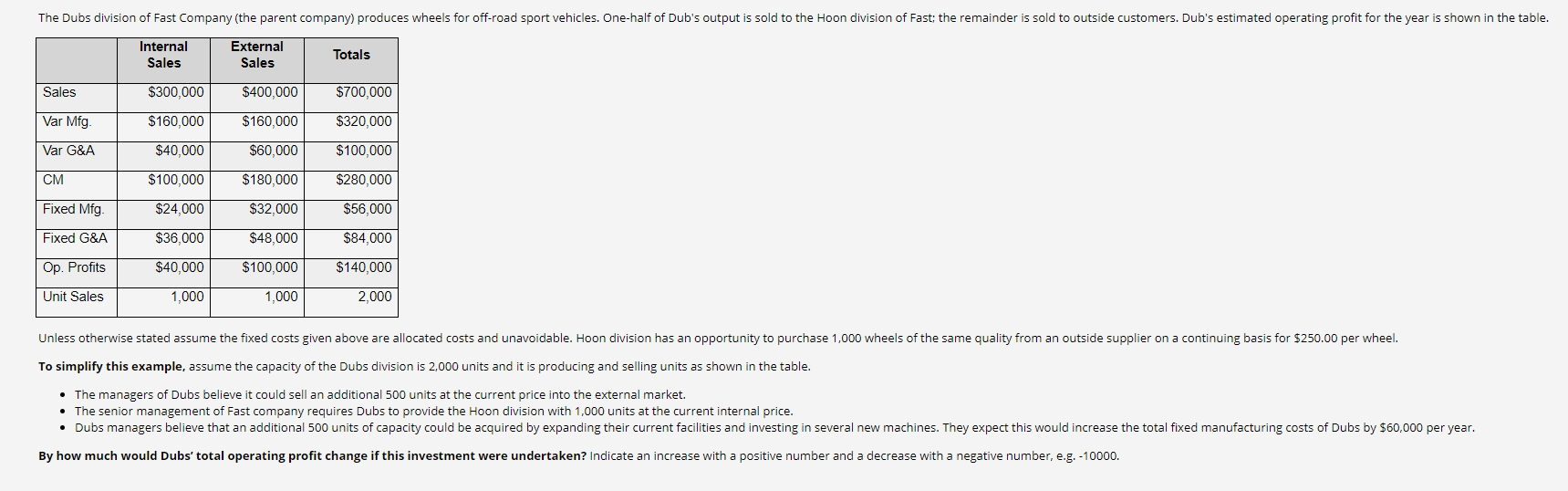

The Dubs division of Fast Company (the parent company) produces wheels for off-road sport vehicles. One-half of Dub's output is sold to the Hoon division of Fast; the remainder is sold to outside customers. Dub's estimated operating profit for the year is shown in the table. Internal Sales External Sales Totals Sales $300,000 $400,000 $700,000 Var Mfg. $160,000 $160,000 $320,000 Var G&A $40,000 $60,000 $100,000 CM $100,000 $180,000 $280,000 Fixed Mfg. $24,000 $32,000 $56,000 Fixed G&A $36,000 $48,000 $84.000 Op. Profits $40,000 $100,000 $140,000 Unit Sales 1,000 1,000 2,000 Unless otherwise stated assume the fixed costs given above are allocated costs and unavoidable. Hoon division has an opportunity to purchase 1,000 wheels of the same quality from an outside supplier on a continuing basis for $250.00 per wheel. To simplify this example, assume the capacity of the Dubs division is 2,000 units and it is producing and selling units as shown in the table. The managers of Dubs believe it could sell an additional 500 units at the current price into the external market. The senior management of Fast company requires Dubs to provide the Hoon division with 1,000 units at the current internal price. Dubs managers believe that an additional 500 units of capacity could be acquired by expanding their current facilities and investing in several new machines. They expect this would increase the total fixed manufacturing costs of Dubs by $60,000 per year. By how much would Dubs' total operating profit change if this investment were undertaken? Indicate an increase with a positive number and a decrease with a negative number, e.g. -10000. The Dubs division of Fast Company (the parent company) produces wheels for off-road sport vehicles. One-half of Dub's output is sold to the Hoon division of Fast; the remainder is sold to outside customers. Dub's estimated operating profit for the year is shown in the table. Internal Sales External Sales Totals Sales $300,000 $400,000 $700,000 Var Mfg. $160,000 $160,000 $320,000 Var G&A $40,000 $60,000 $100,000 CM $100,000 $180,000 $280,000 Fixed Mfg. $24,000 $32,000 $56,000 Fixed G&A $36,000 $48,000 $84.000 Op. Profits $40,000 $100,000 $140,000 Unit Sales 1,000 1,000 2,000 Unless otherwise stated assume the fixed costs given above are allocated costs and unavoidable. Hoon division has an opportunity to purchase 1,000 wheels of the same quality from an outside supplier on a continuing basis for $250.00 per wheel. To simplify this example, assume the capacity of the Dubs division is 2,000 units and it is producing and selling units as shown in the table. The managers of Dubs believe it could sell an additional 500 units at the current price into the external market. The senior management of Fast company requires Dubs to provide the Hoon division with 1,000 units at the current internal price. Dubs managers believe that an additional 500 units of capacity could be acquired by expanding their current facilities and investing in several new machines. They expect this would increase the total fixed manufacturing costs of Dubs by $60,000 per year. By how much would Dubs' total operating profit change if this investment were undertaken? Indicate an increase with a positive number and a decrease with a negative number, e.g. -10000