Answered step by step

Verified Expert Solution

Question

1 Approved Answer

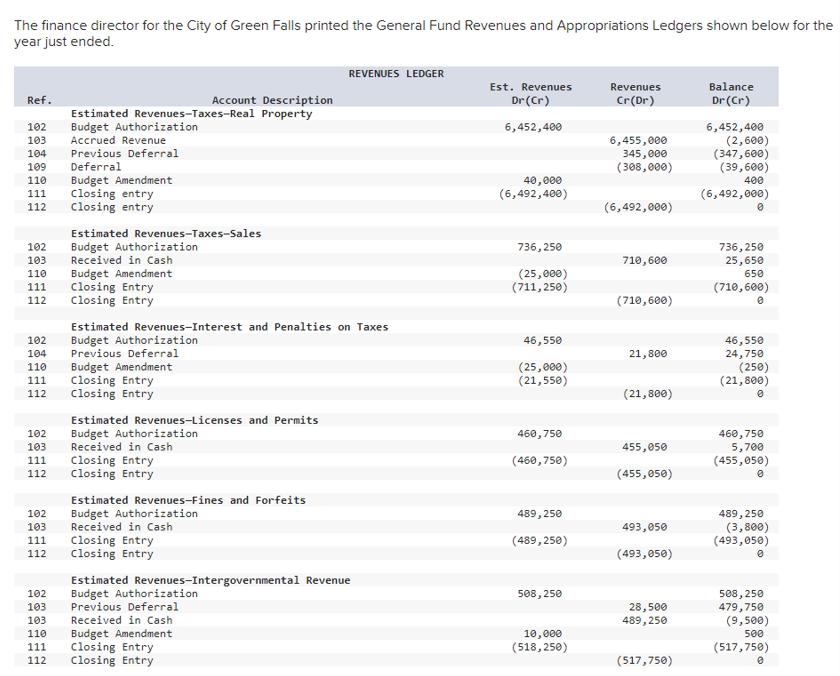

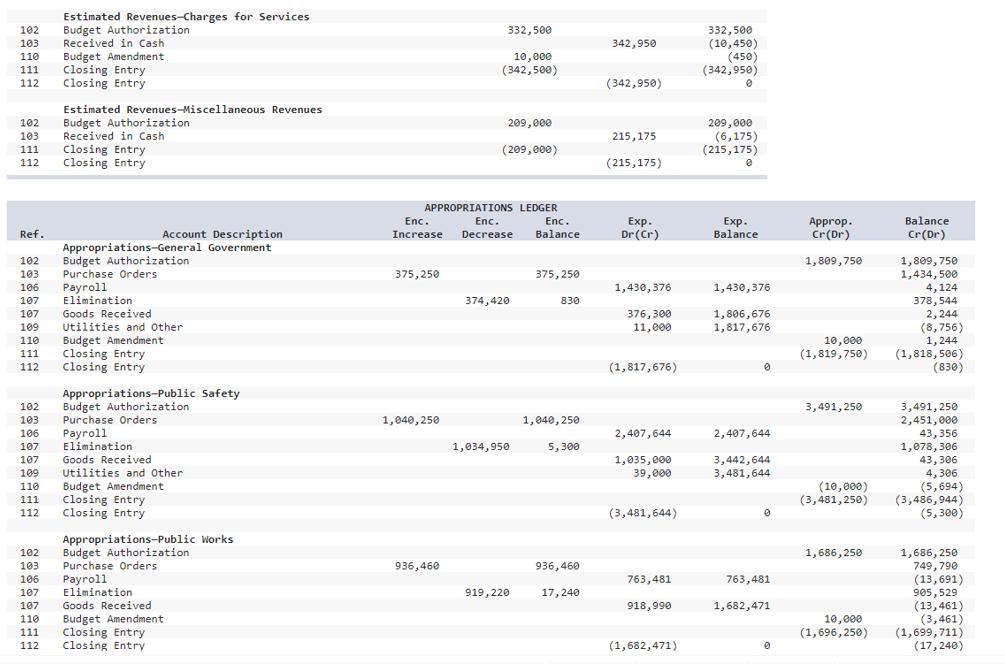

