Question

The figure below shows the spread between the corporate bonds rated Aaa and Baa and the Constant Maturity Treasury (CMT) yield. Discuss how changes in

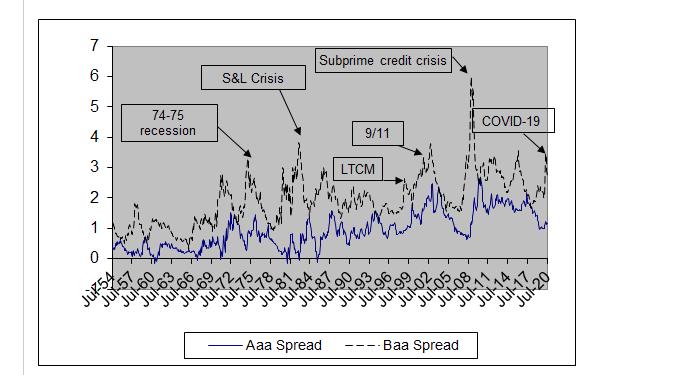

The figure below shows the spread between the corporate bonds rated Aaa and Baa and the Constant Maturity Treasury (CMT) yield. Discuss how changes in the spread will affect a corporation's financing activities in terms of their ability to issue bonds. Based on the figure, how does the credit rating of a particular company enter into the decision? Spread over a 10 year CMT 1953 - 2023

7 9 5 4 3 2 1 0 Juk-54 74-75 recession Jul-57 Jul-60 Jul-63 Jul-66 Jul-69 S&L Crisis Jul-72 Jul-75 Aaa Subprime credit crisis Spread 9/11 LTCM Jul-78 Jul-81 Jul-84 Jul-87 Jul-90 Jul-93 Jul-96 Jul-99 Jul-02 Jul-05 COVID-19 Baa Spread Jul-08 Jul-11 Jul-14 Jul-17 Jul-20

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App