Answered step by step

Verified Expert Solution

Question

1 Approved Answer

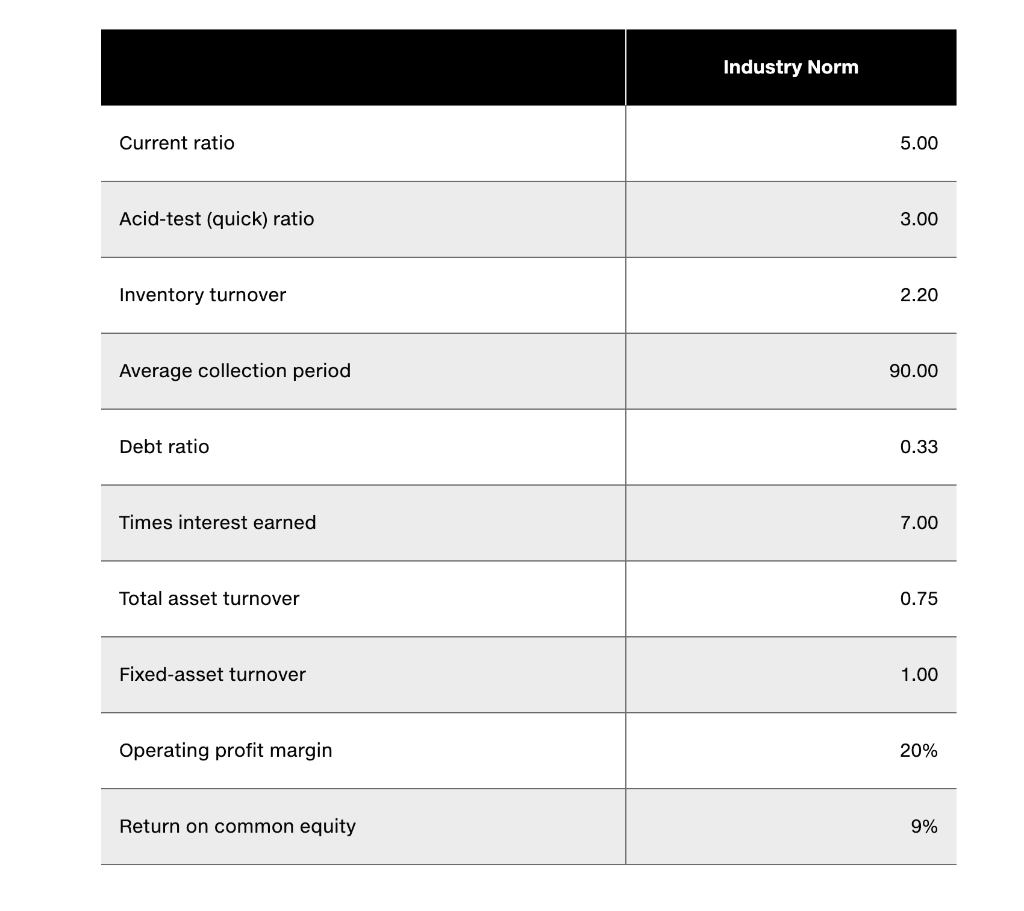

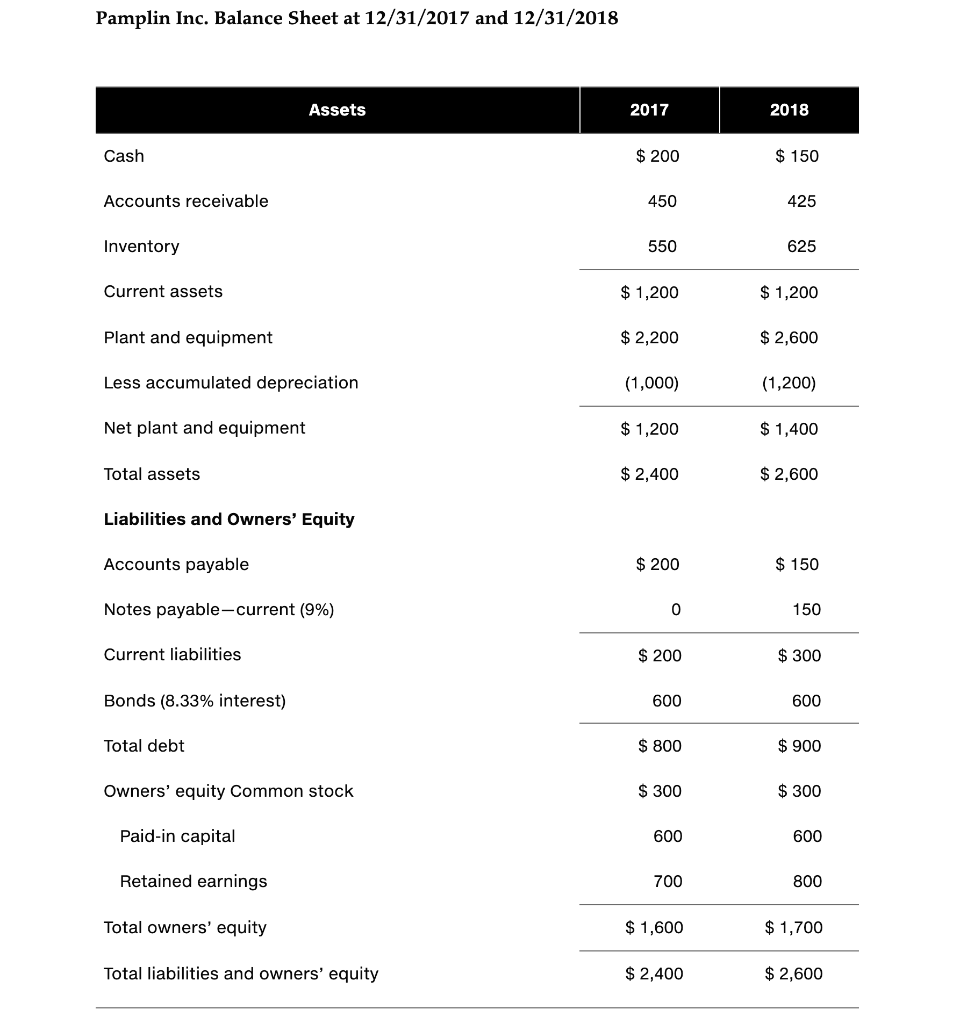

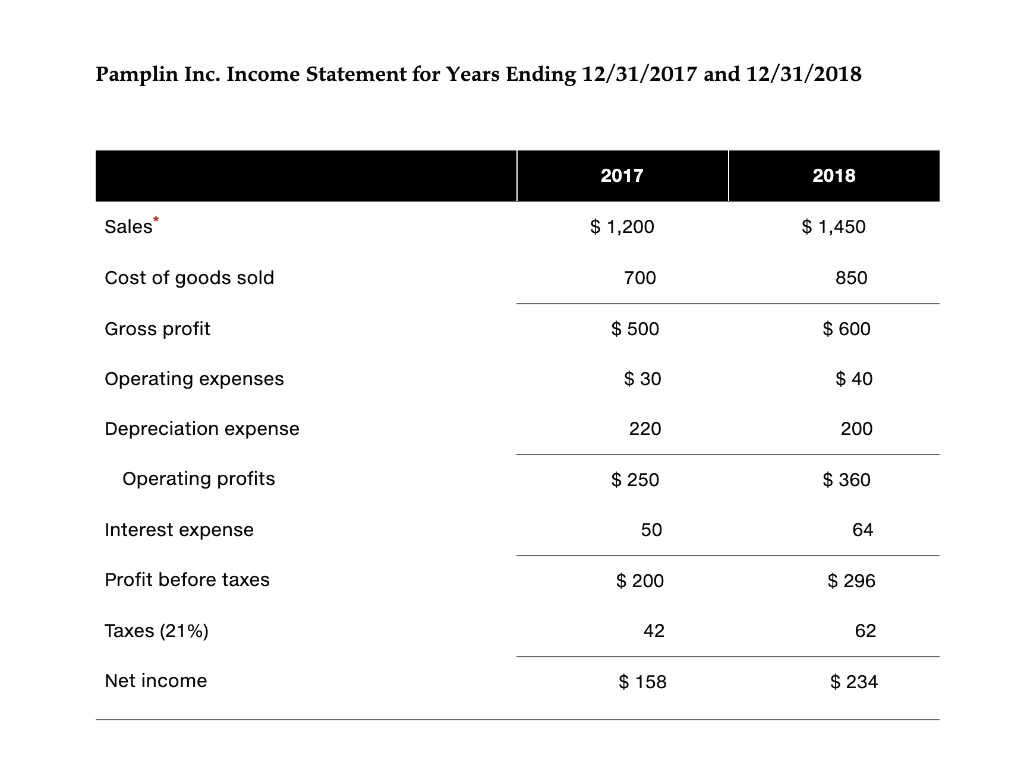

The financial statements and industry norms are shown below for Pamplin, Inc.: A. Compute the financial ratios for Pamplin to compare both 2017 and 2018

The financial statements and industry norms are shown below for Pamplin, Inc.:

A. Compute the financial ratios for Pamplin to compare both 2017 and 2018 against the industry norms.

B. How liquid is the firm?

C. Are its managers generating an adequate operating profit on the firm's assets?

D. How is the firm financing its assets?

E. Are its managers generating a good return on equity?

Industry Norm Current ratio 5.00 Acid-test (quick) ratio 3.00 Inventory turnover 2.20 Average collection period 90.00 Debt ratio 0.33 Times interest earned 7.00 Total asset turnover 0.75 Fixed-asset turnover 1.00 Operating profit margin 20% Return on common equity 9% Pamplin Inc. Balance Sheet at 