Answered step by step

Verified Expert Solution

Question

1 Approved Answer

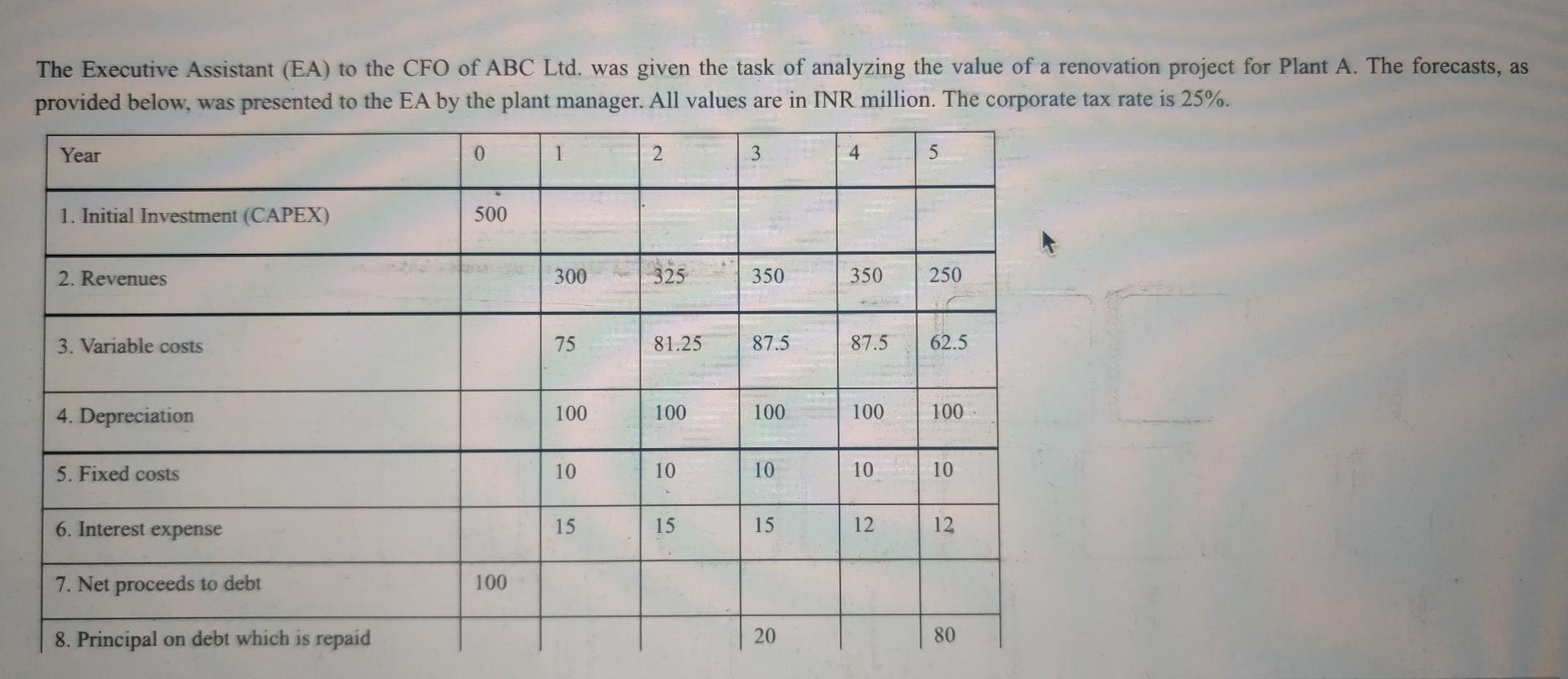

The Executive Assistant (EA) to the CFO of ABC Ltd. was given the task of analyzing the value of a renovation project for Plant A.

