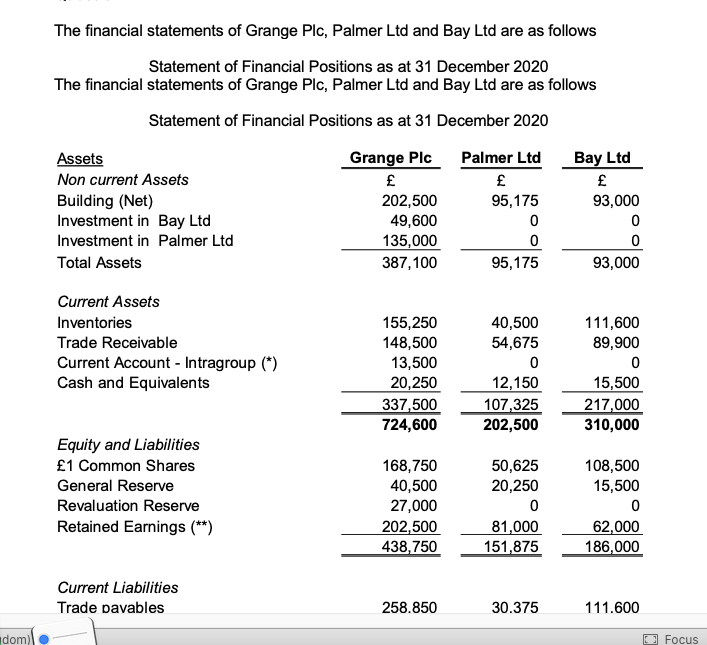

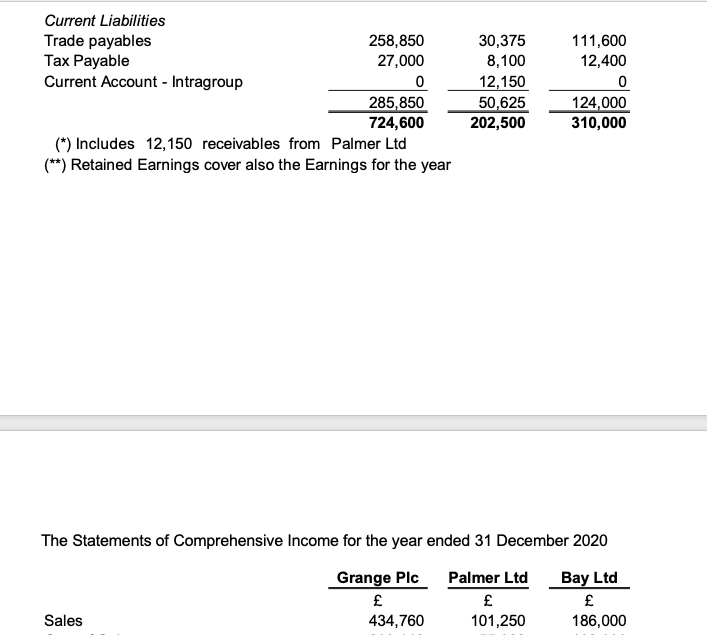

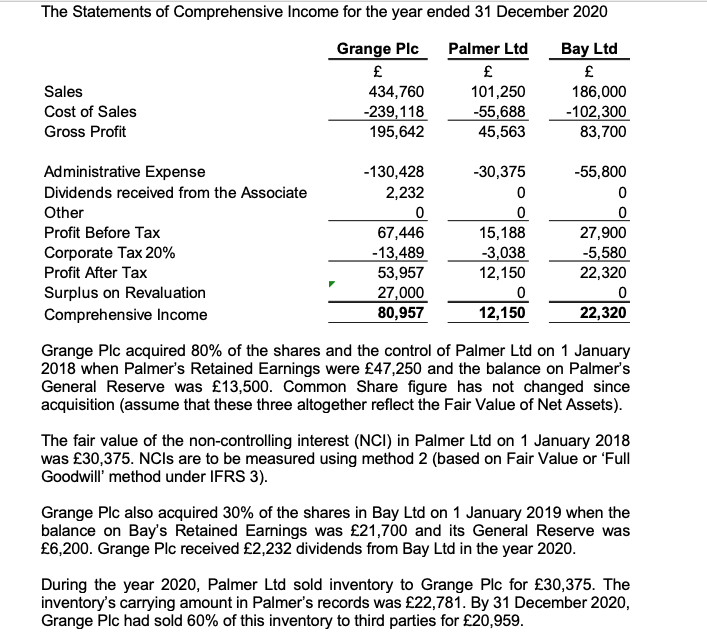

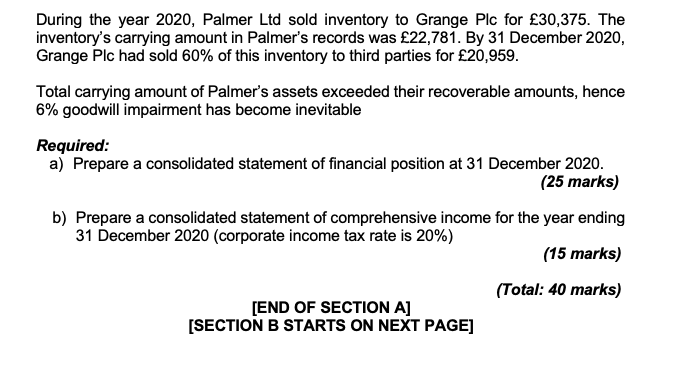

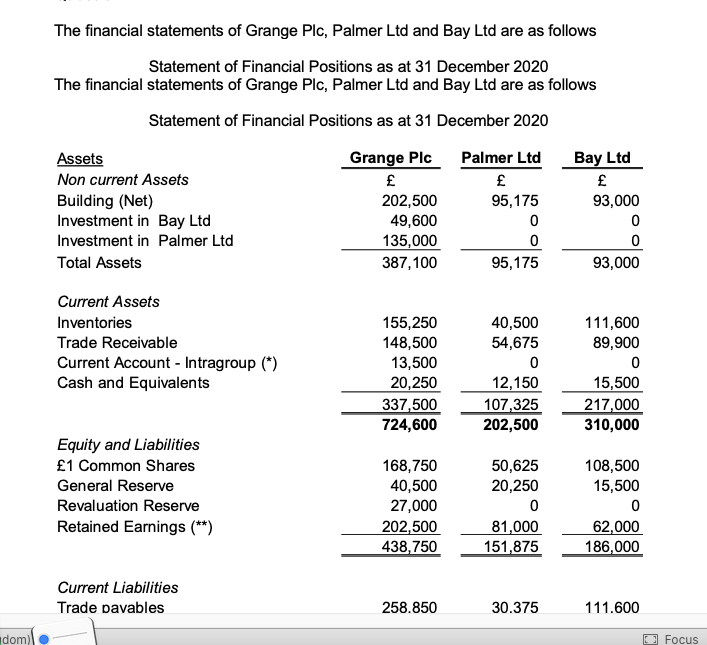

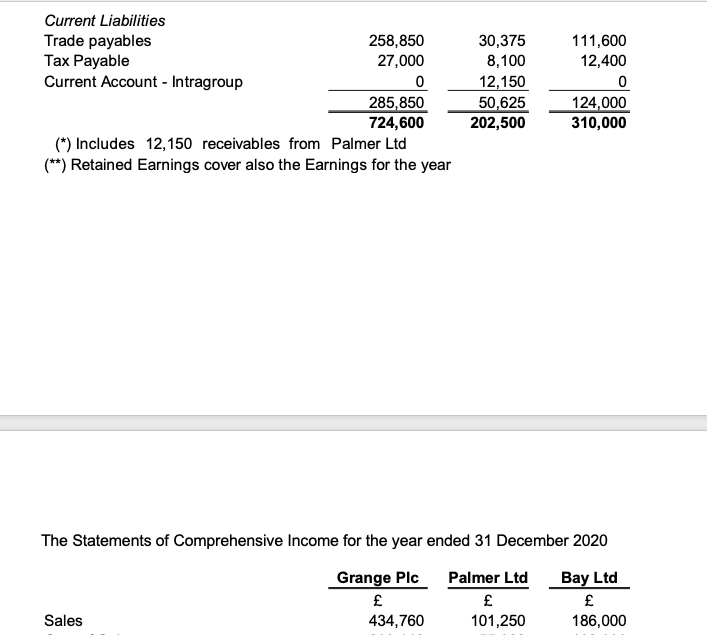

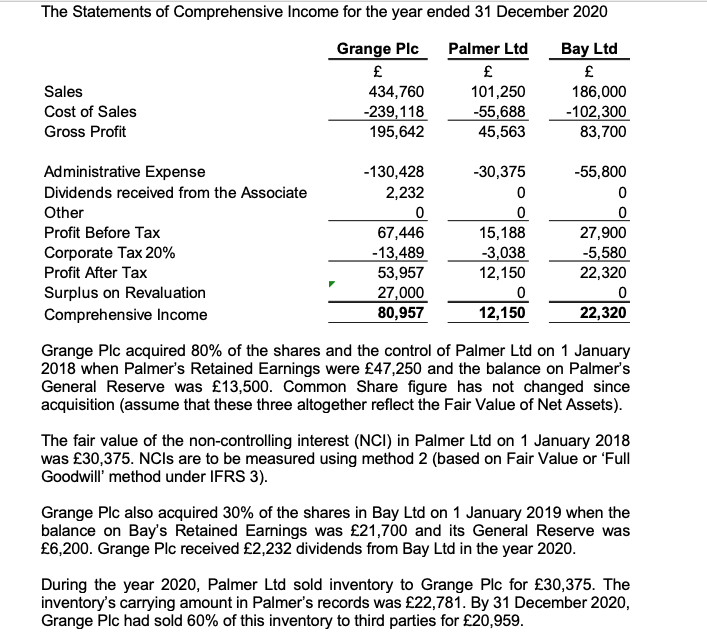

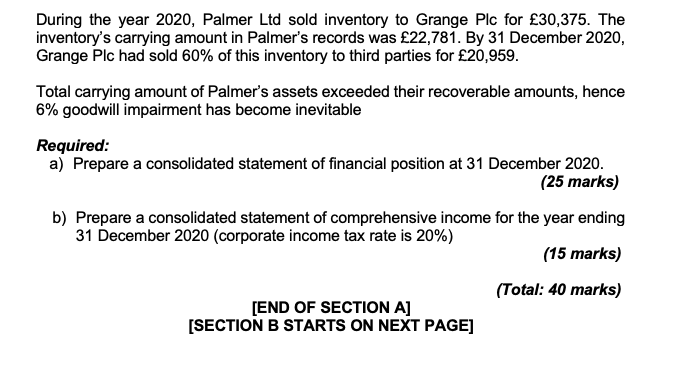

The financial statements of Grange Plc, Palmer Ltd and Bay Ltd are as follows Statement of Financial Positions as at 31 December 2020 The financial statements of Grange Plc, Palmer Ltd and Bay Ltd are as follows Statement of Financial Positions as at 31 December 2020 Assets Non current Assets Building (Net) Investment in Bay Ltd Investment in Palmer Ltd Total Assets Grange Pic 202,500 49,600 135,000 387,100 Palmer Ltd 95,175 0 0 95, 175 Bay Ltd 93,000 0 0 93,000 Current Assets Inventories Trade Receivable Current Account - Intragroup (*) Cash and Equivalents 155,250 148,500 13,500 20,250 337,500 724,600 40,500 54,675 0 12,150 107,325 202,500 111,600 89,900 0 15,500 217,000 310,000 Equity and Liabilities 1 Common Shares General Reserve