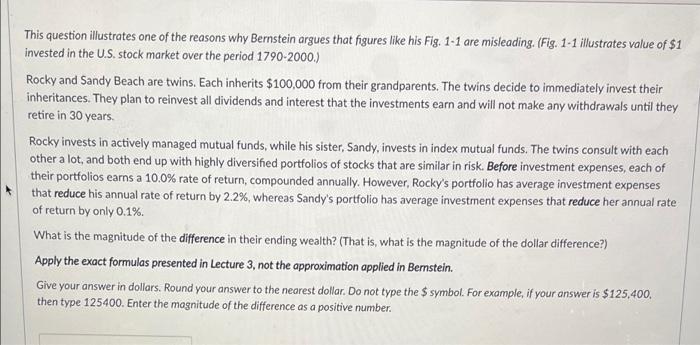

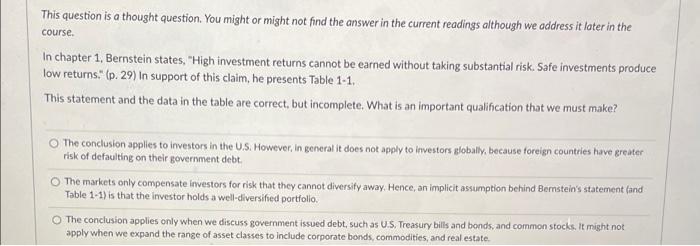

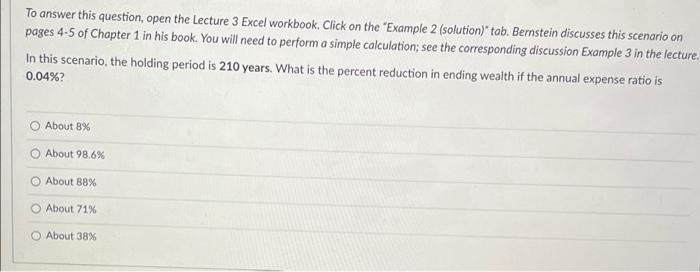

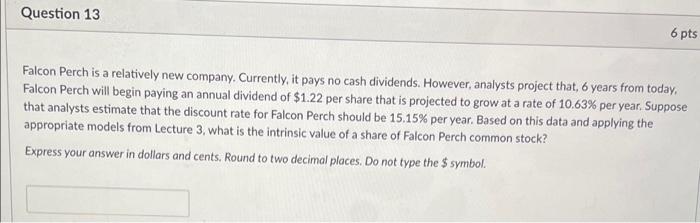

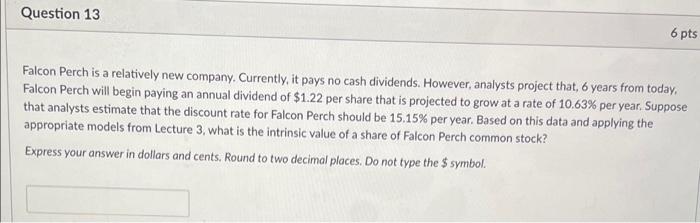

This question illustrates one of the reasons why Bernstein argues that figures like his Fig. 1-1 are misleading. (Fig. 1-1 illustrates value of $1 invested in the U.S. stock market over the period 1790-2000.) Rocky and Sandy Beach are twins. Each inherits $100,000 from their grandparents. The twins decide to immediately invest their inheritances. They plan to reinvest all dividends and interest that the investments earn and will not make any withdrawals until they retire in 30 years Rocky invests in actively managed mutual funds, while his sister, Sandy, invests in index mutual funds. The twins consult with each other a lot, and both end up with highly diversified portfolios of stocks that are similar in risk. Before investment expenses, each of their portfolios earns a 10.0% rate of return, compounded annually. However, Rocky's portfolio has average investment expenses that reduce his annual rate of return by 2.2%, whereas Sandy's portfolio has average investment expenses that reduce her annual rate of return by only 0.1% What is the magnitude of the difference in their ending wealth? (That is, what is the magnitude of the dollar difference? Apply the exact formulas presented in Lecture 3, not the approximation applied in Bernstein. Give your answer in dollars. Round your answer to the nearest dollar. Do not type the $ symbol. For example, if your answer is $125,400, then type 125400. Enter the magnitude of the difference as a positive number. This question is a thought question. You might or might not find the answer in the current readings although we address it later in the course. In chapter 1, Bernstein states, "High investment returns cannot be earned without taking substantial risk. Safe investments produce low returns." (p. 29) In support of this claim, he presents Table 1-1. This statement and the data in the table are correct, but incomplete. What is an important qualification that we must make? The conclusion applies to investors in the U.S. However, in general it does not apply to investors globally, because foreign countries have greater risk of defaulting on their government debt. The markets only compensate investors for risk that they cannot diversity away. Hence, on implicit assumption behind Bernstein's statement (and Table 1-1) is that the investor holds a well-diversified portfolio The conclusion applies only when we discuss government issued debt, such as U.S. Treasury bills and bonds, and common stocks. It might not apply when we expand the range of asset classes to include corporate bonds, commodities, and real estate To answer this question, open the Lecture 3 Excel workbook. Click on the "Example 2 (solution)" tab. Bernstein discusses this scenario on pages 4-5 of Chapter 1 in his book. You will need to perform a simple calculation; see the corresponding discussion Example 3 in the lecture. In this scenario, the holding period is 210 years. What is the percent reduction in ending wealth if the annual expense ratio is 0.04%? About 8% About 98.6% About 88% About 71% About 38% Question 13 6 pts Falcon Perch is a relatively new company. Currently, it pays no cash dividends. However, analysts project that, 6 years from today, Falcon Perch will begin paying an annual dividend of $1.22 per share that is projected to grow at a rate of 10.63% per year. Suppose that analysts estimate that the discount rate for Falcon Perch should be 15.15% per year. Based on this data and applying the appropriate models from Lecture 3, what is the intrinsic value of a share of Falcon Perch common stock? Express your answer in dollars and cents, Round to two decimal places. Do not type the $ symbol