Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The electric vehicle (EV) market is experiencing rapid growth. In your role as an equity research analyst in Singapore, you've been tasked with covering

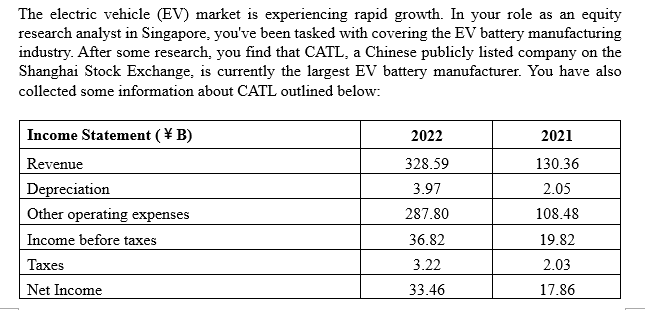

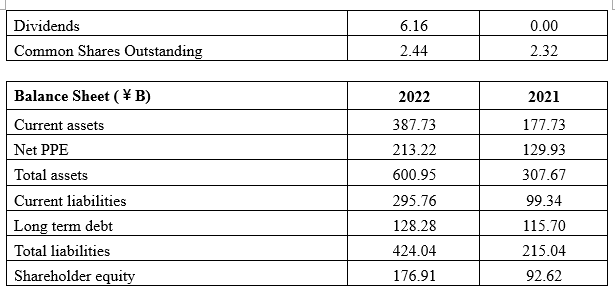

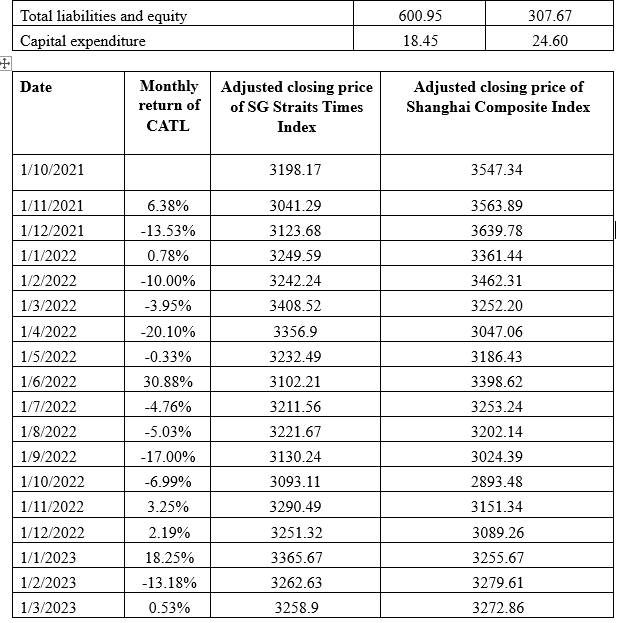

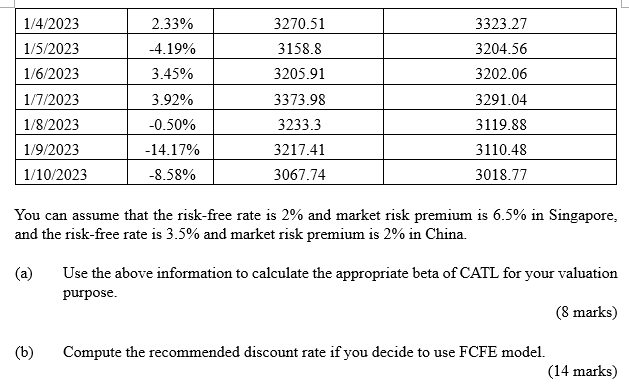

The electric vehicle (EV) market is experiencing rapid growth. In your role as an equity research analyst in Singapore, you've been tasked with covering the EV battery manufacturing industry. After some research, you find that CATL, a Chinese publicly listed company on the Shanghai Stock Exchange, is currently the largest EV battery manufacturer. You have also collected some information about CATL outlined below: Income Statement (\B) 2022 2021 Revenue 328.59 130.36 Depreciation 3.97 2.05 Other operating expenses 287.80 108.48 Income before taxes 36.82 19.82 Taxes 3.22 2.03 Net Income 33.46 17.86 Dividends 6.16 0.00 Common Shares Outstanding 2.44 2.32 Balance Sheet (\B) Current assets Net PPE 2022 2021 387.73 177.73 213.22 129.93 Total assets Current liabilities 600.95 307.67 295.76 99.34 Long term debt 128.28 115.70 Total liabilities 424.04 215.04 Shareholder equity 176.91 92.62 Total liabilities and equity Capital expenditure + Date Monthly 600.95 307.67 18.45 24.60 Adjusted closing price return of of SG Straits Times Adjusted closing price of Shanghai Composite Index CATL Index 1/10/2021 3198.17 3547.34 1/11/2021 6.38% 3041.29 3563.89 1/12/2021 -13.53% 3123.68 3639.78 1/1/2022 0.78% 3249.59 3361.44 1/2/2022 -10.00% 3242.24 3462.31 1/3/2022 -3.95% 3408.52 3252.20 1/4/2022 -20.10% 3356.9 3047.06 1/5/2022 -0.33% 3232.49 3186.43 1/6/2022 30.88% 3102.21 3398.62 1/7/2022 -4.76% 3211.56 3253.24 1/8/2022 -5.03% 3221.67 3202.14 1/9/2022 -17.00% 3130.24 3024.39 1/10/2022 -6.99% 3093.11 2893.48 1/11/2022 3.25% 3290.49 3151.34 1/12/2022 2.19% 3251.32 3089.26 1/1/2023 18.25% 3365.67 3255.67 1/2/2023 -13.18% 3262.63 3279.61 1/3/2023 0.53% 3258.9 3272.86 1/4/2023 2.33% 3270.51 3323.27 1/5/2023 -4.19% 3158.8 3204.56 1/6/2023 3.45% 3205.91 3202.06 1/7/2023 3.92% 3373.98 3291.04 1/8/2023 -0.50% 3233.3 3119.88 1/9/2023 -14.17% 3217.41 3110.48 1/10/2023 -8.58% 3067.74 3018.77 You can assume that the risk-free rate is 2% and market risk premium is 6.5% in Singapore, and the risk-free rate is 3.5% and market risk premium is 2% in China. (a) Use the above information to calculate the appropriate beta of CATL for your valuation purpose. (b) Compute the recommended discount rate if you decide to use FCFE model. (8 marks) (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started