Revaluation Reserve Retained Earnings (**) 168,750 40,500 27,000 202,500 438,750 50,625 20,250 0 81,000 151,875 108,500 15,500 0 62,000 186,000 Current Liabilities Trade pavables 258.850 30.375 111.600 dom) Focus Current Liabilities Trade payables 258,850 Tax Payable 27,000 Current Account - Intragroup 0 285,850 724,600 (*) Includes 12,150 receivables from Palmer Ltd (**) Retained Earnings cover also the Earnings for the year 30,375 8,100 12,150 50,625 202,500 111,600 12,400 0 124,000 310,000 The Statements of Comprehensive Income for the year ended 31 December 2020 Grange Plc 434,760 Palmer Ltd 101,250 Bay Ltd 186,000 Sales The Statements of Comprehensive Income for the year ended 31 December 2020 Sales Cost of Sales Gross Profit Grange Plc 434,760 -239,118 195,642 Palmer Ltd 101,250 -55,688 45,563 Bay Ltd 186,000 -102,300 83,700 Administrative Expense Dividends received from the Associate Other Profit Before Tax Corporate Tax 20% Profit After Tax Surplus on Revaluation Comprehensive Income -130,428 2,232 0 67,446 -13,489 53,957 27,000 80,957 -30,375 0 0 15,188 -3,038 12,150 