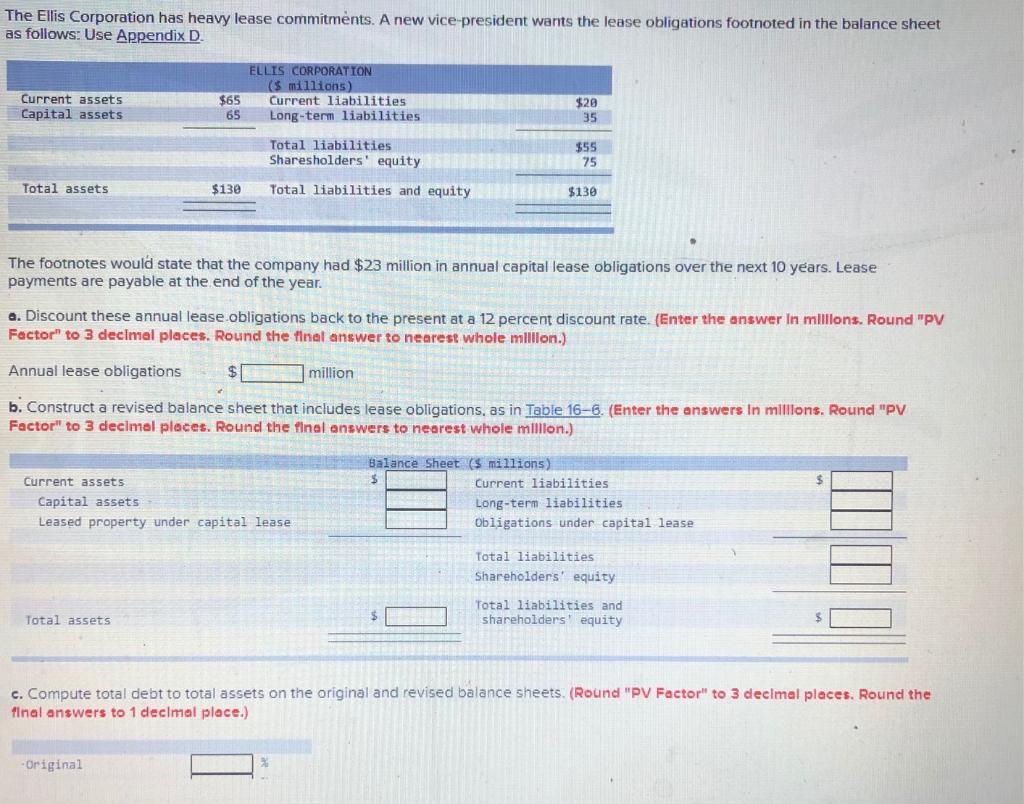

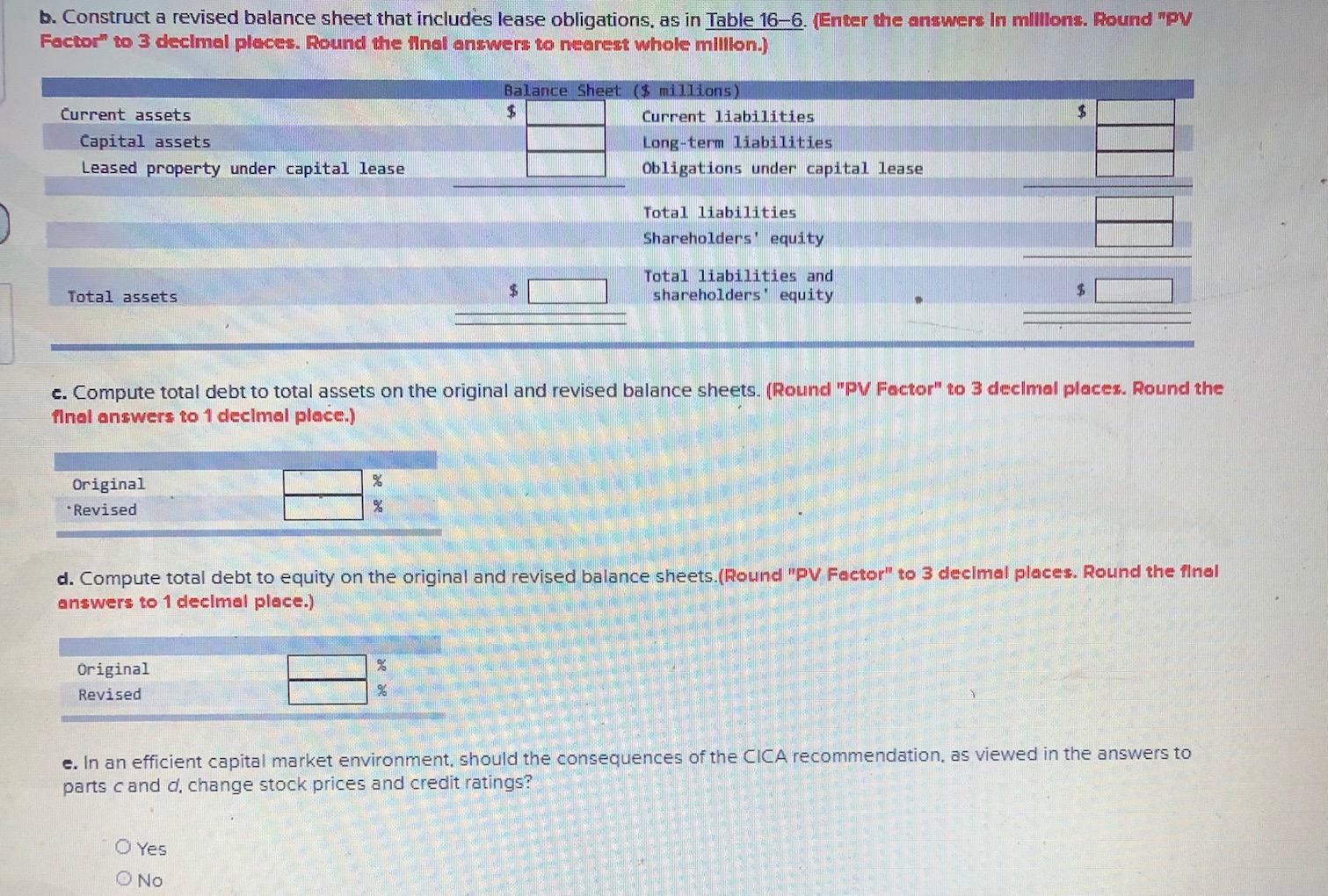

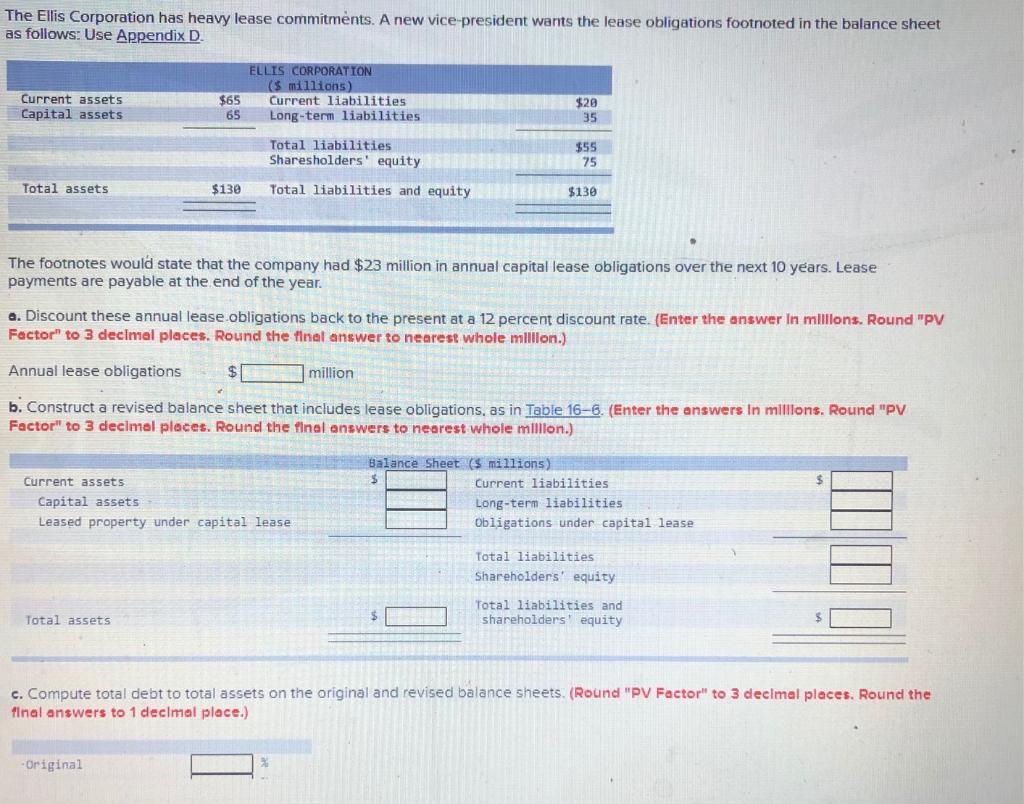

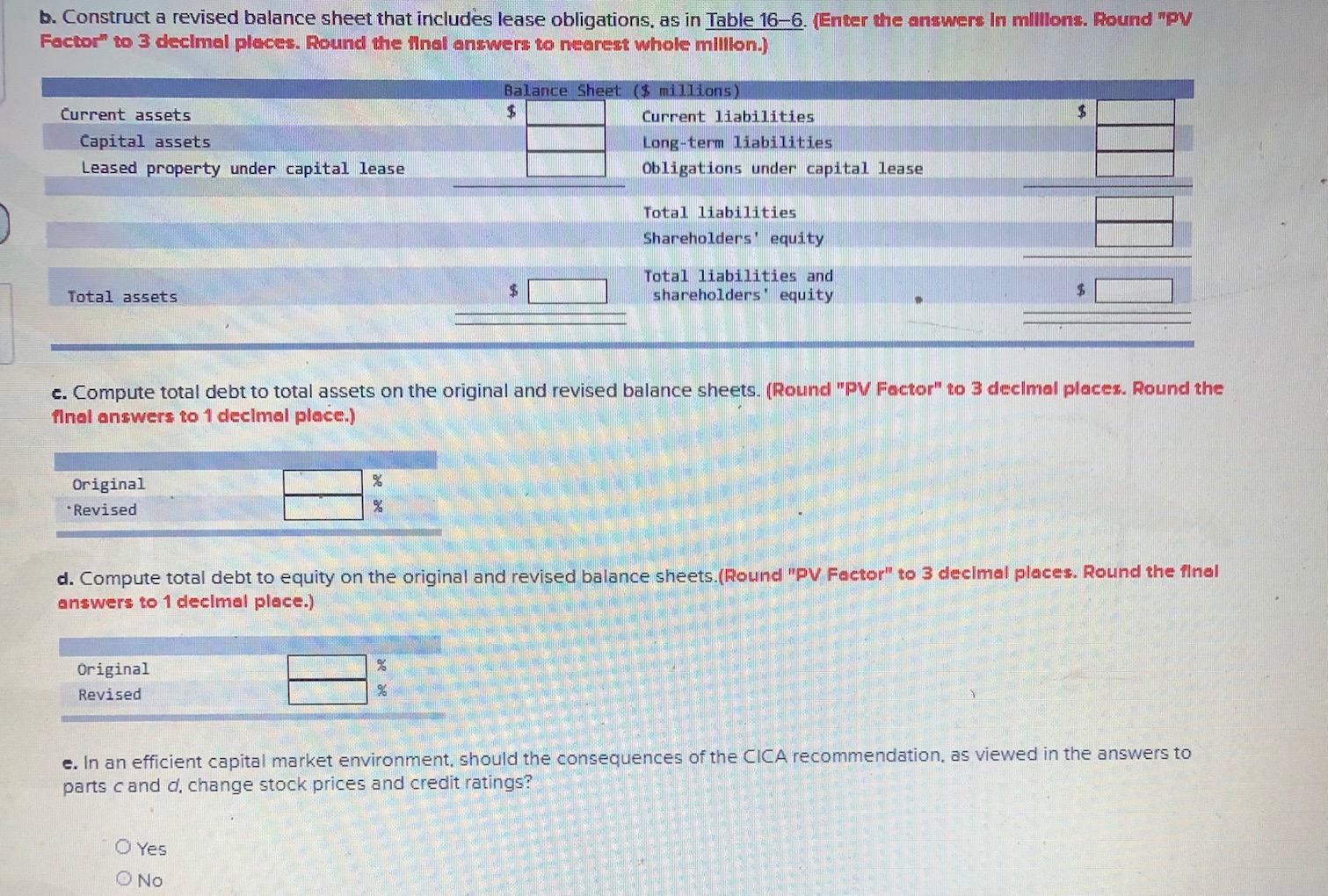

The Ellis Corporation has heavy lease commitments. A new vice-president wants the lease obligations footnoted in the balance sheet as follows: Use Appendix D. Current assets Capital assets $65 65 ELLIS CORPORATION ($ millions) Current liabilities Long-term liabilities $20 35 Total liabilities Sharesholders' equity $55 75 Total assets $130 Total liabilities and equity $130 The footnotes would state that the company had $23 million in annual capital lease obligations over the next 10 years. Lease payments are payable at the end of the year. a. Discount these annual lease obligations back to the present at a 12 percent discount rate. (Enter the answer in millions. Round "PV Factor" to 3 decimal places. Round