Answered step by step

Verified Expert Solution

Question

1 Approved Answer

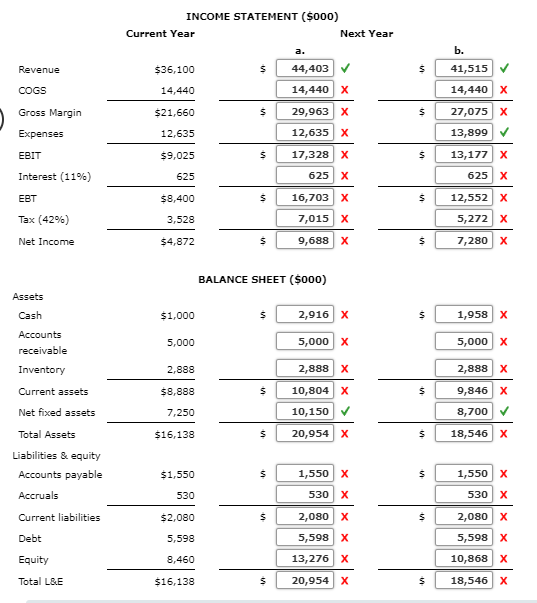

The Eagle Feather Fabric Company expects to complete the current year with the financial results given below. Forecast next year using a modified percentage of

The Eagle Feather Fabric Company expects to complete the current year with the financial results given below.

Forecast next year using a modified percentage of sales method assuming no dividends are paid and no new stock is sold along with the following:

- A 23% growth in sales and a 40% growth in net fixed assets.. (a)

- A 15% growth in sales with a 10% growth in expenses and a 20% growth in net fixed assets. (Note that negative debt means the business will generate more cash than is currently owed.) (b)

Enter your answers in thousands. For example, an answer of $12 thousands should be entered as 12, not 12,000. Round your answer to the nearest thousand. Enter all amounts as a positive number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started