Answered step by step

Verified Expert Solution

Question

1 Approved Answer

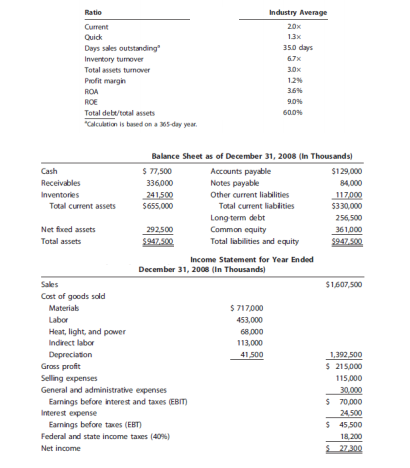

The financial information for Roger Inc. is given below: a. Calculate the debt management and asset management ratios for Roger Inc. b. Outline Rogers strengths

The financial information for Roger Inc. is given below: a. Calculate the debt management and asset management ratios for Roger Inc. b. Outline Rogers strengths and weaknesses as revealed by your analysis. You only have to focus on debt management and asset management areas of business performance. c. Calculate ROE using du-pont equation for the firm and Industry (make table). Conduct Du-pont analysis by comparing the ROE of firm with the industry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started