the final answer to nearest whole million.) Annual lease obligations $ million b. Construct a revised balance sheet that includes lease obligations, as in Table 16-6. (Enter the answers in millions. Round "PV Factor" to 3 decimal places. Round the final answers to nearest whole million.) Current assets Capital assets Leased property under capital lease Balance Sheet ($ millions) $ Current liabilities Long-term liabilities Obligations under capital lease Total liabilities Shareholders' equity Total liabilities and shareholders' equity Total assets c. Compute total debt to total assets on the original and revised balance sheets. (Round "PV Factor" to 3 decimal places. Round the final answers to 1 decimal place.) Original b. Construct a revised balance sheet that includes lease obligations, as in Table 16-6. (Enter the answers in millione. Round "PV Factor to 3 decimal places. Round the final answers to nearest whole million.) $ Current assets Capital assets Leased property under capital lease Balance Sheet ($ millions) $ Current liabilities Long-term liabilities Obligations under capital lease Total liabilities Shareholders' equity $ Total liabilities and shareholders equity Total assets $ c. Compute total debt to total assets on the original and revised balance sheets. (Round "PV Factor" to 3 decimal placer. Round the final answers to 1 decimal place.) % Original Revised % d. Compute total debt to equity on the original and revised balance sheets.(Round "PV Factor" to 3 decimal places. Round the final answers to 1 decimal place.) % Original Revised e. In an efficient capital market environment, should the consequences of the CICA recommendation, as viewed in the answers to parts cand d. change stock prices and credit ratings? O Yes NO