The equity sections from Porter Groups 2016 and 2017 year-end balance sheets follow.

The equity sections from Porter Groups 2016 and 2017 year-end balance sheets follow.

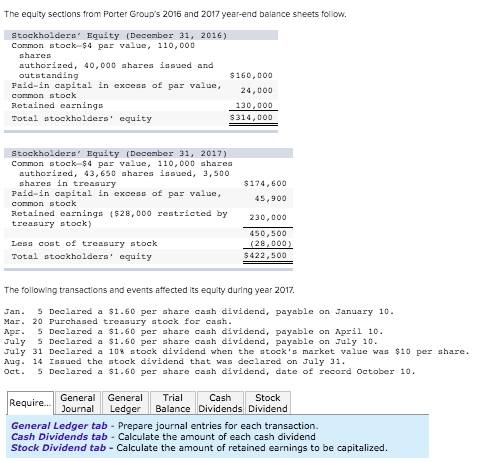

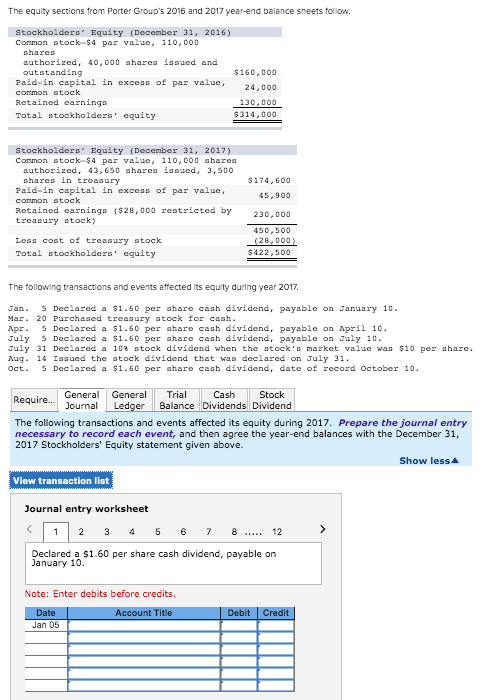

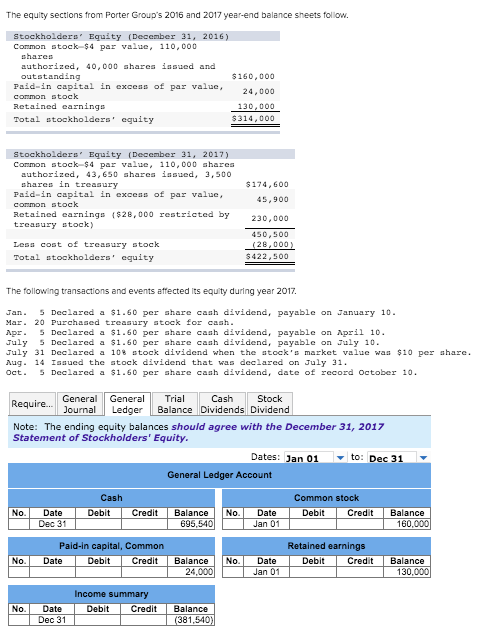

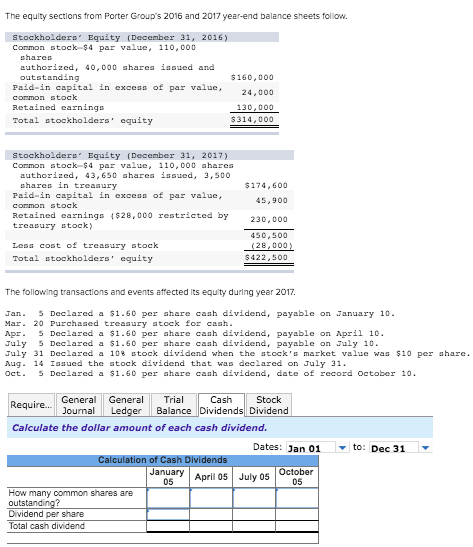

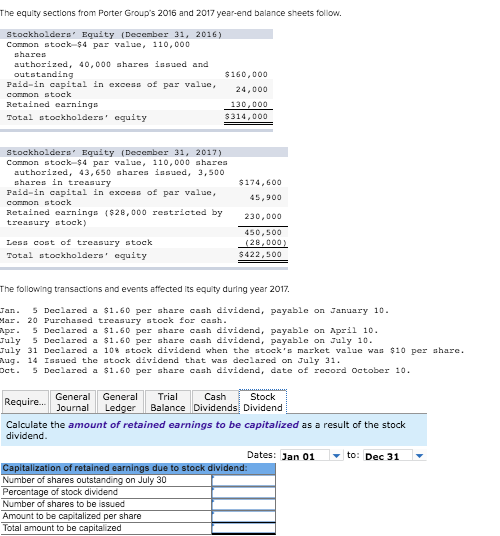

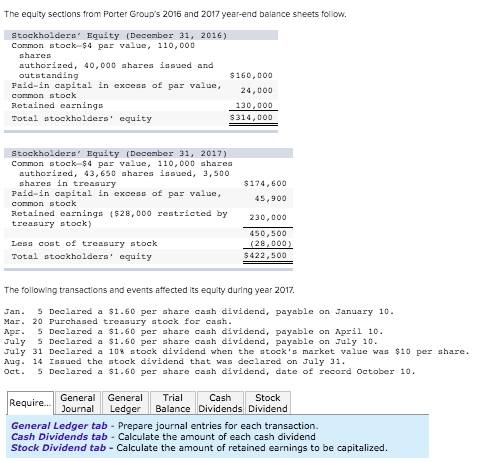

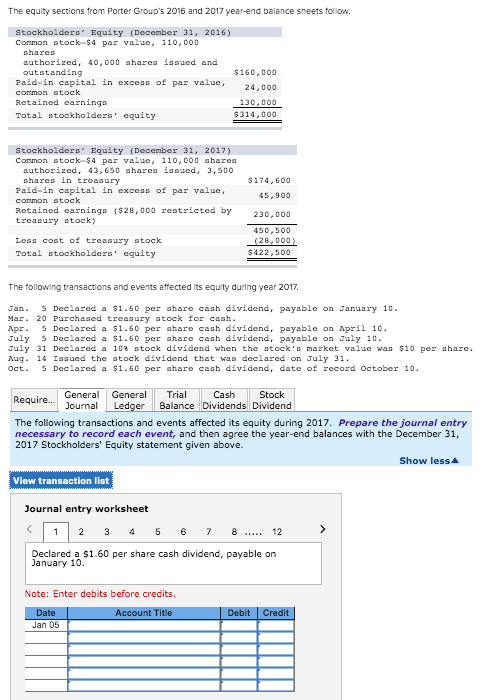

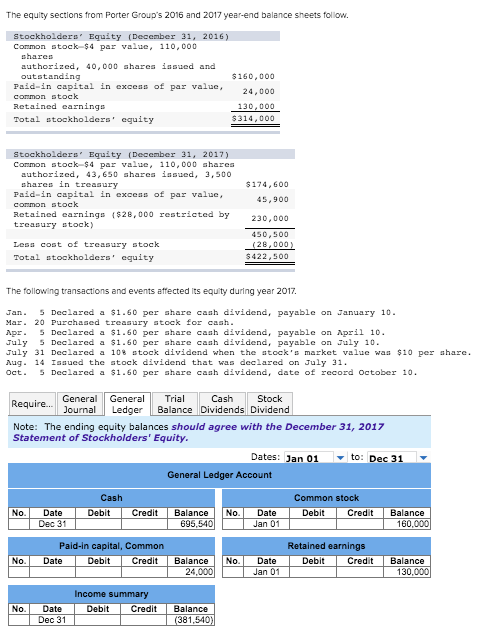

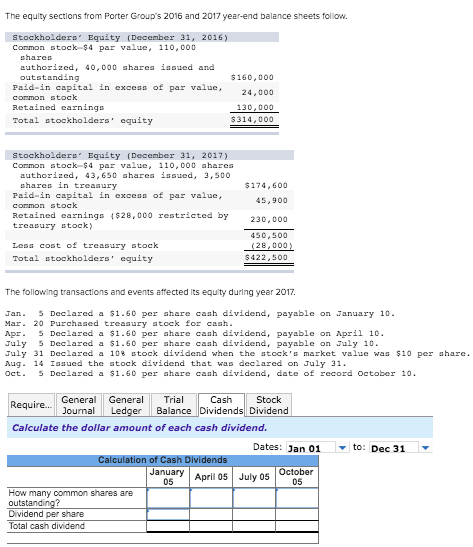

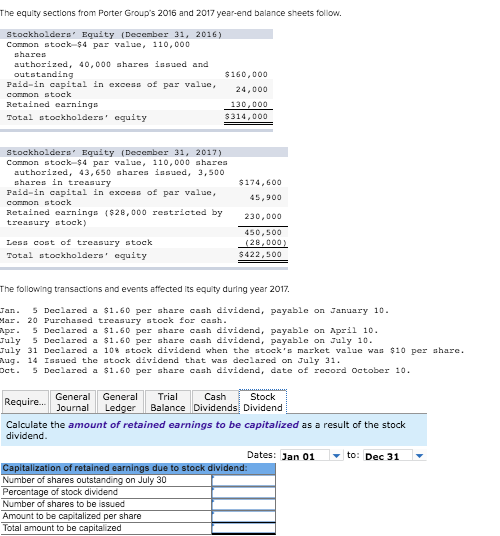

The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. Stockholders Equity (December 31, 2016) Conmon stock $4 par value, 110,000 authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value conmon stock Retained earnings Total stockholders' equity $160,000 24,000 130,000 $314,000 Conmon stock $4 par value, 110,000 shares uthorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174,600 45,900 Less cost of treasury stock Total stockholders' equity $422,500 The following transactions and events affected its equity during year 2017 Tan. 5 Declared a $1-60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash Apr. 5 Declared a $1.60 per share cash dividend, payable on April 10 Tuly 5 Declared a $1.60 per share cash dividend, payable on uly 10 July 31 Declared a 10% stock dividend when the stock's market value was $10 per hare Aug. 14 Issued the stock dividend that was declared on July 31 Oct. 5 Declared a $1.60 per share cash dividend, date of record October 10 General Genera Trial Journal Ledger Balance Dividends Dividend Cash Stock The following transactions and events affected its equity during 2017. Prepare the journal entry necessary to record each event, and then agree the year-end balances with the December 31 2017 Stockholders' Equity statement given above Show lessA View transaction list Journal entry worksheet 12 3 4 5 6 7 8... 12 Declared a $1.60 per share cash dividend, payable on January 10 Note: Enter debits before credits. t Title Jan 05 The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. Conmon stock $4 par value, 110,000 uthorized, 40,000 shares issued and outstanding Paid-in capital in exceas of par value conmon stock $160,000 ,24,000 Total stockholders' equity $314,000 Conmon stock $4 par value, 110,000 shares uthorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174, 