Answered step by step

Verified Expert Solution

Question

1 Approved Answer

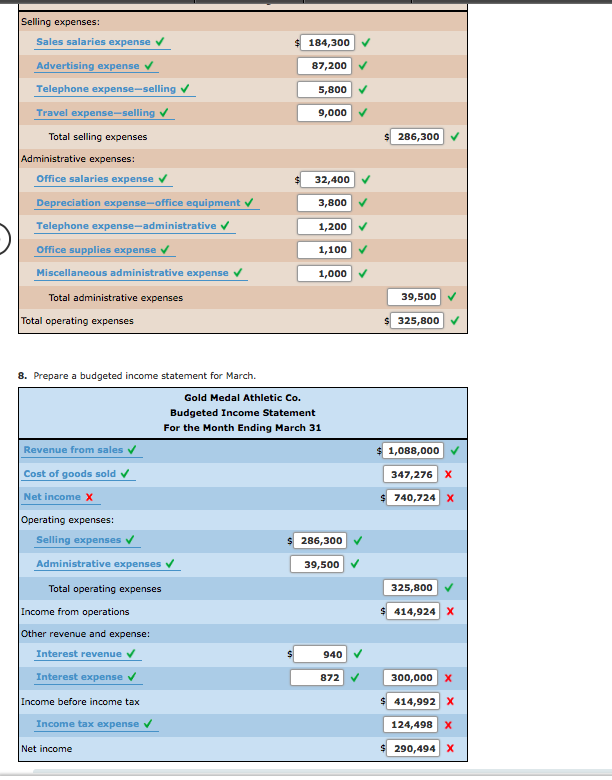

I need help with the answers that are marked wrong (red X), PLEASEE make sure your answers are not the same as in the ones

I need help with the answers that are marked wrong (red X), PLEASEE make sure your answers are not the same as in the ones with the red X cause they are wrong!

