Answered step by step

Verified Expert Solution

Question

1 Approved Answer

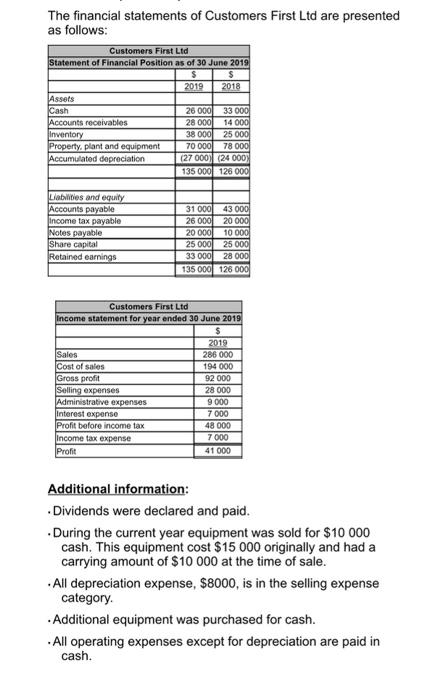

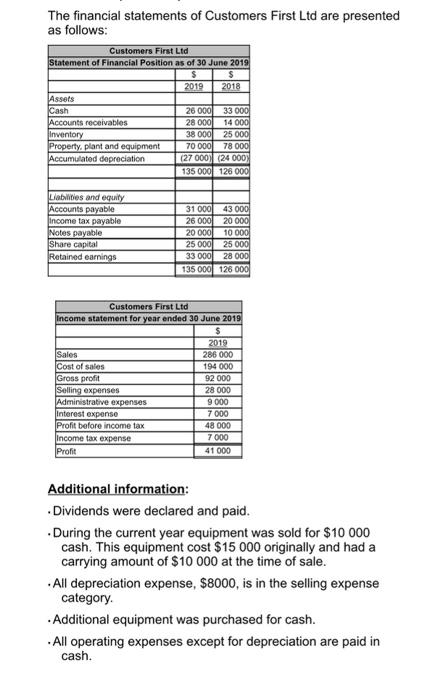

The financial statements of Customers First Ltd are presented as follows: Customers First Ltd Statement of Financial Position as of 30 June 2019 $ $