600 45,900 230,000 Less cost of treasury stock Total stockholders' equity $422,500 The following transactions and events affected its equity during year 2017 Tan. 5 Declared a $1-60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash Apr. 5 Declared a $1.60 per share cash dividend, payable on April 10 Tuly 5 Declared a $1.60 per share cash dividend, payable on uly 10 July 31 Declared a 10% stock dividend when the stock's market value was $10 per hare Aug. 14 Issued the stock dividend that was declared on July 31 Oct. 5 Declared a $1.60 per share cash dividend, date of record October 10 General Genera Trial ournalLedger Balance Dividends Dividend Cash Stock Note: The ending Statement of Stockholders' Equity equity balances should agree with the December 31, 2017 Dates: Jan 01to : Dec 31 General Ledger Account Common stock No. Date Debit t Credit Balance No. Date Jan 01 Debit CreditBalance Dec 31 695,540 160,000 Paid-in capital, Common Retained earnings No. Date Debit t Credit Balance No. Date Jan 01 Debit CreditBalance 24,000 130,000 Income s No. Date Debit CreditBalance Dec 31 381,540) The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. Conmon stock $4 par value, 110,000 shares authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value conmon stock Retained earnings Total stockholders' equity $160,000 24,000 130,000 $314,000 Stockholders Equity (December 31, 2017) Conmon stock $4 par value, 110,000 shares authorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174, 600 45,900 Less cost of treasury Total stockholders' equity stock 28,000 $422,500 The following transactions and events affected its equity during year 2017 Tan. 5 Declared a $1-60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash Apr. 5 Declared a $1.60 per share cash dividend, payable on April 10 Tuly 5 Declared a $1.60 per share cash dividend, payable on uly 10 July 31 Declared a 10% stock dividend when the atack's market value was $10 per share Aug. 14 Issued the stock dividend that was declared on July 31 Oct. 5 Declared a $1.60 per share cash dividend, date of record October 10 General General Trial Journal Ledger Balance Dividends Dividend Cash Stock Calculate the dollar amount of each cash dividend. Dates: Jan 01to Dec 31 n of Cash January 05April 05 July 05 October 05 How many common shares are outs Dividend per share Total cash dividend