Answered step by step

Verified Expert Solution

Question

1 Approved Answer

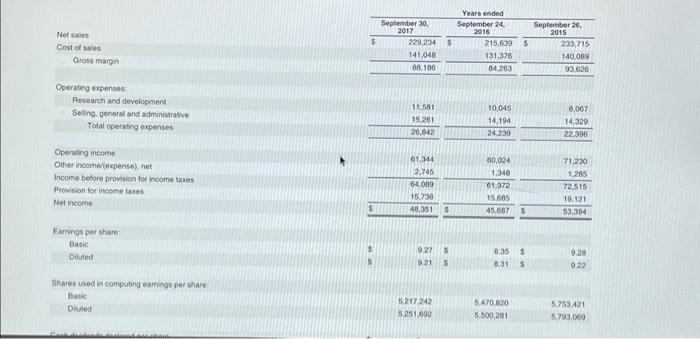

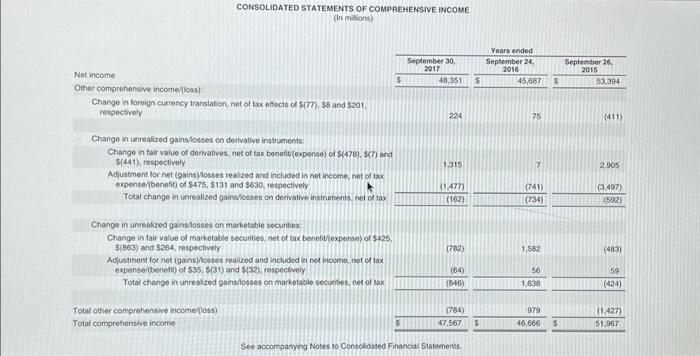

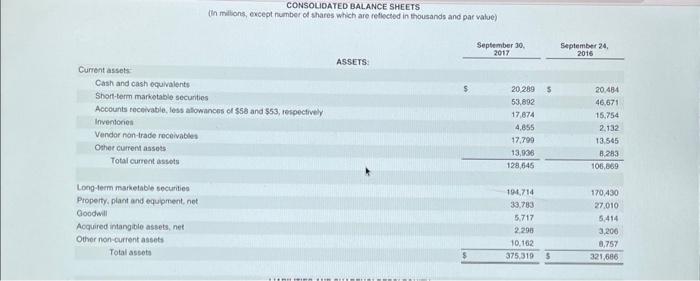

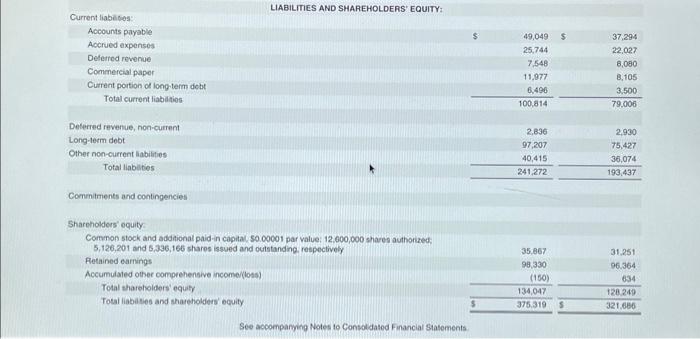

the financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements us available at