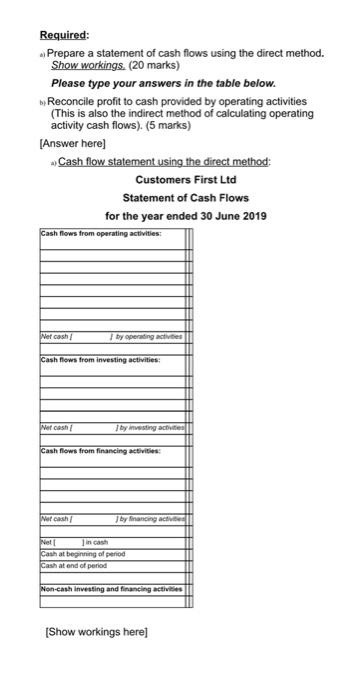

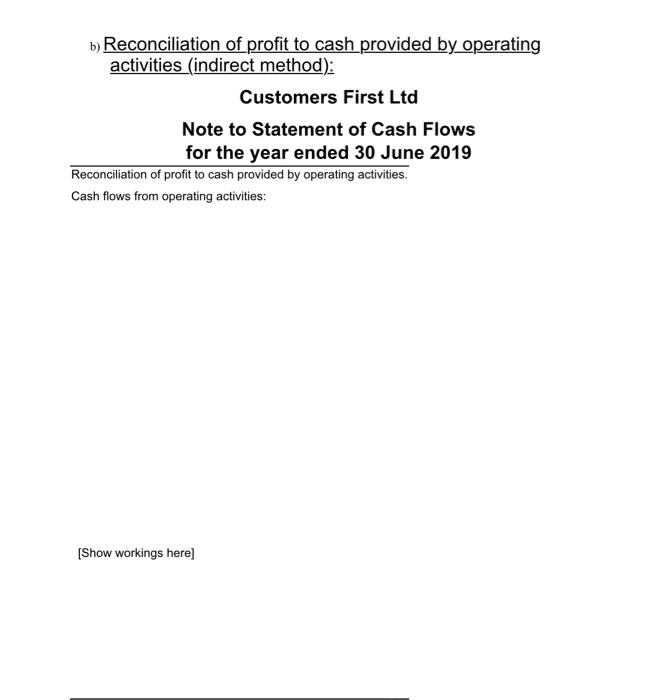

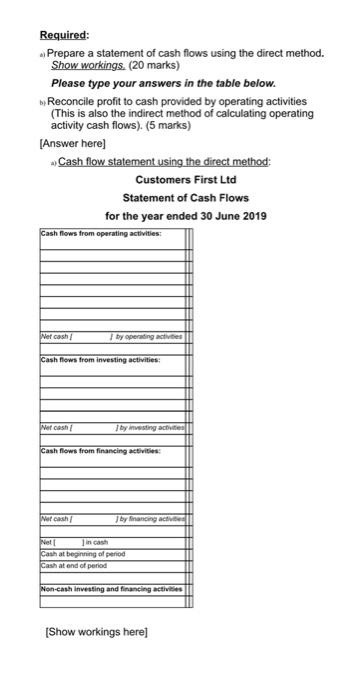

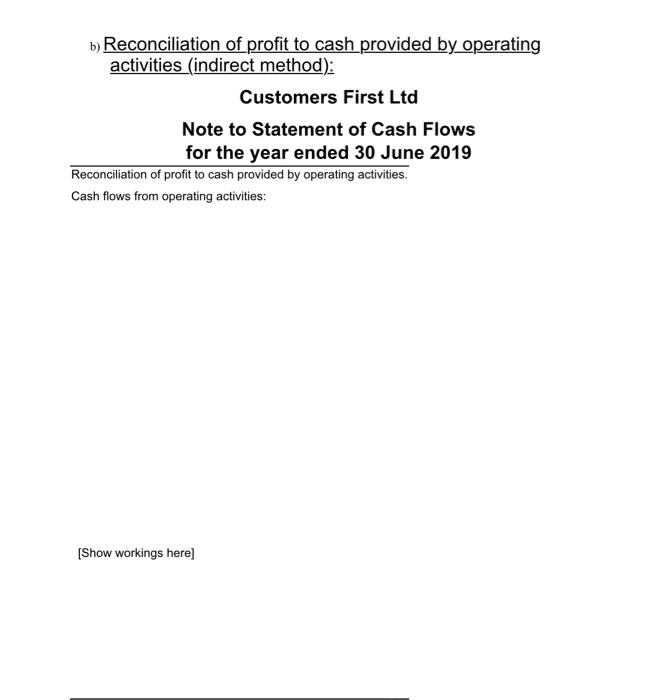

The financial statements of Customers First Ltd are presented as follows: Customers First Ltd Statement of Financial Position as of 30 June 2019 $ $ 2019 2018 Assets Cash 26 000 33 000 Accounts receivables 28 000 14 000 Inventory 38 000 25 000 Property, plant and equipment 70 000 78 000 Accumulated depreciation (27 000) (24 000) 135 000 126 000 Liabilities and equity Accounts payable income tax payable Notes payable Share capital Retained earnings 31 000 43 000 26 000 20 000 20 000 10 000 25 000 25 000 33 000 28 000 135 000 126 000 Customers First Ltd Income statement for year ended 30 June 2019 $ 2019 Sales 286 000 Cost of sales 194 000 Gross profit 92 000 Selling expenses 28 000 Administrative expenses 9 000 Interest expense 7 000 Profit before income tax 48 000 Income tax expense 7 000 Profit 41 000 Additional information: Dividends were declared and paid. During the current year equipment was sold for $10 000 cash. This equipment cost $15 000 originally and had a carrying amount of $10 000 at the time of sale. All depreciation expense, $8000, is in the selling expense category. Additional equipment was purchased for cash. All operating expenses except for depreciation are paid in cash. Required: Prepare a statement of cash flows using the direct method. Show workings. (20 marks) Please type your answers in the table below. Reconcile profit to cash provided by operating activities (This is also the indirect method of calculating operating activity cash flows). (5 marks) [Answer here) Cash flow statement using the direct method: Customers First Ltd Statement of Cash Flows for the year ended 30 June 2019 Cash flows from operating activities et cash/ by operating actives Cash flows from investing activities Nefcash I by investing activities Cash flows from financing activities: Nel cash Jby financing at Net in cash Cash at beginning of period Cash at end of period Non-cash investing and financing activities [Show workings here) b) Reconciliation of profit to cash provided by operating activities (indirect method): Customers First Ltd Note to Statement of Cash Flows for the year ended 30 June 2019 Reconciliation of profit to cash provided by operating activities. Cash flows from operating activities: (Show workings here)

The financial statements of Customers First Ltd are presented as follows: Customers First Ltd Statement of Financial Position as of 30 June 2019 $ $ 2019 2018 Assets Cash 26 000 33 000 Accounts receivables 28 000 14 000 Inventory 38 000 25 000 Property, plant and equipment 70 000 78 000 Accumulated depreciation (27 000) (24 000) 135 000 126 000 Liabilities and equity Accounts payable income tax payable Notes payable Share capital Retained earnings 31 000 43 000 26 000 20 000 20 000 10 000 25 000 25 000 33 000 28 000 135 000 126 000 Customers First Ltd Income statement for year ended 30 June 2019 $ 2019 Sales 286 000 Cost of sales 194 000 Gross profit 92 000 Selling expenses 28 000 Administrative expenses 9 000 Interest expense 7 000 Profit before income tax 48 000 Income tax expense 7 000 Profit 41 000 Additional information: Dividends were declared and paid. During the current year equipment was sold for $10 000 cash. This equipment cost $15 000 originally and had a carrying amount of $10 000 at the time of sale. All depreciation expense, $8000, is in the selling expense category. Additional equipment was purchased for cash. All operating expenses except for depreciation are paid in cash. Required: Prepare a statement of cash flows using the direct method. Show workings. (20 marks) Please type your answers in the table below. Reconcile profit to cash provided by operating activities (This is also the indirect method of calculating operating activity cash flows). (5 marks) [Answer here) Cash flow statement using the direct method: Customers First Ltd Statement of Cash Flows for the year ended 30 June 2019 Cash flows from operating activities et cash/ by operating actives Cash flows from investing activities Nefcash I by investing activities Cash flows from financing activities: Nel cash Jby financing at Net in cash Cash at beginning of period Cash at end of period Non-cash investing and financing activities [Show workings here) b) Reconciliation of profit to cash provided by operating activities (indirect method): Customers First Ltd Note to Statement of Cash Flows for the year ended 30 June 2019 Reconciliation of profit to cash provided by operating activities. Cash flows from operating activities: (Show workings here)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started