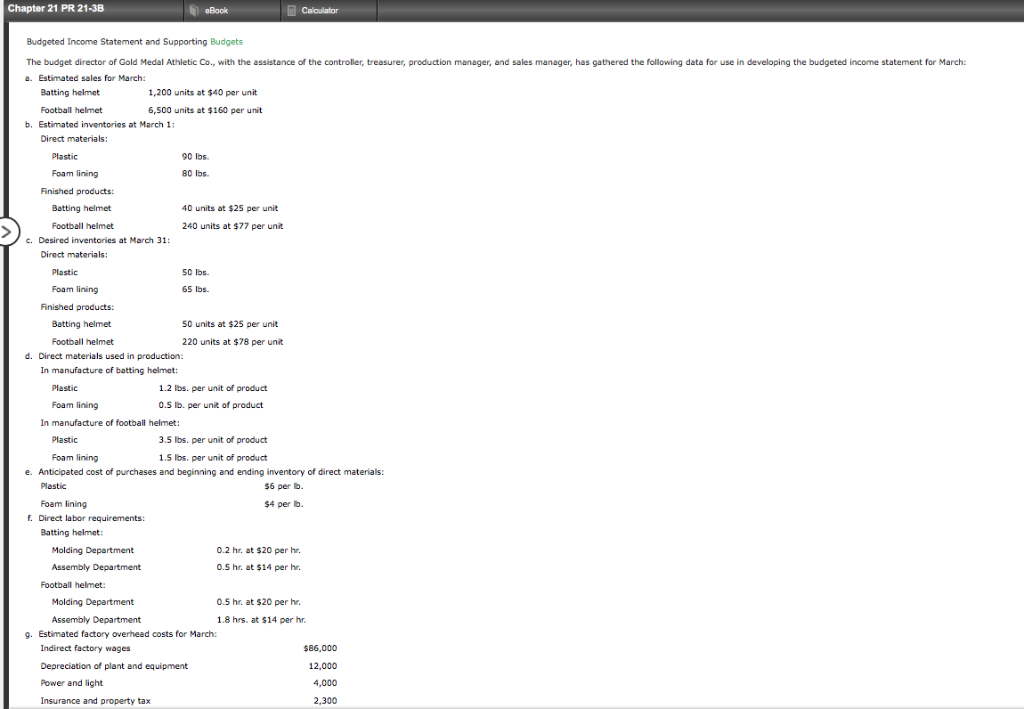

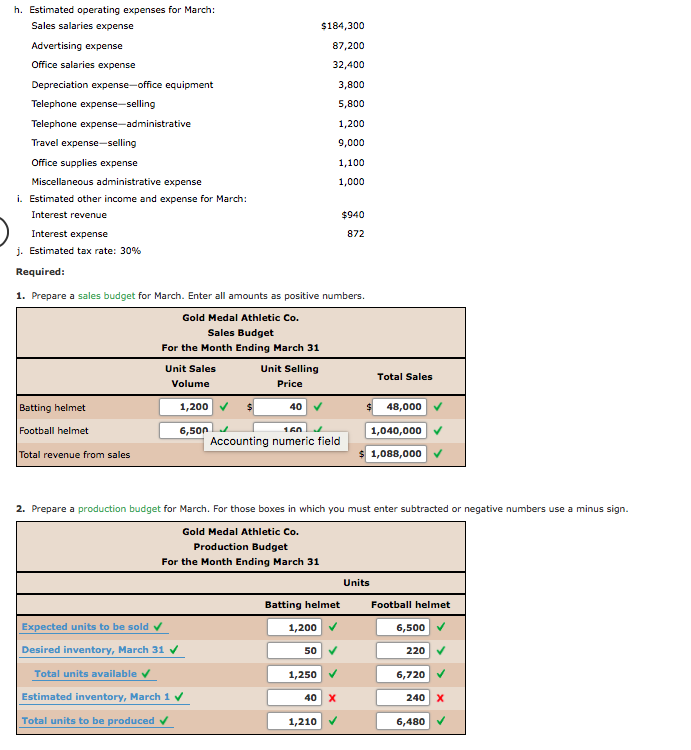

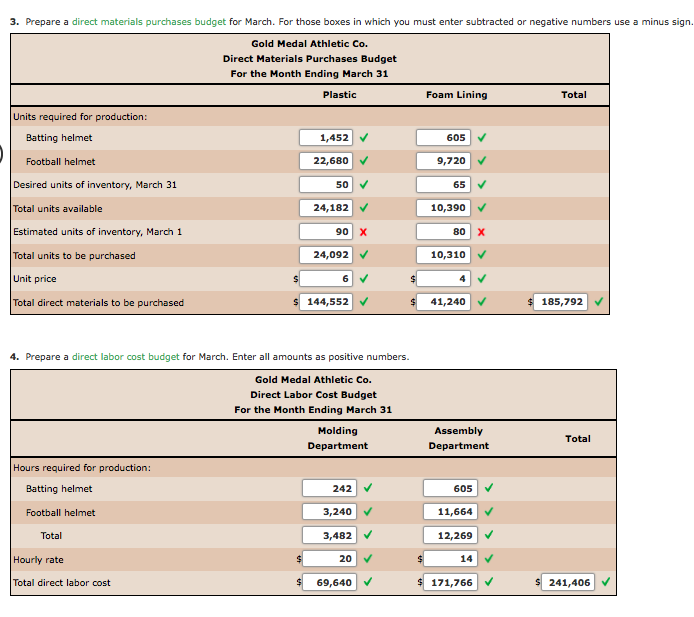

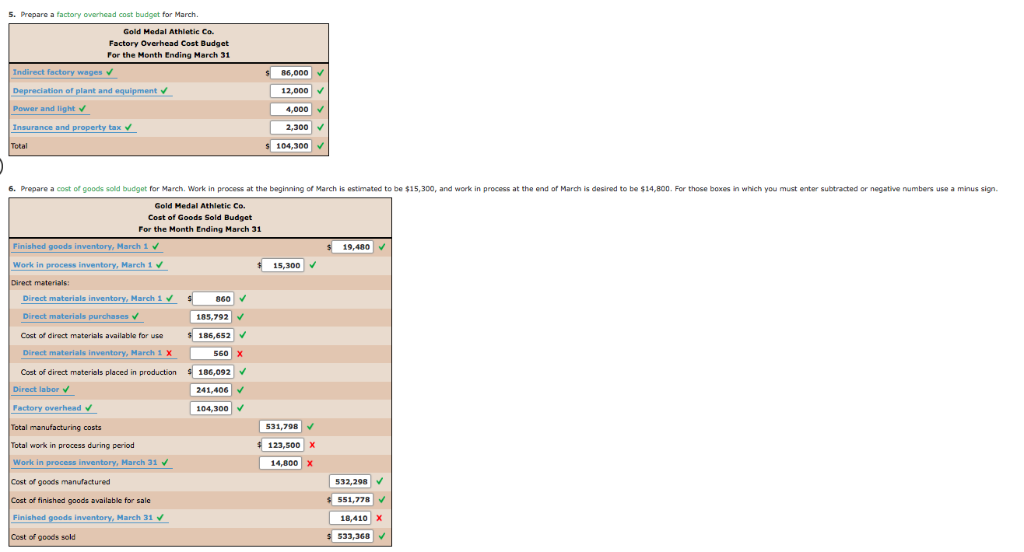

h. Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment $184,300 87,200 32,400 3,800 5,800 1,200 9,000 1,100 1,000 Travel expense-selling Office supplies expense Miscellaneous administrative expense i. Estimated other income and expense for March: Interest revenue $940 Interest expense j. Estimated tax rate: 30% Required 1. Prepare a sales budget for March. Enter al amounts as positive numbers. 872 Gold Medal Athletic Co. Sales Budget For the Month Ending March 31 Unit Selling Unit Sales Volume Total Sales Price 1,200 V 40 V 48,000V 1,040,000 1,088,000 Batting helmet Football helmet 6,500 Accounting numeric field Total revenue from sales 2. Prepare a production budget for March. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Gold Medal Athletic Co. Production Budget For the Month Ending March 31 Units Batting helmet Football helmet 6,500 220 6,720 Expected units to be sold v 1,200 Desired inventory, March 31 50 Total units available Estimated inventory, March 1 Total units to be produced 1,250 40 X 240 X 1,210 6,480 3. Prepare a direct materials purchases budget for March. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Gold Medal Athletic Co. Direct Materials Purchases Budget For the Month Ending March 31 Plastic Foam Lining Total Units required for productiorn 1,452 22,680 50 24,182 605 9,720 65 10,390 Batting helmet Football helmet Desired units of inventory, March 31 Total units available Estimated units of inventory, March 1 Total units to be purchased Unit price Total direct materials to be purchased 90 X 80 X 24,092 V 10,310V 144,552 41,240V 185,792 4. Prepare a direct labor cost budget for March. Enter all amounts as positive numbers. Gold Medal Athletic Co. Direct Labor Cost Budget For the Month Ending March 31 Molding Department Assembly Department Total Hours required for production 242 3,240 3,482 20 605 11,664V 12,269 V 14 Batting helmet Football helmet Total Hourly rate 