Answered step by step

Verified Expert Solution

Question

1 Approved Answer

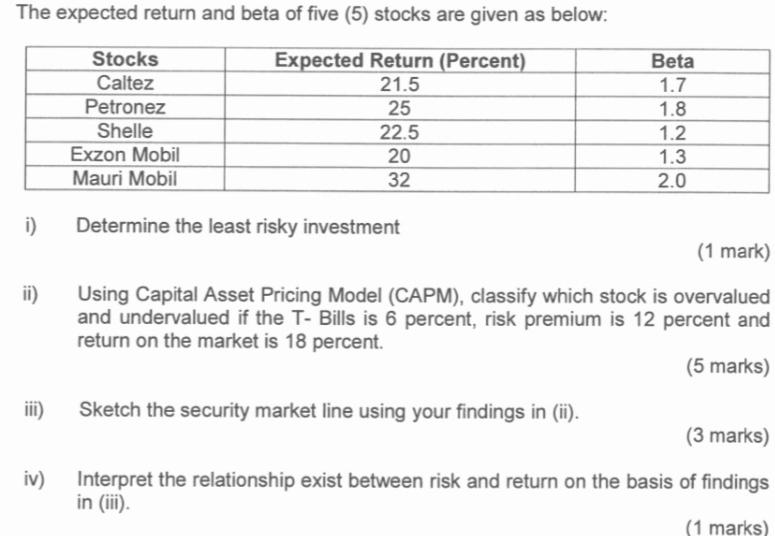

The expected return and beta of five (5) stocks are given as below: Expected Return (Percent) 21.5 25 22.5 20 32 i) ii) iii)

The expected return and beta of five (5) stocks are given as below: Expected Return (Percent) 21.5 25 22.5 20 32 i) ii) iii) iv) Stocks Caltez Petronez Shelle Exzon Mobil Mauri Mobil Determine the least risky investment Beta 1.7 1.8 1.2 1.3 2.0 (1 mark) Using Capital Asset Pricing Model (CAPM), classify which stock is overvalued and undervalued if the T- Bills is 6 percent, risk premium is 12 percent and return on the market is 18 percent. (5 marks) Sketch the security market line using your findings in (ii). (3 marks) Interpret the relationship exist between risk and return on the basis of findings in (iii). (1 marks)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i To determine the least risky investment we need to look at the beta values of each stock The lower the beta the less risky the investment Among the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started