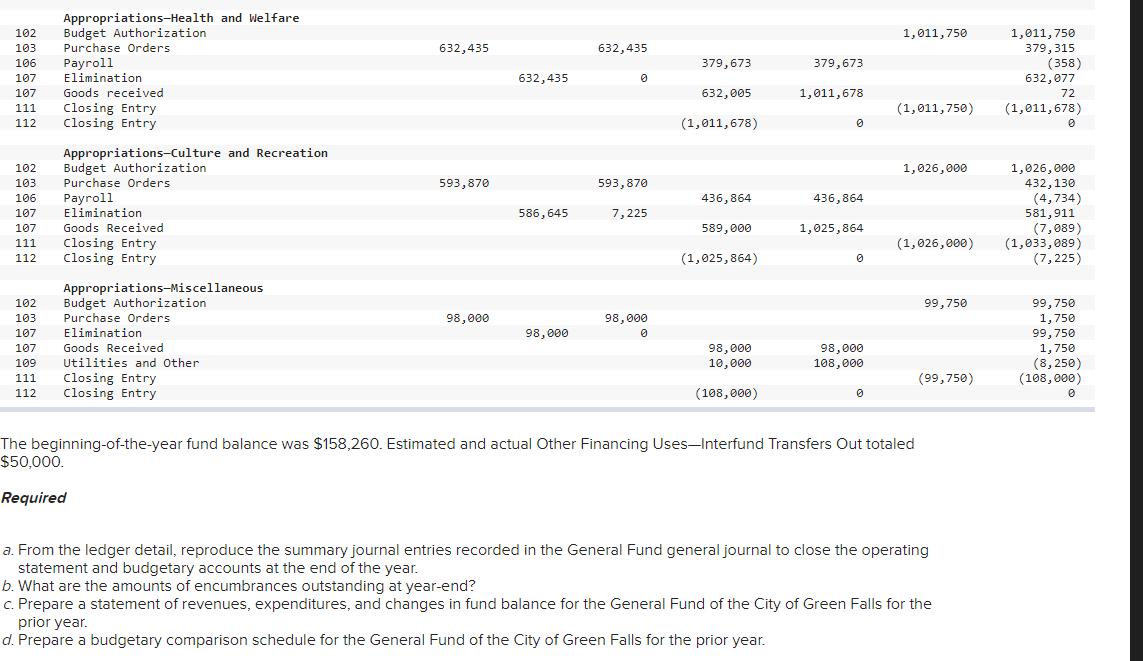

The finance director for the City of Green Falls printed the General Fund Revenues and Appropriations Ledgers shown below for the year just ended.