69,64011766241,406 Total direct labor cost 5. Prepare a factory owerhead cost budget for March. Gold Medal Athletic Co Factory Overhead Cost Budget For the Honth Ending March 31 86,000 v of 12,000 4,000 2,300 Power and light 104,300 6 Pre are a cost of goods sold budget for March work in process at the beginning of March is estimated to be 15,300, and work in process at the end of March is desired to be $14,800. For those boxes in which you must enter subtracted or ne ative numbers use a minus sign Gold Medal Athletie Co. Cost of Goods Sold Budget For the Month Ending March 31 19,480 v Work in March 1 15,300 materials: March 1 V 860 V Direct materials i Direct materials purchases Cost of direct materials available for use Direct materials inventory, Harch 1X Cost of direct materials placed in production 186,092 185,792 186,652 560 X Direct labor 241,406 Factory overhead 104,300 work in process during period Work in process inventory, March 31 531,798 123,500 X 14,800 X of goods manufactured 532,298 51,778 18,410 X 533,368 of finished goods available for sale Harch 31 of goods sold Selling expenses: Sales salaries expense Advertising expense Telephone expense-selling Travel expense-selling 184,300 87,200 5,800 9,000 V Total selling expenses 286,300 Administrative expenses Office salaries expense 32,400 3,800 1,200 1,100v 1,000 ion expense-office equipment Telephone expense-administrative V Office supplies expense Miscellaneous administrative expense Total administrative expenses 39,500 Total operating expenses 325,800 8. Prepare a budgeted income statement for March. Gold Medal Athletic Co. Budgeted Income Statement For the Month Ending March 31 Revenue from sales Cost of goods sold v Net income X Operating expenses: 1,088,000 347,276 X 740,724X Selling 286,300 Administrative expenses 39,500 V Total operating expenses 325,800 Income from operations 414,924X Other revenue and expense Interest revenue 940 Interest expense v 872 300,000 X 414,992X 124,498X 290,494X Income before income tax Income tax expense Net incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started