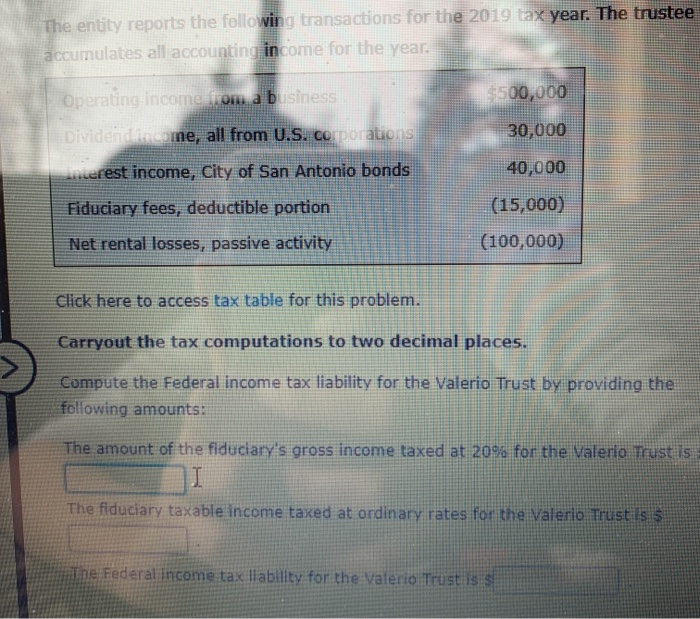

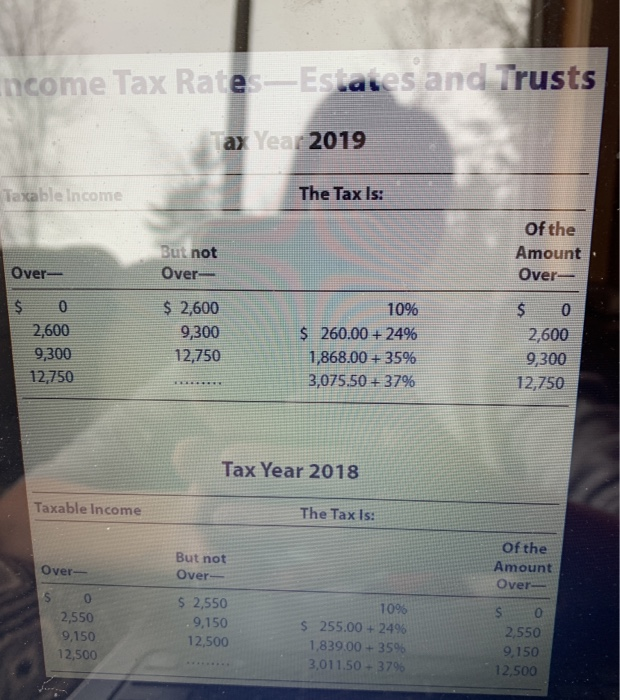

The entity reports the following transactions for the 2019 tax year. The trustee accumulates all accounting in come for the year: $500,000 30,000 Operating income on a business Dividendiname, all from U.S. Corporations interest income, City of San Antonio bonds Fiduciary fees, deductible portion 40,000 (15,000) (100,000) Net rental losses, passive activity Click here to access tax table for this problem. Carryout the tax computations to two decimal places. Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the fiduciary's gross income taxed at 20% for the Valerio mustus The fiduciary taxable income taxed at ordinary rates for the Valerio Trust iss bine Federal income tax liability for the Valerio Trust Income Tax Rate -Estates and Trusts ay Year 2019 Taxable income The Tax Is: But not Over of the Amount Over- Over- $ 0 2,600 9,300 12,750 $ 2,600 9,300 12,750 10% $ 260.00 + 24% 1,868.00 + 35% 3,075,50 + 37% $ 0 2,600 9,300 12,750 Tax Year 2018 Taxable income The Tax Is: Over- 0 2,550 9,150 12,500 But not Over- $ 2,550 9,150 12,500 1098 $ 255.00 + 2496 1,839.00 + 35% 3,011.50 - 379 of the Amount Over- $ 0 2,550 9.150 12,500 The entity reports the following transactions for the 2019 tax year. The trustee accumulates all accounting in come for the year: $500,000 30,000 Operating income on a business Dividendiname, all from U.S. Corporations interest income, City of San Antonio bonds Fiduciary fees, deductible portion 40,000 (15,000) (100,000) Net rental losses, passive activity Click here to access tax table for this problem. Carryout the tax computations to two decimal places. Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the fiduciary's gross income taxed at 20% for the Valerio mustus The fiduciary taxable income taxed at ordinary rates for the Valerio Trust iss bine Federal income tax liability for the Valerio Trust Income Tax Rate -Estates and Trusts ay Year 2019 Taxable income The Tax Is: But not Over of the Amount Over- Over- $ 0 2,600 9,300 12,750 $ 2,600 9,300 12,750 10% $ 260.00 + 24% 1,868.00 + 35% 3,075,50 + 37% $ 0 2,600 9,300 12,750 Tax Year 2018 Taxable income The Tax Is: Over- 0 2,550 9,150 12,500 But not Over- $ 2,550 9,150 12,500 1098 $ 255.00 + 2496 1,839.00 + 35% 3,011.50 - 379 of the Amount Over- $ 0 2,550 9.150 12,500