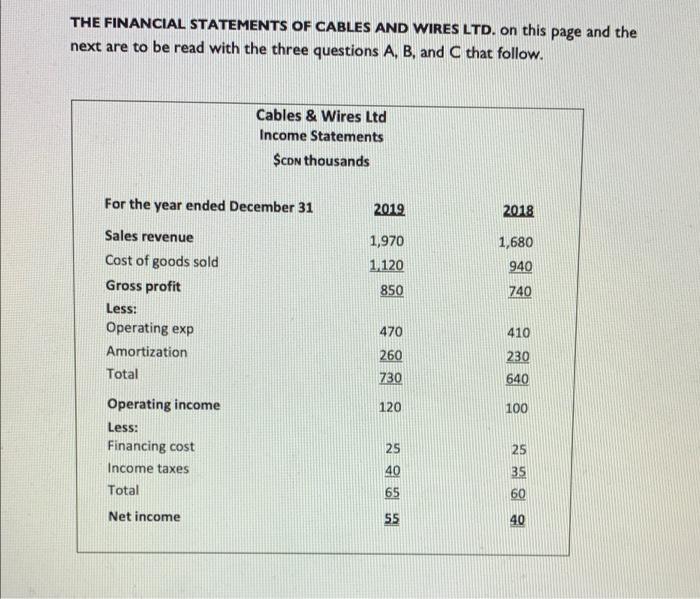

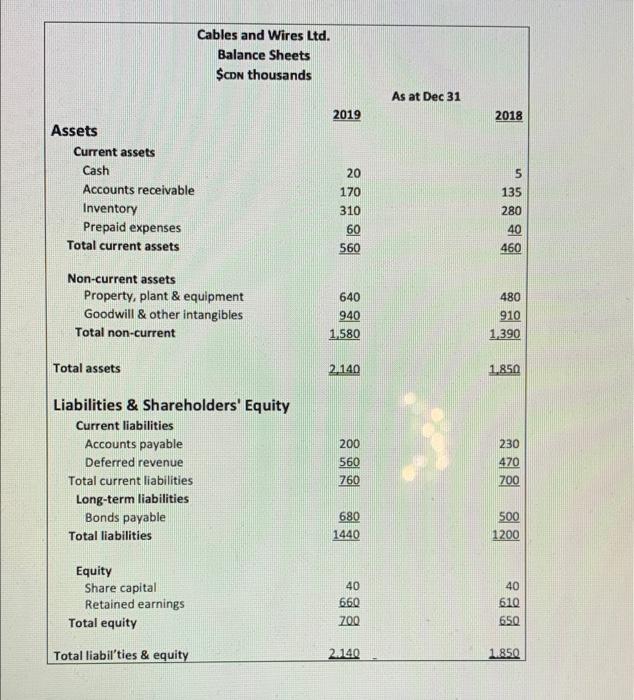

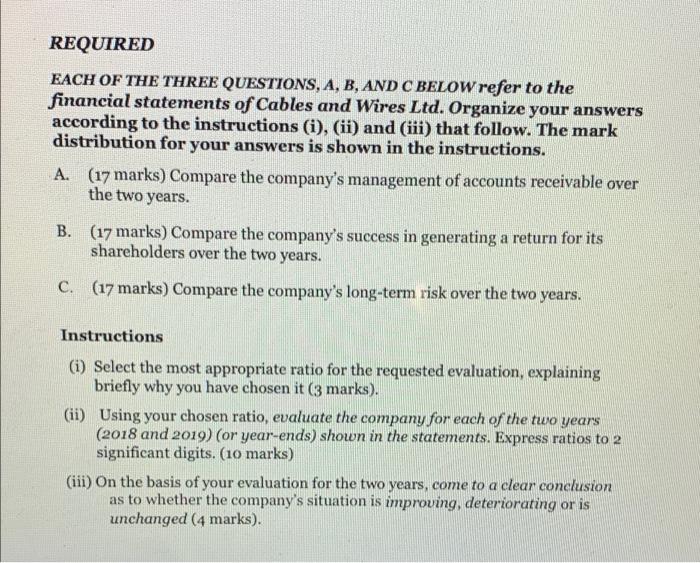

THE FINANCIAL STATEMENTS OF CABLES AND WIRES LTD. on this page and the next are to be read with the three questions A, B, and C that follow. Cables & Wires Ltd Income Statements $con thousands For the year ended December 31 2019 2018 1,680 1,970 1,120 850 940 740 Sales revenue Cost of goods sold Gross profit Less: Operating exp Amortization Total 410 470 260 730 230 640 120 100 Operating income Less: Financing cost Income taxes Total 25 25 40 35 60 65 Net income 55 40 Cables and Wires Ltd. Balance Sheets $con thousands As at Dec 31 2019 2018 5 Assets Current assets Cash Accounts receivable Inventory Prepaid expenses Total current assets 20 170 310 135 280 40 460 60 560 Non-current assets Property, plant & equipment Goodwill & other intangibles Total non-current 640 940 1.580 480 910 1,390 Total assets 20140 1.850 Liabilities & Shareholders' Equity Current liabilities Accounts payable Deferred revenue Total current liabilities Long-term liabilities Bonds payable Total liabilities 200 560 760 230 470 700 680 500 1200 1440 Equity Share capital Retained earnings Total equity 40 660 70,0 40 610 650 Total liabil'ties & equity 2140 1.850 REQUIRED EACH OF THE THREE QUESTIONS, A, B, AND C BELOW refer to the financial statements of Cables and Wires Ltd. Organize your answers according to the instructions (i), (ii) and (iii) that follow. The mark distribution for your answers is shown in the instructions. A. (17 marks) Compare the company's management of accounts receivable over the two years. B. (17 marks) Compare the company's success in generating a return for its shareholders over the two years. c. (17 marks) Compare the company's long-term risk over the two years. Instructions (i) Select the most appropriate ratio for the requested evaluation, explaining briefly why you have chosen it (3 marks). (ii) Using your chosen ratio, evaluate the company for each of the two years (2018 and 2019) (or year-ends) shown in the statements. Express ratios to 2 significant digits. (10 marks) (iii) On the basis of your evaluation for the two years, come to a clear conclusion as to whether the company's situation is improving, deteriorating or is unchanged (4 marks)