The finance director for the City of Green Falls printed the General Fund Revenues and Appropriations Ledgers shown below for the year just ended. Ref. 102 103 Accrued Revenue Previous Deferral 104 109 Deferral 110 Budget Amendment 111 Closing entry 112 Closing entry 102 104 110 102 103 Received in Cash 110 Budget Amendment 111 Closing Entry 112 Closing Entry 111 112 102 103 111 112 102 103 111 112 Account Description Estimated Revenues-Taxes-Real Property Budget Authorization 102 103 103 Estimated Revenues-Taxes-Sales Budget Authorization 110 111 Estimated Revenues-Interest and Penalties on Taxes Budget Authorization. Previous Deferral Budget Amendment Closing Entry Closing Entry Estimated Revenues-Licenses and Permits Budget Authorization Received in Cash Closing Entry Closing Entry REVENUES LEDGER Estimated Revenues-Fines and Forfeits Budget Authorization Received in Cash Closing Entry Closing Entry Estimated Revenues-Intergovernmental Revenue Budget Authorization Previous Deferral Received in Cash Budget Amendment Closing Entry 112 O Closing Entry Est. Revenues Dr (Cr) 6,452,400 40,000 (6,492,400) 736,250 (25,000) (711,250) 46,550 (25,000) (21,550) 460,750 (460,750) 489, 250 (489,250) 508,250 10,000 (518,250) Revenues Cr(Dr) 6,455,000 345,000 (308,000) (6,492,000) 710,600 (710,600) 21,800 (21,800) 455,050 (455,050) 493,050 (493,050) 28,500 489,250 (517,750) Balance Dr (Cr) 6,452,400 (2,600) (347,600) (39,600) 400 (6,492,000) 736,250 25,650 650 (710,600) 0 46,550 24,750 (250) (21,800) 0 460,750 5,700 (455,050) 489,250 (3,800) (493,050) 0 508,250 479,750 (9,500) 500 (517,750) Estimated Revenues-Charges for Services 102 Budget Authorization 103 Received in Cash 110 Budget Amendment 111 Closing Entry Closing Entry 112 102 103. Received in Cash Closing Entry 112 Closing Entry 111 Ref. Account Description Appropriations-General Government 102 Budget Authorization 103 Purchase Orders 106 Payroll 107 Elimination 107 109 110 111 112 102 103 106 107 Estimated Revenues-Miscellaneous Revenues Budget Authorization 107 109 110 111 112 102 103 106 107 107 110 Goods Received Utilities and Other Budget Amendment Closing Entry Closing Entry Appropriations-Public Safety Budget Authorization Purchase Orders Payroll Elimination Goods Received Utilities and Other Budget Amendment Closing Entry Closing Entry Appropriations-Public Works Budget Authorization Purchase Orders Payroll Elimination Goods Received Budget Amendment 111 Closing Entry 112 Closing Entry 375,250 APPROPRIATIONS LEDGER Enc. Enc. Enc. Increase Decrease Balance 1,040,250 332,500 10,000 (342,500) 936,460 209,000 (209,000) 374,420 1,034,950 919, 220 375,250 830 1,040, 250 5,300 936,460 17,240 342,950 (342,950) 215,175 (215,175) Exp. Dr (Cr) 1,430,376 376,300 11,000 (1,817,676) 2,407,644 1,035,000 39,000 (3,481,644) 763,481 918,990 (1,682,471) 332,500 (10,450) (450) (342,950) 0 209,000 (6,175) (215,175) 0 Exp. Balance 1,430,376 1,806,676 1,817,676 0 2,407,644 3,442,644 3,481,644 0 763,481 1,682,471 0 Approp. Cr(Dr) 1,809,750 10,000 (1,819,750) 3,491,250 (10,000) (3,481,250) 1,686,250 10,000 (1,696,250) Balance. Cr(Dr) 1,809,750 1,434,500 4,124 378,544 2,244 (8,756) 1,244 (1,818,506) (830) 3,491,250 2,451,000 43,356 1,078, 306 43,306 4,306 (5,694) (3,486,944) (5,300) 1,686,250 749,790 (13,691) 905,529 (13,461) (3,461) (1,699,711) (17,240) 102 Budget Authorization 103 Purchase Orders 106 Payroll 107 Elimination 107 Goods received 111 Closing Entry 112 Closing Entry Appropriations-Health and Welfare 111 112 102 Budget Authorization 103 Purchase Orders 106 Payroll 107 107 Appropriations-Culture and Recreation 109 111 112 Elimination Goods Received Closing Entry Closing Entry Appropriations-Miscellaneous 102 Budget Authorization 103 Purchase Orders 107 Elimination 107 Goods Received Utilities and Other Closing Entry Closing Entry 632,435 593,870 98,000 632,435 586,645 98,000 632,435 0 593,870 7,225 98,000 0 379,673 632,005 (1,011,678) 436,864 589,000 (1,025,864) 98,000 10,000 (108,000) 379,673 1,011,678 0 436,864 1,025,864 0 98,000 108,000 0 1,011,750 (1,011,750) 1,026,000 (1,026,000) The beginning-of-the-year fund balance was $158,260. Estimated and actual Other Financing Uses-Interfund Transfers Out totaled $50,000. Required 99,750 (99,750) a. From the ledger detail, reproduce the summary journal entries recorded in the General Fund general journal to close the operating statement and budgetary accounts at the end of the year. b. What are the amounts of encumbrances outstanding at year-end? c. Prepare a statement of revenues, expenditures, and changes in fund balance for the General Fund of the City of Green Falls for the prior year. d. Prepare a budgetary comparison schedule for the General Fund of the City of Green Falls for the prior year. 1,011,750 379,315 (358) 632,077 72 (1,011,678) 0 1,026,000 432, 130 (4,734) 581,911 (7,089) (1,033,089) (7,225) 99,750 1,750 99,750 1,750 (8,250) (108,000) 0

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The summary journal entries to close the operating statement and budgetary accounts at the end of the year can be derived from the ledger detail provided Here are the entries 1 Closing entry for Est...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started