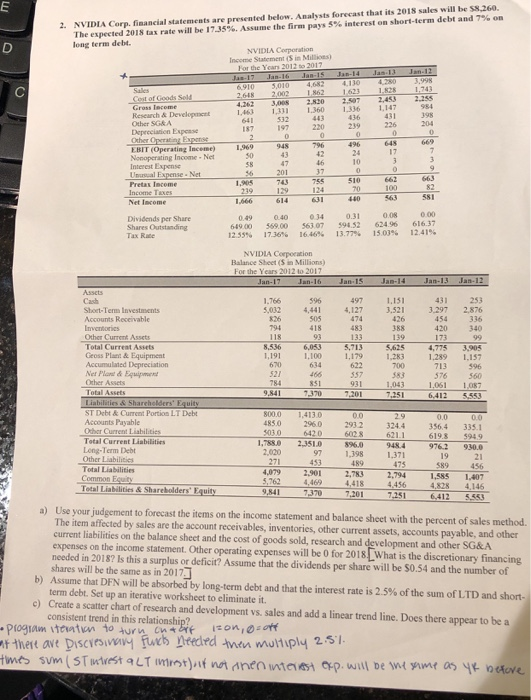

The expected 2018 tax rate will be 17.35%. Assume the firm pays 5% interest on short-term debt and long term debt. on 2. NVIDIA Corp. financial statements are presented below. Analysts forecast that its 2018 sales will be $8,260. NVIDLA Corporation Income Statement (3 in Millions) 64 1,332.820 623 120 1,4 1,331 1360 1336 1,147 o 239 31 17 3,998 4,682 4.130 420 4,262 3,008 2,820 2,507 2,453 2.255 Research & Developmen Other SG&A Depreciation Expesse EBIT (Operating Inceme) 1969 948 796 50 10 Interest Expense 1,905 1,666 0.49 70 Net Iscome Dividends per Share Tax Rate 0.08 000 040 649.00 56900 56307 594.52 62496 61637 12.55% 17.36% 16.46% 13.77% 1503% 12.41% NVIDIA Corpocation Balance Sheet (5 in Millions) Jan-16 Jan-15 Jan-14Jan-13 Jan-12 1151 3,297 336 431 253 3.297 2,876 1.766 5,032 596 4,441 4,127 3,52 Shoet-Term Investments Accounts Receivable $2618 483 420 340 Other Currenk Assets Total Curreat Assets Geoss Plan& Equipment Accumulaled Depreciation Net Plon & Equipmen Other Assets 93 8,536 6,053 5,713 5,625 4,775 3,905 1,179 1,283 1,289 1157 713 396 576 560 1,061 1,087 6,412 5,553 1,179 622 1,191 1,100 634 700 ST Debt &Current Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Total Liabilities 800.0 1,413.0 4850 2960 2932 3244 3564 335.1 619.3 5949 1,788.0 2,3510 960 9484 9762 930.0 602 8 97 1,398 19 489 1,37 475 4,079 2,901 2,783 2,.794 1,585 1,407 4,828 4,146 6,412 5555 4,469 Total Liabilities & Sharebolders' Equity 9.841 .370 7201 7251 a) Use your judgement to forecast the items on the income statement and balance sheet with the percent of sales method. The item affected by sales are the account receivables, inventories, other current assets, accounts payable, and other current liabilities on the balance sheet and the cost of goods sold, research and development and other SG&A expenses on the income statement. Other operating expenses will be 0 for 2018 What is the discretionary financing needed in 2018? Is this a surplus or deficit? Assume that the dividends per share will be S0.54 and the number of shares will be the same as in 2017 Assume that DFN will be absorbed by long-term debt and that the interest rate is 2.5% ofthe sum of LTD and short term debt. Set up an iterative worksheet to eliminate it. Create a scatter chart of research and development vs. sales and add a linear trend line. Does there appear to be a consistent trend in this relationship? b) c) thert ave piscveswainy fuweb Deecird -men multiply 25 me sm(STwvest aLT t)it n anennte opp.will De w The expected 2018 tax rate will be 17.35%. Assume the firm pays 5% interest on short-term debt and long term debt. on 2. NVIDIA Corp. financial statements are presented below. Analysts forecast that its 2018 sales will be $8,260. NVIDLA Corporation Income Statement (3 in Millions) 64 1,332.820 623 120 1,4 1,331 1360 1336 1,147 o 239 31 17 3,998 4,682 4.130 420 4,262 3,008 2,820 2,507 2,453 2.255 Research & Developmen Other SG&A Depreciation Expesse EBIT (Operating Inceme) 1969 948 796 50 10 Interest Expense 1,905 1,666 0.49 70 Net Iscome Dividends per Share Tax Rate 0.08 000 040 649.00 56900 56307 594.52 62496 61637 12.55% 17.36% 16.46% 13.77% 1503% 12.41% NVIDIA Corpocation Balance Sheet (5 in Millions) Jan-16 Jan-15 Jan-14Jan-13 Jan-12 1151 3,297 336 431 253 3.297 2,876 1.766 5,032 596 4,441 4,127 3,52 Shoet-Term Investments Accounts Receivable $2618 483 420 340 Other Currenk Assets Total Curreat Assets Geoss Plan& Equipment Accumulaled Depreciation Net Plon & Equipmen Other Assets 93 8,536 6,053 5,713 5,625 4,775 3,905 1,179 1,283 1,289 1157 713 396 576 560 1,061 1,087 6,412 5,553 1,179 622 1,191 1,100 634 700 ST Debt &Current Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Total Liabilities 800.0 1,413.0 4850 2960 2932 3244 3564 335.1 619.3 5949 1,788.0 2,3510 960 9484 9762 930.0 602 8 97 1,398 19 489 1,37 475 4,079 2,901 2,783 2,.794 1,585 1,407 4,828 4,146 6,412 5555 4,469 Total Liabilities & Sharebolders' Equity 9.841 .370 7201 7251 a) Use your judgement to forecast the items on the income statement and balance sheet with the percent of sales method. The item affected by sales are the account receivables, inventories, other current assets, accounts payable, and other current liabilities on the balance sheet and the cost of goods sold, research and development and other SG&A expenses on the income statement. Other operating expenses will be 0 for 2018 What is the discretionary financing needed in 2018? Is this a surplus or deficit? Assume that the dividends per share will be S0.54 and the number of shares will be the same as in 2017 Assume that DFN will be absorbed by long-term debt and that the interest rate is 2.5% ofthe sum of LTD and short term debt. Set up an iterative worksheet to eliminate it. Create a scatter chart of research and development vs. sales and add a linear trend line. Does there appear to be a consistent trend in this relationship? b) c) thert ave piscveswainy fuweb Deecird -men multiply 25 me sm(STwvest aLT t)it n anennte opp.will De w