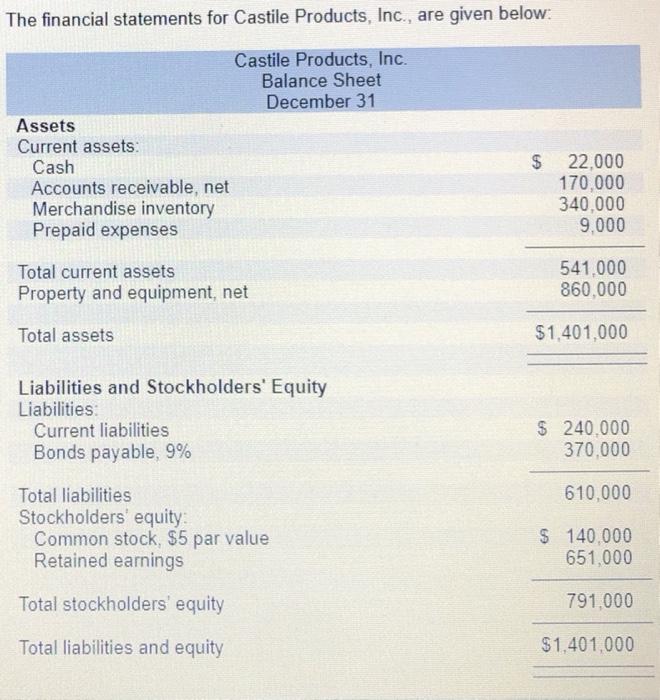

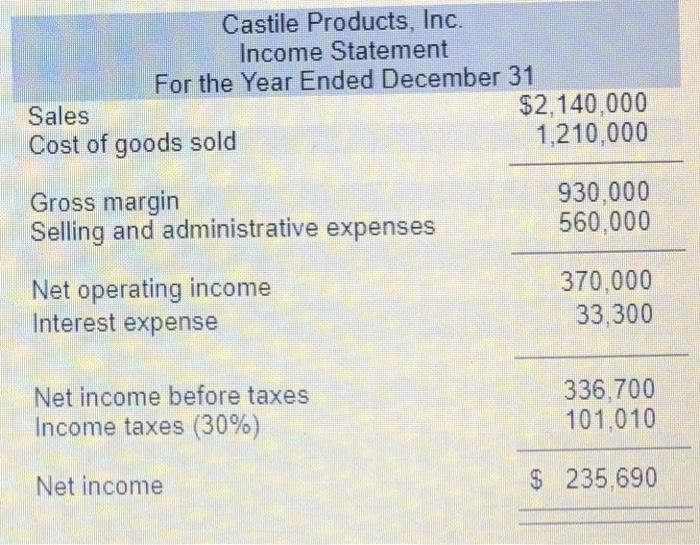

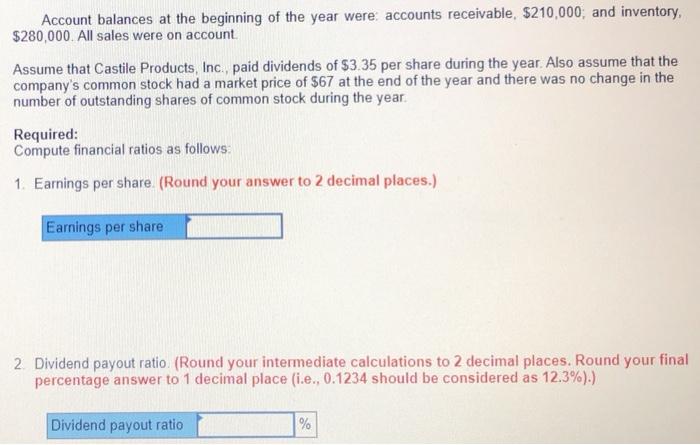

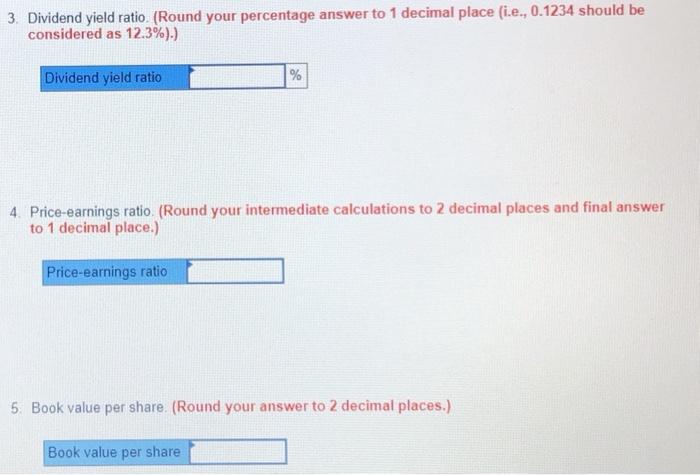

The financial statements for Castile Products, Inc., are given below: Castile Products, Inc. Balance Sheet December 31 Assets Current assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses $ 22,000 170,000 340,000 9.000 Total current assets Property and equipment, net 541.000 860.000 Total assets $1,401,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 9% $ 240.000 370.000 610,000 Total liabilities Stockholders' equity: Common stock, $5 par value Retained earnings $ 140.000 651000 Total stockholders' equity 791,000 Total liabilities and equity $1,401,000 Castile Products, Inc. Income Statement For the Year Ended December 31 Sales $2,140,000 Cost of goods sold 1,210,000 Gross margin Selling and administrative expenses 930,000 560,000 Net operating income Interest expense 370.000 33,300 Net income before taxes Income taxes (30%) 336,700 101,010 Net income $ 235,690 Account balances at the beginning of the year were accounts receivable, $210,000, and inventory, $280,000. All sales were on account Assume that Castile Products, Inc. paid dividends of $3.35 per share during the year. Also assume that the company's common stock had a market price of $67 at the end of the year and there was no change in the number of outstanding shares of common stock during the year. Required: Compute financial ratios as follows: 1. Earnings per share (Round your answer to 2 decimal places.) Earnings per share 2 Dividend payout ratio (Round your intermediate calculations to 2 decimal places. Round your final percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%).) Dividend payout ratio % 3. Dividend yield ratio (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%).) Dividend yield ratio % 4. Price-earnings ratio (Round your intermediate calculations to 2 decimal places and final answer to 1 decimal place.) Price-earnings ratio 5. Book value per share. (Round your answer to 2 decimal places.) Book value per share