Question

The Earth Bag Corp. Federal Tax Return FACTS: Gladys Jackson, a graduate in biology and textiles, developed and patented a vegetable based biodegradable cloth. The

The Earth Bag Corp. Federal Tax Return FACTS: Gladys Jackson, a graduate in biology and textiles, developed and patented a vegetable based biodegradable cloth. The cloth is made into reusable grocery bags, which decrease the amount of waste caused by plastic and paper bags that are only used once. Gladys set up the Earth Bag Corp. to manufacture and sell her product. The Earth Bag Corp. is owned by the Jackson family. The corporation is a small, closely-held manufacturer (the business code number is 339900, and the employer identification number is 11-1111111). The company is located at 80 Green St., Austin, Texas 78701. The corporation, which uses a calendar year for tax purposes, has been an S corporation since its incorporation on July 1, 2008. Gladys Jackson (social security number 123-45-6789) is president of the corporation. Gladys owned 100% of the stock until September 13, 2021 when she sold 1% to Pete Jackson (Gladys uncle, social security number 123-45-6788), who serves as vice president for the company. Both officers devote 100 percent of their time to the corporation and live a 35 Eco Drive, Austin, Texas 78710. Annual compensation is $55,080 for Gladys and $27,540 for Pete. The corporation does not engage in activities to which the at-risk or passive activity loss limitation apply. The corporation files its tax return on the accrual method. Inventory has been consistently valued at cost under the FIFO method using the full absorption procedure. Inventory capitalization rules of Internal Revenue Code Section 263A do not apply due to the small business exception (average annual gross receipts for the three preceding taxable years do not exceed $10 million). The accounting records are computerized. ADDITIONAL INFORMATION: 1. Employees account to the company and are reimbursed by the exact amount of travel and entertainment expenses incurred on business. Included in Miscellaneous Expenses are $230 for meals subject to 50% deduction. 2. Dividend income is from minor investments in: Cotton Corp. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,534 American Insurance Company (a dividend on the keyperson life insurance policy) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 644 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,178 3. Contributions were paid in cash to: Humane Society . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . $ 459 Republican Party . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 184 Total Contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 643

4. The key-person life insurance policy provides $500,000 coverage on Gladys Jackson. The company is the owner and beneficiary of the policy. 5. A schedule attached in the prior years working papers reconciles Retained Earnings and Accumulated Adjustments Account balances at 12/31/20 as follows: Balance per Schedule L (Balance Sheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $90,277 Accumulated depreciation for machinery and equipment (M&E) for tax M&E Acquired 07/01/19 . . . . . . . . . . . . . . . . . . $ 7,119 M&E Acquired 02/01/20 . . . . . . . . . . . . . . . . . . 28,615 $35,734 Accumulated depreciation per books. . . . . . . . . . . 17,778 Excess of Accumulated Tax over Book Depreciation for M&E . . . . . . . . . . (17,956) Balance per Schedule M (Analysis of the Accumulated Adjustments Account) . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 72,321 6. The balance in the Other Adjustments Account (Form 1120S, p. 4, Sch. M-2, col. (b) at the beginning of the year was $-0-. 7. Depreciation information is attached. 8. Machine #2, purchased on 02/01/20 for $45,900, was sold to an unrelated party on 11/01/21 for $46,818. 9. Machine #1, purchased on 07/01/19 for $18,360, was destroyed by fire caused by a short in an electrical circuit on 04/01/21. Proceeds of $14,229 were received from the insurance company. On 08/01/21 $13,770 of the proceeds were invested in a replacement machine. Assume there will be no further qualified reinvestment of the proceeds. 10. Interest expense was on loans for the following purposes: Purchase M&E . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,945 Invest in stock of Cotton Corp. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 826 Invest in Trenton County, New Jersey water and sewer bonds . . . . . . . 92 Cover shortage in working capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,584 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10,447 11. On June 5, 2021, 450 shares of Cotton Corp. common stock were sold. The company bought 1,800 shares of the stock on June 2, 2012 for $5,508. The stock was split 3-for-1 on February 21, 2015. 12. On May 15, 2011 The Earth Bag Corp. purchased at par $8,500 of Austin, Texas water and sewer bonds. Interest of $344 was received on the bonds during the year.