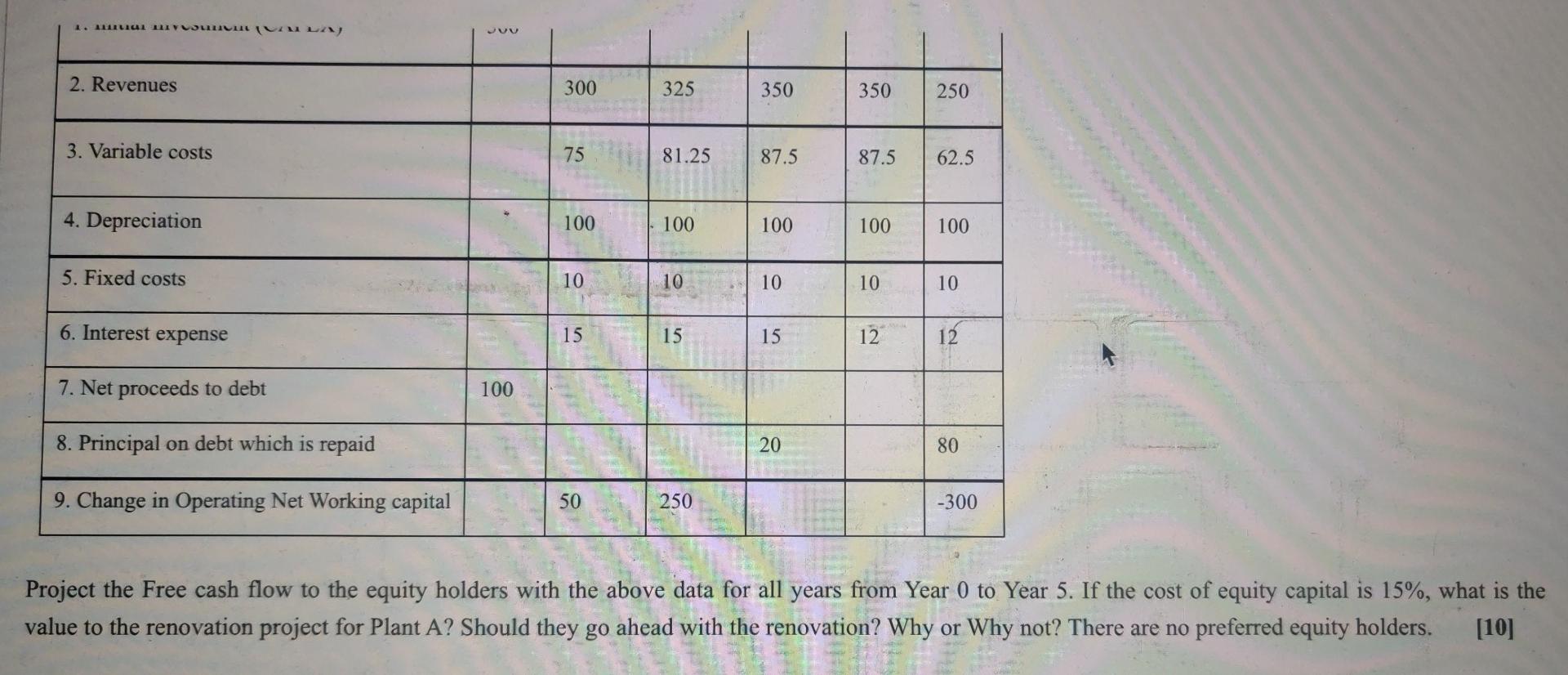

The Executive Assistant (EA) to the CFO of ABC Ltd. was given the task of analyzing the value of a renovation project for Plant A. The forecasts, as provided below, was presented to the EA by the plant manager. All values are in INR million. The corporate tax rate is 25%. Year 0 1 2 3 4 5 1. Initial Investment (CAPEX) 500 2. Revenues 300 325 350 350 250 3. Variable costs 75 81.25 87.5 87.5 62.5 4. Depreciation 100 100 100 100 100 5. Fixed costs 10 10 10 10 10 6. Interest expense 15 15 15 12 12 7. Net proceeds to debt 100 20 80 8. Principal on debt which is repaid 1. muu uuuuuu ALLA 2. Revenues 300 325 350 350 250 3. Variable costs 75 81.25 87.5 87.5 62.5 4. Depreciation 100 100 100 100 100 5. Fixed costs 10 10 10 10 10 6. Interest expense 15 15 15 12 12 7. Net proceeds to debt 100 8. Principal on debt which is repaid 20 80 9. Change in Operating Net Working capital 50 250 -300 Project the Free cash flow to the equity holders with the above data for all years from Year 0 to Year 5. If the cost of equity capital is 15%, what is the value to the renovation project for Plant A? Should they go ahead with the renovation? Why or Why not? There are no preferred equity holders. [10]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started