the European call option with longer maturity is more expensive given that the asset does not pay any dividend. However, this result is no

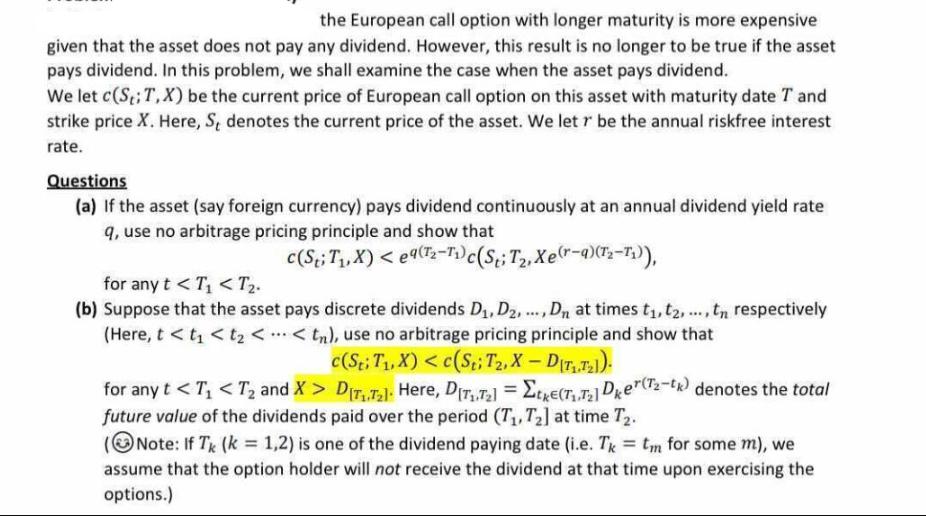

the European call option with longer maturity is more expensive given that the asset does not pay any dividend. However, this result is no longer to be true if the asset pays dividend. In this problem, we shall examine the case when the asset pays dividend. We let c(S,;T, X) be the current price of European call option on this asset with maturity date T and strike price X. Here, S, denotes the current price of the asset. We let r be the annual riskfree interest rate. Questions (a) If the asset (say foreign currency) pays dividend continuously at an annual dividend yield rate q, use no arbitrage pricing principle and show that c(ST, X) < 9(T-T) c(St; T, Xe(-a)(1-)), for any t < T T. (b) Suppose that the asset pays discrete dividends D, D2, ..., Dn at times t, t2, ..., tn respectively (Here, t < t DITT). Here, DTT] = tre(T T] Dker (-tk) denotes the total future value of the dividends paid over the period (T, T] at time T. (Note: If Tk (k = 1,2) is one of the dividend paying date (i.e. Tk = tm for some m), we assume that the option holder will not receive the dividend at that time upon exercising the options.)

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a When the asset pays dividends continuously at an annual dividend yield rate q we can use the noarbitrage pricing principle to show that CSt T1 X T2 T1 cSt T2 XerqT2T1 for any t T1 T2 To prove this i...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started