Answered step by step

Verified Expert Solution

Question

1 Approved Answer

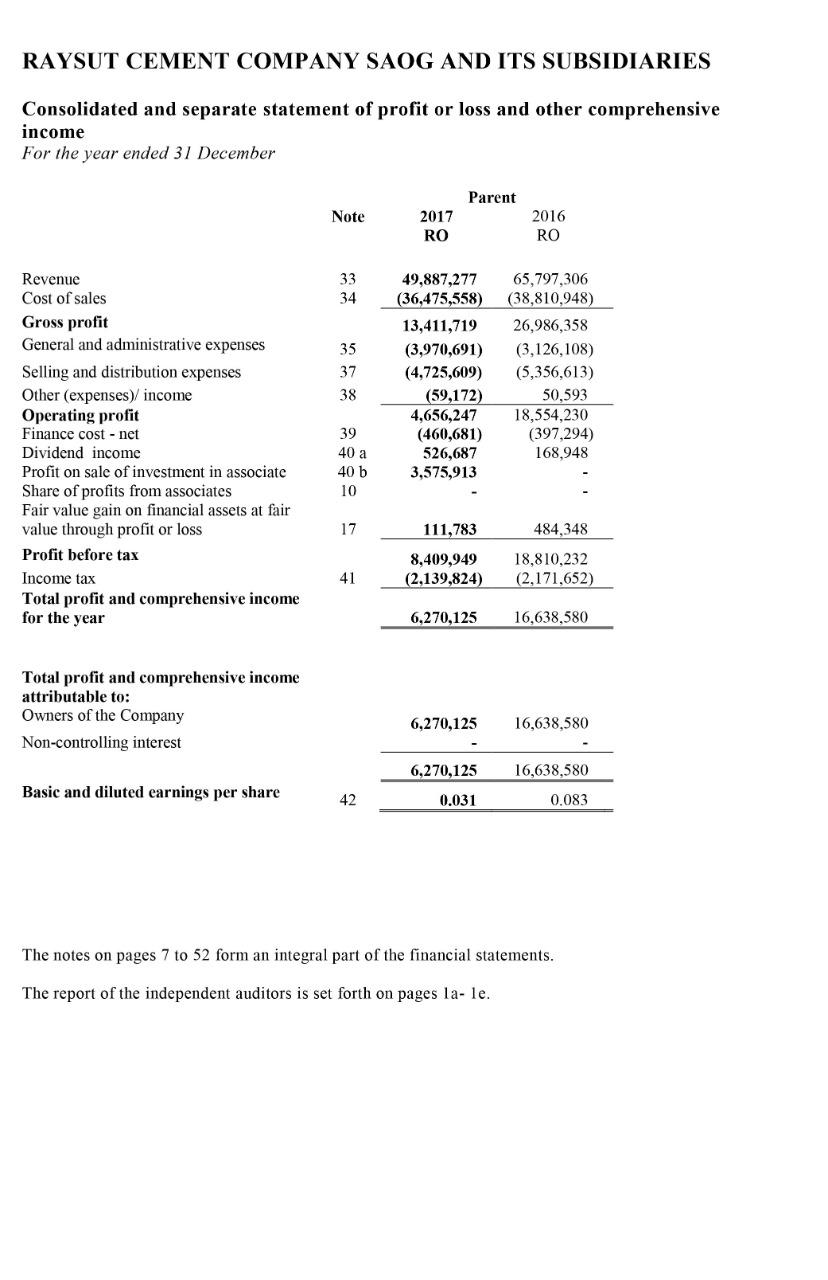

The financial statement is reported on the basis of Historical Cost Accounting (HCA) and you are required to convert income statements by applying Current Purchasing

The financial statement is reported on the basis of Historical Cost Accounting (HCA) and you are required to convert income statements by applying Current Purchasing Power (CPP) method.

General price index to be applied: opening index = 112.4 closing index = 110.6 average index = 111.5

Note: Do Not solve by hand writing.

it requires you to convert the statement from historical cost to current purchasing power and the price index to convert is given.

RAYSUT CEMENT COMPANY SAOG AND ITS SUBSIDIARIES Consolidated and separate statement of profit or loss and other comprehensive income For the year ended 31 December Parent Note 2017 RO 2016 RO 33 34 35 37 Revenue Cost of sales Gross profit General and administrative expenses Selling and distribution expenses Other (expenses)/ income Operating profit Finance cost - net Dividend income Profit on sale of investment in associate Share of profits from associates Fair value gain on financial assets at fair value through profit or loss Profit before tax Income tax Total profit and comprehensive income for the year 49,887,277 (36,475,558) 13,411,719 (3,970,691) (4,725,609) (59,172) 4,656,247 (460,681) 526,687 3,575,913 65,797,306 (38,810,948) 26,986,358 (3,126,108) (5,356,613) 50,593 18,554,230 (397,294) 168,948 38 39 40 a 40 b 10 17 111,783 484,348 8,409,949 (2,139,824) 18,810,232 (2.171,652) 41 6,270,125 16,638,580 Total profit and comprehensive income attributable to: Owners of the Company Non-controlling interest 6,270,125 16,638,580 6,270,125 16,638,580 Basic and diluted earnings per share 42 0.031 0.083 The notes on pages 7 to 52 form an integral part of the financial statements. The report of the independent auditors is set forth on pages la- le. RAYSUT CEMENT COMPANY SAOG AND ITS SUBSIDIARIES Consolidated and separate statement of profit or loss and other comprehensive income For the year ended 31 December Parent Note 2017 RO 2016 RO 33 34 35 37 Revenue Cost of sales Gross profit General and administrative expenses Selling and distribution expenses Other (expenses)/ income Operating profit Finance cost - net Dividend income Profit on sale of investment in associate Share of profits from associates Fair value gain on financial assets at fair value through profit or loss Profit before tax Income tax Total profit and comprehensive income for the year 49,887,277 (36,475,558) 13,411,719 (3,970,691) (4,725,609) (59,172) 4,656,247 (460,681) 526,687 3,575,913 65,797,306 (38,810,948) 26,986,358 (3,126,108) (5,356,613) 50,593 18,554,230 (397,294) 168,948 38 39 40 a 40 b 10 17 111,783 484,348 8,409,949 (2,139,824) 18,810,232 (2.171,652) 41 6,270,125 16,638,580 Total profit and comprehensive income attributable to: Owners of the Company Non-controlling interest 6,270,125 16,638,580 6,270,125 16,638,580 Basic and diluted earnings per share 42 0.031 0.083 The notes on pages 7 to 52 form an integral part of the financial statements. The report of the independent auditors is set forth on pages la- leStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started