The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. stockholders Equity (December 31, 2016) Conmon stock $4 par value, 110,000 uthorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value conmon stock Retained earnings Total stockholders' equity $160,000 ,24,000 130,000 $314,000 Conmon stock $4 par value, 110,000 shares uthorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174, 600 45,900 230,000 450,500 28,000 $422,500 Less cost of t e sury stock Total stockholders' equity The following transactions and events affected its equity during year 2017 Jan. 5 Declared a 1.60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash pr5 Declared a 1.60 per share cash dividend, payable on April 10 Tuly Declared a 1.60 per share cash dividend, payable on 7uly 10 uly 31 Declared a 10% stock dividend when the stock's market value was 10 per hare Nug. 14 Issued the stock dividend that was declared on July 31 Oct 5 Declared a 1.60 per share cash dividend, date of record October 10 General Genera Trial Journal Ledger Balance Dividends Dividend Cash Stock Calculate the amount of retained earnings to be capitalized as a result of the stock dividend Dates: Jan 01 to: Dec 31 s due to stock Number of shares outstanding on July 30 Percentage of stock dividend Number of shares to be issued Amount to be capitalized per share Total amount to be capitalized The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. Stockholders Equity (December 31, 2016) Conmon stock $4 par value, 110,000 authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value conmon stock Retained earnings Total stockholders' equity $160,000 24,000 130,000 $314,000 Conmon stock $4 par value, 110,000 shares uthorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174,600 45,900 Less cost of treasury stock Total stockholders' equity $422,500 The following transactions and events affected its equity during year 2017 Tan. 5 Declared a $1-60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash Apr. 5 Declared a $1.60 per share cash dividend, payable on April 10 Tuly 5 Declared a $1.60 per share cash dividend, payable on uly 10 July 31 Declared a 10% stock dividend when the stock's market value was $10 per hare Aug. 14 Issued the stock dividend that was declared on July 31 Oct. 5 Declared a $1.60 per share cash dividend, date of record October 10 General Genera Trial Journal Ledger Balance Dividends Dividend Cash Stock The following transactions and events affected its equity during 2017. Prepare the journal entry necessary to record each event, and then agree the year-end balances with the December 31 2017 Stockholders' Equity statement given above Show lessA View transaction list Journal entry worksheet 12 3 4 5 6 7 8... 