Question

The Family Place Kitchen is a small chain of kitchen remodeling stores. The company's year-end trial balance on December 31, 20X1, included the information shown

The Family Place Kitchen is a small chain of kitchen remodeling stores. The company's year-end trial balance on December 31, 20X1, included the information shown below:

| Accounts Receivable | $ | 558,220 | |

| Allowance for Doubtful Accounts (credit) | 23,100 | ||

Net credit sales for 20X1 were $4,630,000. Allowance for Doubtful Accounts has not yet been adjusted. Required: 1. At the end of 20X1, the following additional accounts receivable are deemed uncollectible:

| Hayward Anderson | $ | 7,200 | |

| Richard Bennett | 1,270 | ||

| Donald O'Brian | 3,900 | ||

| Sergio Tirado | 4,415 | ||

| Columbus Wilkerson | 3,350 | ||

| Total | $ | 20,135 | |

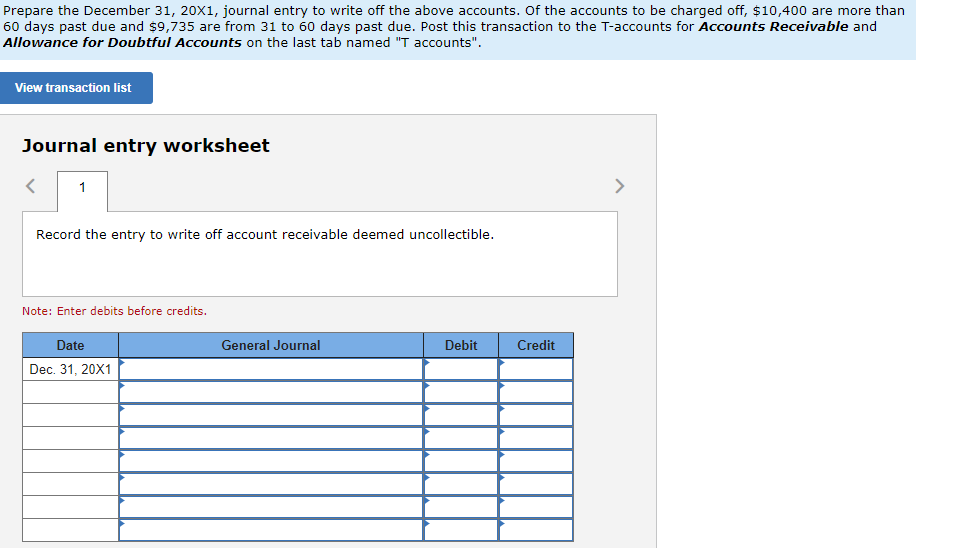

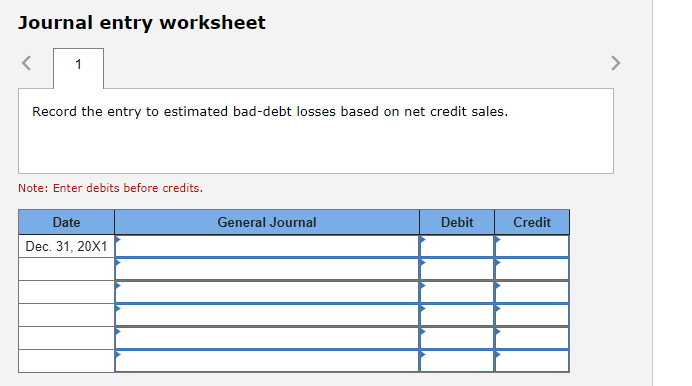

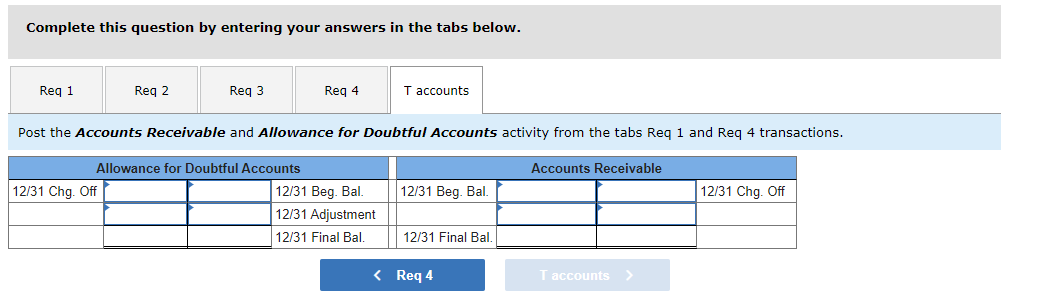

Prepare the December 31, 20X1, journal entry to write off the above accounts. Of the accounts to be charged off, $10,400 are more than 60 days past due and $9,735 are from 31 to 60 days past due. Post this transaction to the T-accounts for Accounts Receivable and Allowance for Doubtful Accounts. 