REQUIRED From the above information, prepare The Earth Bag Corp.s 2020 Federal income tax return (Form 1120S), including all supporting statements, schedules, and forms. Unless otherwise noted, assume the corporation makes all available elections to minimize the shareholders current taxable incomes. Round amounts to the nearest dollar. If additional information is needed, make realistic assumptions and fill in all required data. Even though the corporation may not be technically required to do so, Gladys has expressed a desire that Schedule L (Balance Sheets), Schedule M-1 (Reconciliation of Income (Loss) per Books With Income (Loss) per Return), and Schedule M-2 (Analysis of Accumulated Adjustments Account, Other Adjustments Account, and Shareholders Undistributed Taxable Income Previously Taxed) on Form 1120S, p. 4 be completed. Please complete forms: 1120S 1125-A 1120S Schedule D 1125-E 1120S Schedule K-1(2) 4562 4797 4684 TAX DEPRECIATION INFORMATION MACRS (Modified Accelerated Cost Recovery SystemFor property placed is service after 1986) Machinery and equipment (7-year statutory life, 200% declining balance switching to straight line, half- year convention). Statutory percentage for assets placed in service during a year are 14.29%, 24.49%, 17.49%, 12.49%, 8.93%, 8.92%, 8.93%, and 4.46% for recovery years 1-8, respectively. One-half of the normal MACRS amount is allowed for the year of disposition. The corporation has not elected Internal Revenue Code Sec 179 expense in the past; however Sec 179 expense is to be claimed for machinery and equipment placed in service on 5/1/21.

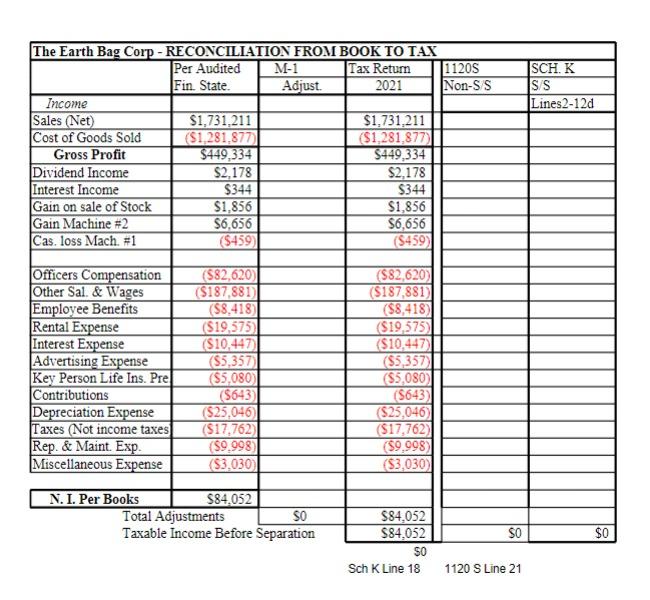

SCH. K SS Lines2-12d The Earth Bag Corp - RECONCILIATION FROM BOOK TO TAX Per Audited M-1 Tax Return 1120S Fin. State. Adjust. 2021 Non-SS Income Sales (Net) $1,731,211 $1,731,211 Cost of Goods Sold ($1,281.8771 ($1,281,877) Gross Profit $449,334 $449,334 Dividend Income $2,178 $2,178 Interest Income $344 $344 Gain on sale of Stock $1,856 $1,856 Gain Machine #2 $6,656 $6,656 Cas, loss Mach. #1 ($4591 (S459) Officers Compensation Other Sal. & Wages Employee Benefits Rental Expense Interest Expense Advertising Expense Key Person Life Ins. Pre Contributions Depreciation Expense Taxes (Not income taxes Rep. & Maint. Exp. Miscellaneous Expense ($82,620) ($187,881) ($8,418) ($19,575 ($10,447 (S5,357 ($5,080 ($643) ($25,046 ($17,762 (59.998) $3,030) (582,620) ($187,881) ($8,418) ($19,575 ($10,447 ($5,357 ($5,080) (5643) ($25,046 ($17,762) ($9.998) (83,030) N. I. Per Books $84.052 Total Adjustments SO Taxable Income Before Separation SO $0 $84,052 $84,052 $0 Sch K Line 18 1120 S Line 21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started