12 Declared a $1.60 per share cash dividend, payable on January 10 Note: Enter debits before credits. t Title Jan 05 The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. Conmon stock $4 par value, 110,000 uthorized, 40,000 shares issued and outstanding Paid-in capital in exceas of par value conmon stock $160,000 ,24,000 Total stockholders' equity $314,000 Conmon stock $4 par value, 110,000 shares uthorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174, 600 45,900 230,000 Less cost of treasury stock Total stockholders' equity $422,500 The following transactions and events affected its equity during year 2017 Tan. 5 Declared a $1-60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash Apr. 5 Declared a $1.60 per share cash dividend, payable on April 10 Tuly 5 Declared a $1.60 per share cash dividend, payable on uly 10 July 31 Declared a 10% stock dividend when the stock's market value was $10 per hare Aug. 14 Issued the stock dividend that was declared on July 31 Oct. 5 Declared a $1.60 per share cash dividend, date of record October 10 General Genera Trial ournalLedger Balance Dividends Dividend Cash Stock Note: The ending Statement of Stockholders' Equity equity balances should agree with the December 31, 2017 Dates: Jan 01to : Dec 31 General Ledger Account Common stock No. Date Debit t Credit Balance No. Date Jan 01 Debit CreditBalance Dec 31 695,540 160,000 Paid-in capital, Common Retained earnings No. Date Debit t Credit Balance No. Date Jan 01 Debit CreditBalance 24,000 130,000 Income s No. Date Debit CreditBalance Dec 31 381,540) The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. Conmon stock $4 par value, 110,000 shares authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value conmon stock Retained earnings Total stockholders' equity $160,000 24,000 130,000 $314,000 Stockholders Equity (December 31, 2017) Conmon stock $4 par value, 110,000 shares authorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174, 600 45,900 Less cost of treasury Total stockholders' equity stock 28,000 $422,500 The following transactions and events affected its equity during year 2017 