Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Excel Spreadsheet Project is a computer project designed to help you develop hhhspreadsheet skills. You will prepare consolidated worksheets using formulas that illustrate the

The Excel Spreadsheet Project is a computer project designed to help you develop hhhspreadsheet

skills. You will prepare consolidated worksheets using formulas that illustrate the consolidation

Alternative Investment Methods, Goodwill Impairment, and Consolidated

Financial Statements

In this project, you are to provide an analysis of alternative accounting methods for controlling interest investments and subsequent

effects on consolidated reporting using Excel. Modeling in Excel helps you quickly assess the impact of alternative accounting methods

on consolidated financial reporting, and helps you develop a better understanding of accounting for combined reporting entities.

Consolidated Worksheet Preparation

You will be creating and entering formulas to complete four worksheets. The first objective is to demonstrate the effect of different

methods of accounting for the investments equity initial value, and partial equity on the parent company's trial balance and on the

consolidated worksheet subsequent to acquisition. The second objective is to show the effect on consolidated balances and key financial

ratios of recognizing a goodwill impairment loss.

The project requires preparation of the following four separate worksheets:

a Consolidated information worksheet follows

b Equity method consolidation worksheet.

c Initial value method consolidation worksheet.

d Partial equity method consolidation worksheet.

In formulating your solution, each worksheet should link directly to the first worksheet. Also, feel free to create supplemental schedules to

enhance the capabilities of your worksheet.

Project Scenario

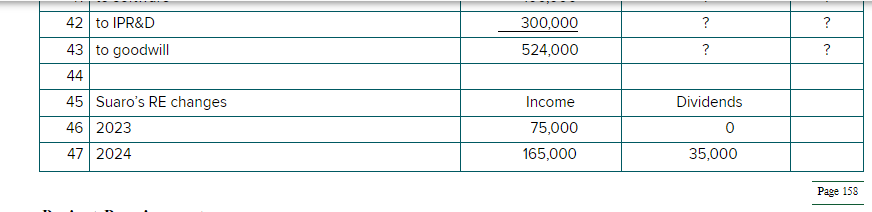

Pecos Company acquired percent of Suaro's outstanding stock for $ cash on January when Suaro had the

following balance sheet:At the acquisition date, the fair values of each identifiable asset and liability that differed from book value were as follows:

Land

$

Brand name

indefinite lifeunrecognized on Suaro's books

Software

year estimated remaining useful life

Inprocess R&D

Additional Information

Although at acquisition date Pecos expected future benefits from Suaro's inprocess research and development R&D by the end of it became clear that the research project was a failure with no future economic benefits.

During Suaro earns $ and pays no dividends.

Selected amounts from Pecos's and Suaro's separate financial statements at December are presented in the consolidated information worksheet. All consolidated worksheets are to be prepared as of December two years subsequent to acquisition.

Pecos's January Retained Earnings balancebefore any effect from Suaro's incomeis $credit balance

Pecos has common shares outstanding for EPS calculations and reported $ for consolidated assets at the beginning of the period.

The following is the consolidated information worksheet:

Page

tableABCDtableDecember trialbalancesPecos,Suaro,tableentries needed when the parent uses the equity method, partial equity method, or initial value

method of accounting for its investment in a subsidiary. The detailed information for this project

is found at the end of Chapter under the heading of Excel Spreadsheet Project.

INSTRUCTIONS

You are to create an Excel workbook with tabs as follows:

Tab Consolidated Information Worksheet

Tab Equity Method

Tab Partial Equity Method

Tab Initial Value Method

This assignment encompasses the first project requirements as listed in the Computer Project

within the textbook. The consolidated worksheets that you are preparing are not for the year of

acquisition, but for the succeeding year. Therefore, when determining the beginning parent

company retained earnings and Investment account balances for the year in question under the

initial value and partial equity methods, remember that those balances will be converted to the

equity method as of the beginning of the year in the consolidated worksheet via the C entry.

The beginning retained earnings and investment account balances based on parent company

records will differ under each of the three methods. The difference will be reflected in the C

entry.

You will complete the Excel Spreadsheet Project in parts:

For Excel Spreadsheet Project: Initial Assignment, you must complete Tab with the fair

value allocation schedule. Then you will begin Tabs completing trial balances for Pecos and

Suaro. This assignment encompasses the first project requirements stated in the textbook.

For Excel Spreadsheet Project: Final Assignment, you must complete all remaining

information for Tabs This assignment encompasses the third project requirement stated in

the textbook.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started