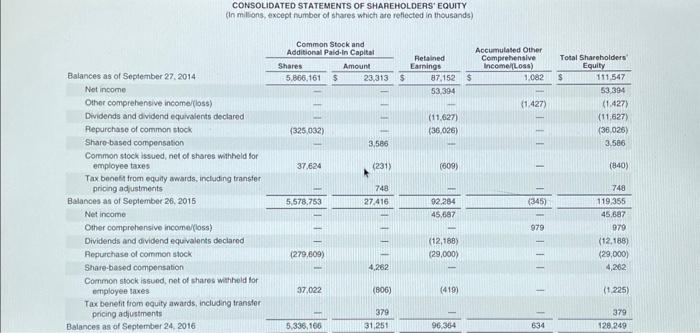

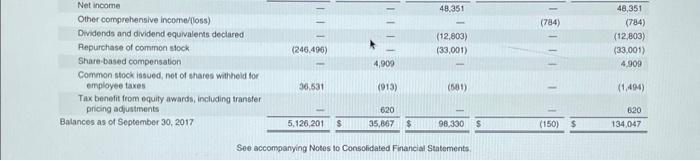

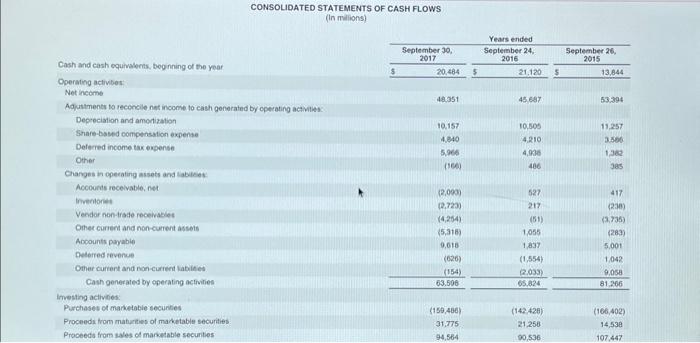

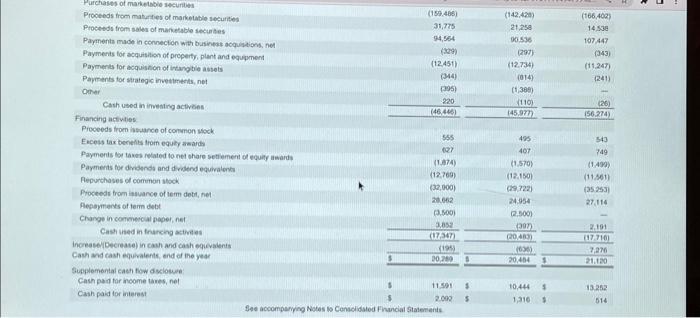

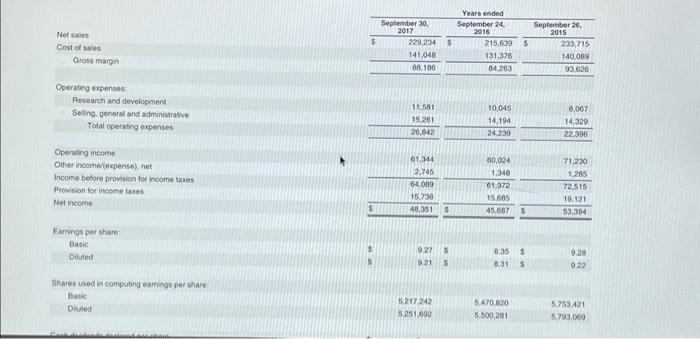

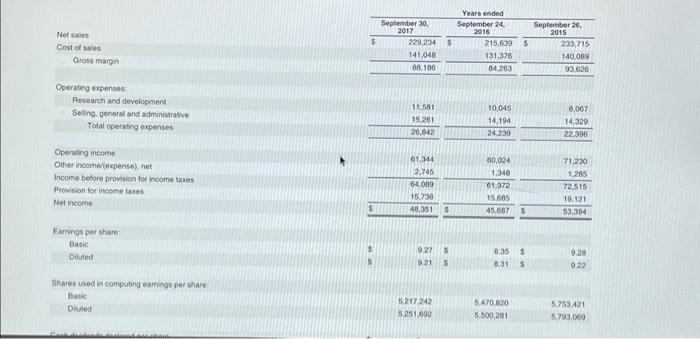

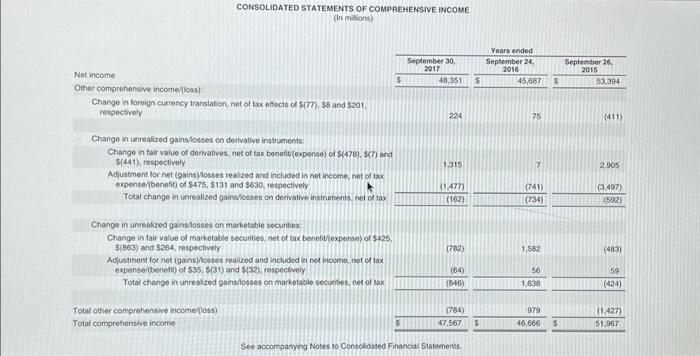

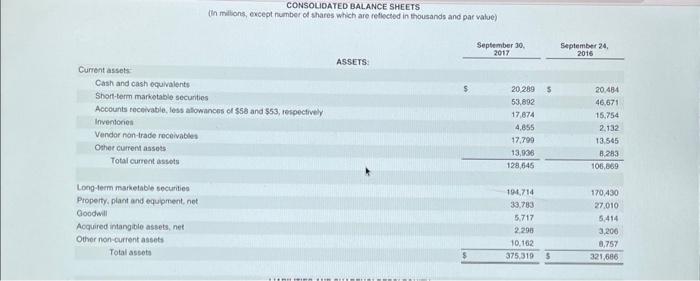

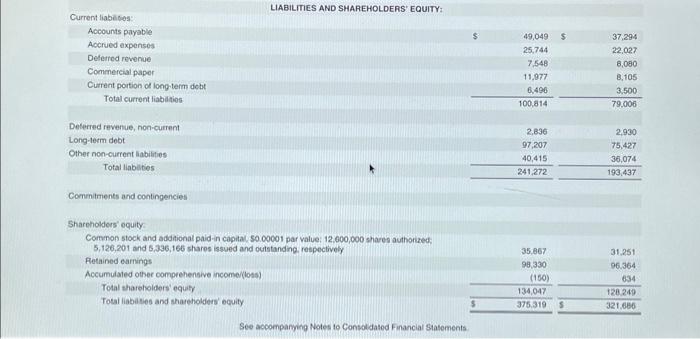

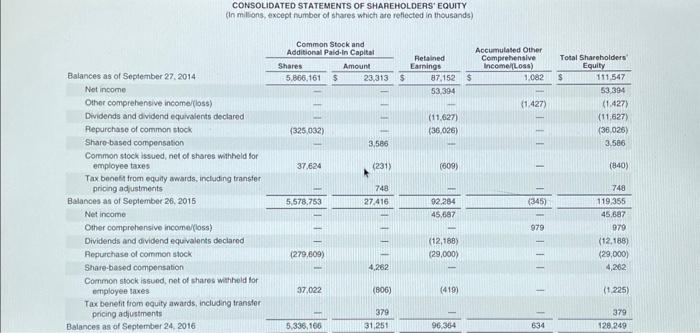

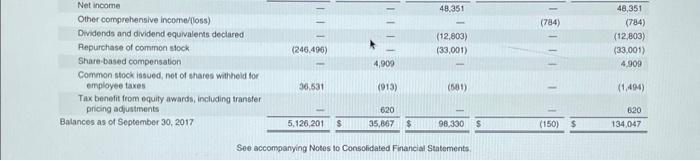

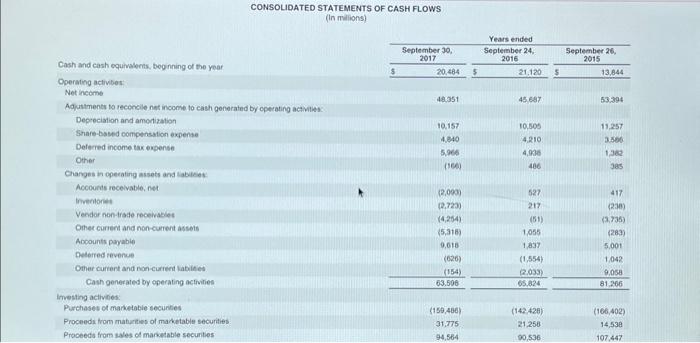

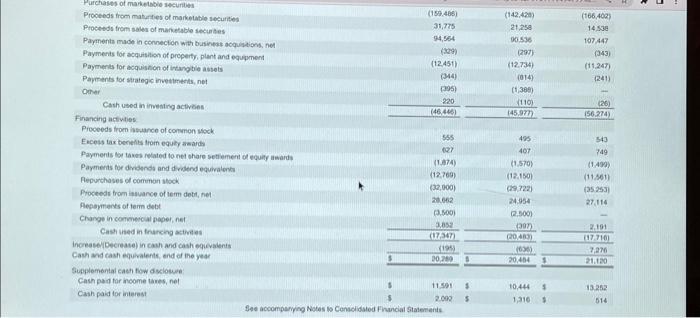

the financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements us available at the company's website. A) What were the total cost and book value of property, plant and equipment at September 40, 2017? B) What was rhe amount of depreciation and amoratization expense for each of the 3 years 2015-2017? C) Using the statement of cash flows, what are the amounts of property, plant and equipment purchase in 2017 and 2016? Appendix A:

Net siales Cost of sales Gross inargin Cperating expenses. Abtearch and development Selling, general and administrave Todal operatrog expenses Operating incerne Other income(expensel net Inceme belore provision for income taxes Provelan for income tawes Aet income Earregs per share: batic Disited Years ended 6.35 6.31 5 9.2 . 