Tan. 5 Declared a $1-60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash Apr. 5 Declared a $1.60 per share cash dividend, payable on April 10 Tuly 5 Declared a $1.60 per share cash dividend, payable on uly 10 July 31 Declared a 10% stock dividend when the atack's market value was $10 per share Aug. 14 Issued the stock dividend that was declared on July 31 Oct. 5 Declared a $1.60 per share cash dividend, date of record October 10 General General Trial Journal Ledger Balance Dividends Dividend Cash Stock Calculate the dollar amount of each cash dividend. Dates: Jan 01to Dec 31 n of Cash January 05April 05 July 05 October 05 How many common shares are outs Dividend per share Total cash dividend The equity sections from Porter Group's 2016 and 2017 year-end balance sheets follow. stockholders Equity (December 31, 2016) Conmon stock $4 par value, 110,000 uthorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value conmon stock Retained earnings Total stockholders' equity $160,000 ,24,000 130,000 $314,000 Conmon stock $4 par value, 110,000 shares uthorized, 43,650 shares issued, 3,500 shares in treasury Paid-in capital in excess of par value conmon stock Retained earnings $28,000 restricted by treasury stock) $174, 600 45,900 230,000 450,500 28,000 $422,500 Less cost of t e sury stock Total stockholders' equity The following transactions and events affected its equity during year 2017 Jan. 5 Declared a 1.60 per share cash dividend, payable on January 10 Mar. 20 Purchased treasury stock for cash pr5 Declared a 1.60 per share cash dividend, payable on April 10 Tuly Declared a 1.60 per share cash dividend, payable on 7uly 10 uly 31 Declared a 10% stock dividend when the stock's market value was 10 per hare Nug. 14 Issued the stock dividend that was declared on July 31 Oct 5 Declared a 1.60 per share cash dividend, date of record October 10 General Genera Trial Journal Ledger Balance Dividends Dividend Cash Stock Calculate the amount of retained earnings to be capitalized as a result of the stock dividend Dates: Jan 01 to: Dec 31 s due to stock Number of shares outstanding on July 30 Percentage of stock dividend Number of shares to be issued Amount to be capitalized per share Total amount to be capitalized

The equity sections from Porter Groups 2016 and 2017 year-end balance sheets follow.

The equity sections from Porter Groups 2016 and 2017 year-end balance sheets follow.