Answered step by step

Verified Expert Solution

Question

1 Approved Answer

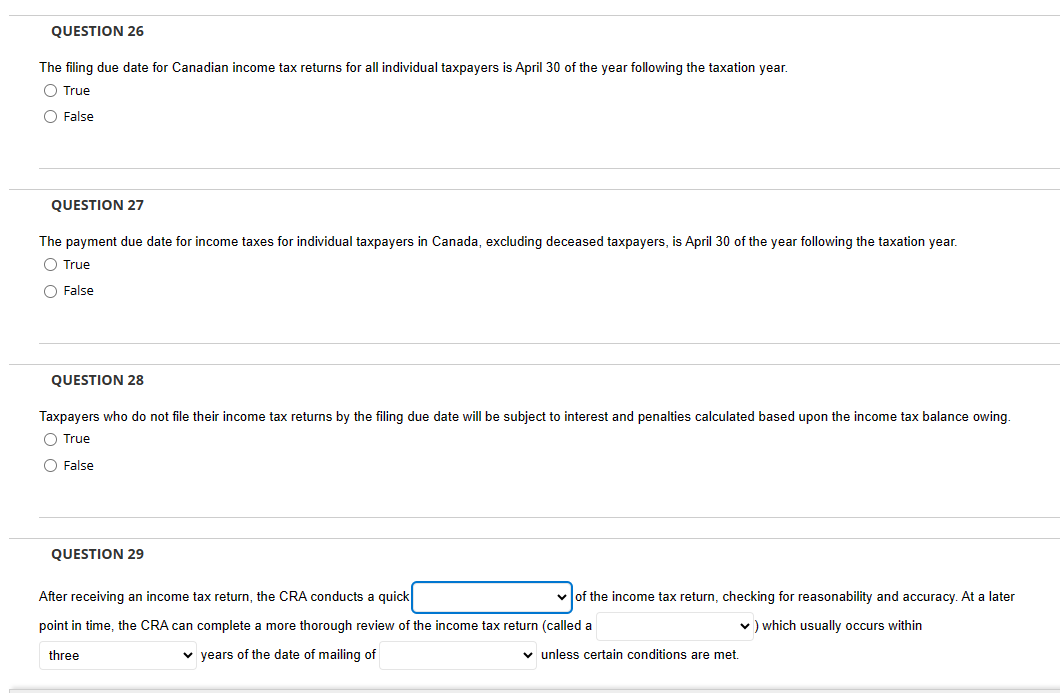

The filing due date for Canadian income tax returns for all individual taxpayers is April 30 of the year following the taxation year. True False

The filing due date for Canadian income tax returns for all individual taxpayers is April 30 of the year following the taxation year. True False QUESTION 27 The payment due date for income taxes for individual taxpayers in Canada, excluding deceased taxpayers, is April 30 of the year following the taxation year. True False QUESTION 28 Taxpayers who do not file their income tax returns by the filing due date will be subject to interest and penalties calculated based upon the income tax balance owing. True False QUESTION 29 After receiving an income tax return, the CRA conducts a quick of the income tax return, checking for reasonability and accuracy. At a later point in time, the CRA can complete a more thorough review of the income tax return (called a which usually occurs within years of the date of mailing of unless certain conditions are met

The filing due date for Canadian income tax returns for all individual taxpayers is April 30 of the year following the taxation year. True False QUESTION 27 The payment due date for income taxes for individual taxpayers in Canada, excluding deceased taxpayers, is April 30 of the year following the taxation year. True False QUESTION 28 Taxpayers who do not file their income tax returns by the filing due date will be subject to interest and penalties calculated based upon the income tax balance owing. True False QUESTION 29 After receiving an income tax return, the CRA conducts a quick of the income tax return, checking for reasonability and accuracy. At a later point in time, the CRA can complete a more thorough review of the income tax return (called a which usually occurs within years of the date of mailing of unless certain conditions are met Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started