922 Eharet used in computing earricgs per share: flasic Givied 5,217,242 5,251,092 5. 470.080 5,000,281 5, 763,421 5.793,069 CONSOLIDATED STATEMENTS OF COMPAEHERSIVE INCOME (in malions) See accormanying Notes 90 Conscilidaled Financial Statemens. CONSOLDATED BALANCE SHEETS (in milions, except number d shares which are retected in thousands and par value) LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabcsos: Accounts payable Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabditios Deterred revenue, non-current Long-term dobt Other non-current labilities Total liabitios Commitments and contingencies Shareholders' equity: Common stock and additional paid-in cagital so.00001 par value: 12,600,000 shares authorized: 5,126,201 and 5,336,166 shares issued and outstanding, respectively Fletained earnings Accumulated other comprehensive income/loss) Total thareholders' equily Total liabasies and shayeholders' equity See acpomparyieg Notes to Consoldated Financial Statements COHSOLIDATED STATEMENTS OF SHAPEHOLDEAS' EQUITY (In milions, except number of shares which are refiected in thousands) See accompanying Notes to Consolidated Financial Statements. CONSOLDATED STATEMENTS OF CASH FLOWS (in mullions) Purchases of marketsele afcuribes Proceeds from matyrties of marketable securities Proceseds from salea of manetable secunites Payments made in connection with businest acquations, net Payments for acquisition of properfy, plant and equpment Payments for acquisnon of intave ble astets Payments for strategie invettmects, nel Crtar Cash used in imesting activenes Financing actuties Proceeds from istuance of comvmen sieck Ecess tax benefts troin equly asaadh Payments for taves related to net thare setlement of equity iasand Payments for dresends and dribend equiralenk Aepurthases of common stock Proceeds from isuance of lem deth, nel Alesermens of term debt Change in commeicial paper, ne! Cast whed in frarcing asthet increase(Becreate) in cauh and cash equvalents Cash and cash equivaients, end of the year tupplemental caeh fow dsclowes cash pad for inoome tanes, nel Cash paid tor interest (15s,46s) 31,775 94,964 (3) (12,451) (24) () sis (Q) (1, (1)7) (12.769) (3,000) (32,000) (a,soo) (17,347)2.052 432194320259 1101 2cog 2.698 (142,47:4) 2) 258 00.596 (29y) (12734) (0) 4) [t,389) 11109 (45.977) (56274)(26) 485 407 (1,570) (12.150) chazi) (t66,409) 14,338 107,447 (43) (11.247) (241). 24.954 R.500) 343 749 (1,492) (11. 801) (25 253) 27,116 10,444 37.276(17.710)2.191 4. 5 1,316 4 13.252 See accompering Notes is Censcidated Fincicial statements See accomparying Notes Is Conscidated Finucial tatements