2. Assume that the company uses the percentage of sales method to estimate uncollectible accounts expense. After analyzing the prior years activities, management determined that losses from uncollectible accounts for 20X1 should be 0.32 percent of net credit sales. Prepare the necessary adjusting journal entry. 3. Assume that the company uses the aging of accounts receivable method. The following information was furnished by the credit manager for use in calculating the estimated loss from uncollectible accounts. The balances of accounts were computed prior to the charge-offs in item 1.

| Receivable Category | Estimated Loss Rate | Balances of Accounts (before charge-offs) | |||||

| Current | 1.0 | % | $ | 423,000 | |||

| 1-30 days past due | 5.0 | % | 63,000 | ||||

| 31-60 days past due | 10.0 | % | 33,700 | ||||

| Over 60 days past due | 40.0 | % | 38,520 | ||||

| Total | $ | 558,220 | |||||

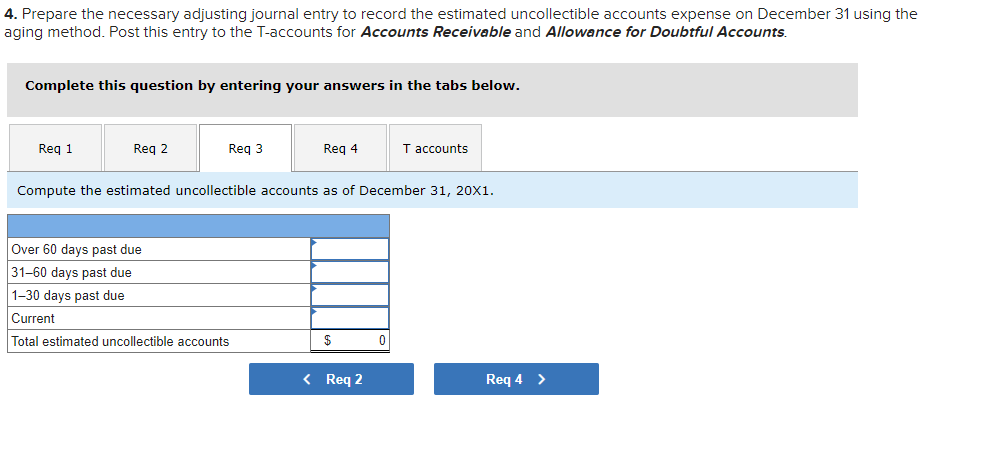

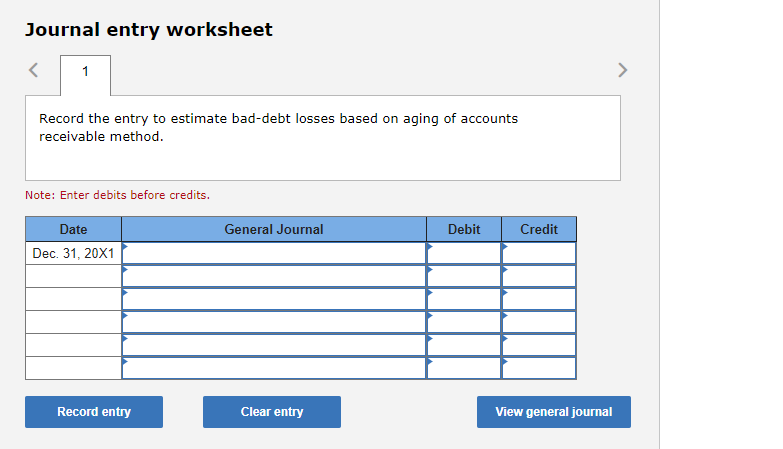

Compute the estimated uncollectible accounts as of December 31, 20X1. 4. Prepare the necessary adjusting journal entry to record the estimated uncollectible accounts expense on December 31 using the aging method. Post this entry to the T-accounts for Accounts Receivable and Allowance for Doubtful Accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started