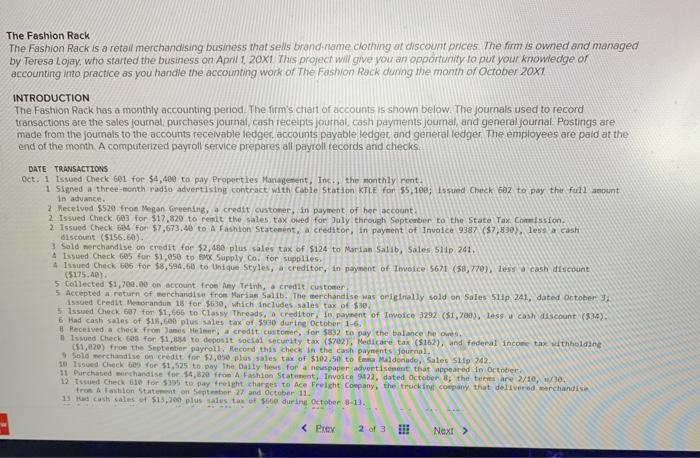

The Fashion Rack The Fashion Rack is a retail merchandising business that sells brand name clothing at discount prices. The firm is owned and managed by Teresa Lojay, who started the business on April 120x1 This project will give you an opportunity to put your knowledge of accounting into practice as you handle the accounting work of The Fashion Rock during the month of October 20X1 INTRODUCTION The Fashion Rack has a monthly accounting period. The firm's chart of accounts is shown below. The Journals used to record transactions are the sales journal purchases journal, cash receipts journal cash payments journal and general journal Postings are made from the journals to the accounts receivable ledger accounts payable ledger and general ledger The employees are paid at the end of the month A computerized payroll service prepares all payroll records and checks DATE TRANSACTIONS Oct. 1 Issund Check 601 for $4,400 to pay Properties Management, Inc., the monthly rent 1 Signed three-month radio advertising contract with Cable Station KTLE for $5,100; issued Check 6hz to pay the full amount in advance. 2 Meceived 5520 fron Megan Breening credit customer, in payment of her account 2 Issued Check 603 for $17,820 to renit the sales tax owed for July through September to the State Tax Commission 2 Issued Check 604 for $7,67340 to A Fashion Statement, a creditor, in payment of Invoice 9387 ($7,830), less cash discount ($156.60). Sold merchandise on credit for $2,480 plus sales tax of $124 to Marian Salib, Sales Slip 241. 4 Issued Check 605 for $1,050 to BMX Supply Co. for supplies. 4 Issued Check 606 for $8,594,60 to Unique Styles, a creditor, in payment of Twoice 5671 (58, 770), les cash discount (5175.40) 5 Collected $1,700.00 on account from my Trinks, credit customer 5. Accepted a return of merchandise from Marian Salib. The merchandise was originally sold on Sales Slip 241, dated October issued Credit Menandun 15 for $630, which includes sales tax of $30 5 Issued Check 607 for $1,665 to Classy Threads, a creditor, in payment of Invoice 3292 ($1,700), less was discount (534) 6 Had cash sales of $18.600 plus sales tax of 1980 durine October 1-6. B Received a check from James Helmer, a credit customer, for $82 to pay the balance he Issued Check 600 for $1,054 to deposit social security tax (5702), Medicare tax (5162), and federal income tax withholding (51,020) from the September payroll Record this check in the cash payments Journal Sold merchandise on credit for $2,050 plus sales tax of $102.50 to Emma Maldonado, Sales Slip 242 10 Issued Check 63 Yor 51,525 to pay the Daily for a newspaper advertisement that appeared in October 11 Purchased merchandise for 54,820 ron A Fashion Statement, Invoice 22. dated October 8; the terms are 7/10, 1/30. 12 Issued Check 610 for $335 to pay freight charges to Ace Frelicht Company, the trucking company that delivered marchandise tros A Fashion Station September 27 and October 11. 15 Had cash sales of $13,700 plus sales tax of during October 8-13.