Net siales Cost of sales Gross inargin Cperating expenses. Abtearch and development Selling, general and administrave Todal operatrog expenses Operating incerne Other income(expensel net Inceme belore provision for income taxes Provelan for income tawes Aet income Earregs per share: batic Disited Years ended 6.35 6.31 5 9.2 . 922 Eharet used in computing earricgs per share: flasic Givied 5,217,242 5,251,092 5. 470.080 5,000,281 5, 763,421 5.793,069 CONSOLIDATED STATEMENTS OF COMPAEHERSIVE INCOME (in malions) See accormanying Notes 90 Conscilidaled Financial Statemens. CONSOLDATED BALANCE SHEETS (in milions, except number d shares which are retected in thousands and par value) LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabcsos: Accounts payable Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabditios Deterred revenue, non-current Long-term dobt Other non-current labilities Total liabitios Commitments and contingencies Shareholders' equity: Common stock and additional paid-in cagital so.00001 par value: 12,600,000 shares authorized: 5,126,201 and 5,336,166 shares issued and outstanding, respectively Fletained earnings Accumulated other comprehensive income/loss) Total thareholders' equily Total liabasies and shayeholders' equity See acpomparyieg Notes to Consoldated Financial Statements COHSOLIDATED STATEMENTS OF SHAPEHOLDEAS' EQUITY (In milions, except number of shares which are refiected in thousands) See accompanying Notes to Consolidated Financial Statements. CONSOLDATED STATEMENTS OF CASH FLOWS (in mullions) Purchases of marketsele afcuribes Proceeds from matyrties of marketable securities Proceseds from salea of manetable secunites Payments made in connection with businest acquations, net Payments for acquisition of properfy, plant and equpment Payments for acquisnon of intave ble astets Payments for strategie invettmects, nel Crtar Cash used in imesting activenes Financing actuties Proceeds from istuance of comvmen sieck Ecess tax benefts troin equly asaadh Payments for taves related to net thare setlement of equity iasand Payments for dresends and dribend equiralenk Aepurthases of common stock Proceeds from isuance of lem deth, nel Alesermens of term debt Change in commeicial paper, ne! Cast whed in frarcing asthet increase(Becreate) in cauh and cash equvalents Cash and cash equivaients, end of the year tupplemental caeh fow dsclowes cash pad for inoome tanes, nel Cash paid tor interest (15s,46s) 31,775 94,964 (3) (12,451) (24) () sis (Q) (1, (1)7) (12.769) (3,000) (32,000) (a,soo) (17,347)2.052 432194320259 1101 2cog 2.698 (142,47:4) 2) 258 00.596 (29y) (12734) (0) 4) [t,389) 11109 (45.977) (56274)(26) 485 407 (1,570) (12.150) chazi) (t66,409) 14,338 107,447 (43) (11.247) (241). 24.954 R.500) 343 749 (1,492) (11. 801) (25 253) 27,116 10,444 37.276(17.710)2.191 4. 5 1,316 4 13.252 See accompering Notes is Censcidated Fincicial statements See accomparying Notes Is Conscidated Finucial tatements

A) What were the total cost and book value of property, plant and equipment at September 40, 2017?

B) What was rhe amount of depreciation and amoratization expense for each of the 3 years 2015-2017?

C) Using the statement of cash flows, what are the amounts of property, plant and equipment purchase in 2017 and 2016?

Appendix A:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started