12/31/2017 and 12/31/2018 Assets 2017 2018 Cash $ 200 $ 150 Accounts receivable 450 425 Inventory 550 625 Current assets $ 1,200 $ 1,200 Plant and equipment $ 2,200 $ 2,600 Less accumulated depreciation (1,000) (1,200) Net plant and equipment $ 1,200 $ 1,400 Total assets $ 2,400 $ 2,600 Liabilities and Owners' Equity Accounts payable $ 200 $ 150 Notes payable-current (9%) 0 150 Current liabilities $ 200 $ 300 Bonds (8.33% interest) 600 600 Total debt $ 800 $ 900 Owners' equity Common stock $ 300 $ 300 Paid-in capital 600 600 Retained earnings 700 800 Total owners' equity $ 1,600 $ 1,700 Total liabilities and owners' equity $ 2,400 $ 2,600 Pamplin Inc. Income Statement for Years Ending 12/31/2017 and 12/31/2018 2017 2018 Sales $ 1,200 $ 1,450 Cost of goods sold 700 850 Gross profit $ 500 $ 600 Operating expenses $ 30 $ 40 Depreciation expense 220 200 Operating profits $ 250 $ 360 Interest expense 50 64 Profit before taxes $ 200 $ 296 Taxes (21%) 42 62 Net income $ 158 $ 234

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started