Question

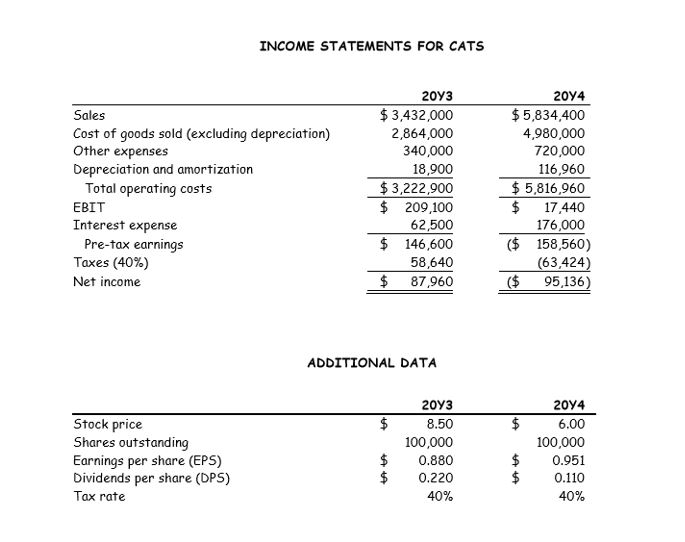

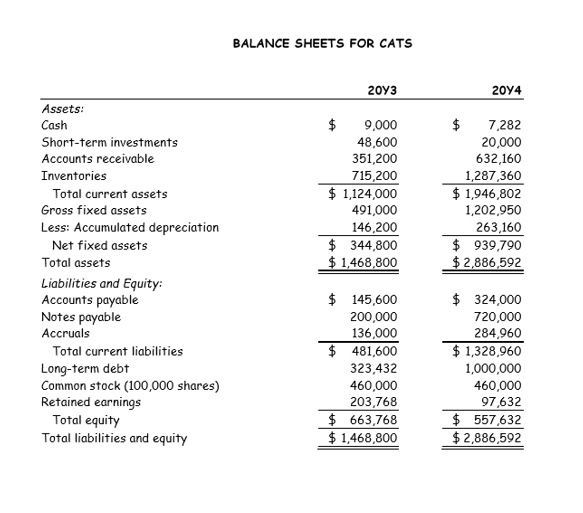

The finance group at CATS is working on forecasting its financial statements for 20Y5. They are working with the following assumptions: CATS will invest $180,000

The finance group at CATS is working on forecasting its financial statements for 20Y5. They are working with the following assumptions:

CATS will invest $180,000 in fixed assets in 20Y5; depreciation expense will increase by $17,469 in 20Y5 over the 20Y4 amount.

CATS will fund the investment in fixed assets with a long-term loan of $180,000. Interest expense will increase by $16,300 in 20Y5 over the 20Y4 amount. There will no change in the number of shares of common stock.

CATS will increase its common dividend by 5%.

The marketing group estimates that sales will increase 12.5% in 20Y5.

All NOWC accounts, except cash, will increase by 10% over the 20Y4 amounts. The ending cash balance for 20Y5 is expected to increase 22% over the 20Y4 amount. ST investments will remain constant.

The ratio of operating expenses (excluding other expenses and depreciation) to sales will decline from ~85.4% to 83%. The other expenses item on the income statement will increase 3%. The tax rate will remain at 40%.

The WACC for CATS is expected to remain at 10% for 20Y5.

Any additional funds needed (AFN) will come from a short-term borrowing, i.e., an increase in notes payable. Similarly, any funds released would be used to reduce notes payable. In other words, notes payable is a plug variable which will be used to balance the balance sheet.

c. Compute the free cash flow (FCF) and the return on invested capital (ROIC) for CATS in 20Y5. Explain any changes in ROIC, i.e., were changes due to changes in operating profitability or capital utilization?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started