0 12,150 -55,800 0 0 27,900 -5,580 22,320 0 22,320 Grange Plc acquired 80% of the shares and the control of Palmer Ltd on 1 January 2018 when Palmer's Retained Earnings were 47,250 and the balance on Palmer's General Reserve was 13,500. Common Share figure has not changed since acquisition (assume that these three altogether reflect the Fair Value of Net Assets). The fair value of the non-controlling interest (NCI) in Palmer Ltd on 1 January 2018 was 30,375. NCls are to be measured using method 2 (based on Fair Value or 'Full Goodwill method under IFRS 3). Grange Plc also acquired 30% of the shares in Bay Ltd on 1 January 2019 when the balance on Bay's Retained Earnings was 21,700 and its General Reserve was 6,200. Grange Plc received 2,232 dividends from Bay Ltd in the year 2020. During the year 2020, Palmer Ltd sold inventory to Grange Plc for 30,375. The inventory's carrying amount in Palmer's records was 22,781. By 31 December 2020, Grange Plc had sold 60% of this inventory to third parties for 20,959. During the year 2020, Palmer Ltd sold inventory to Grange Plc for 30,375. The inventory's carrying amount in Palmer's records was 22,781. By 31 December 2020, Grange Plc had sold 60% of this inventory to third parties for 20,959. Total carrying amount of Palmer's assets exceeded their recoverable amounts, hence 6% goodwill impairment has become inevitable Required: a) Prepare a consolidated statement of financial position at 31 December 2020. (25 marks) b) Prepare a consolidated statement of comprehensive income for the year ending 31 December 2020 (corporate income tax rate is 20%) (15 marks) (Total: 40 marks) [END OF SECTION A] [SECTION B STARTS ON NEXT PAGE] The financial statements of Grange Plc, Palmer Ltd and Bay Ltd are as follows Statement of Financial Positions as at 31 December 2020 The financial statements of Grange Plc, Palmer Ltd and Bay Ltd are as follows Statement of Financial Positions as at 31 December 2020 Assets Non current Assets Building (Net) Investment in Bay Ltd Investment in Palmer Ltd Total Assets Grange Pic 202,500 49,600 135,000 387,100 Palmer Ltd 95,175 0 0 95, 175 Bay Ltd 93,000 0 0 93,000 Current Assets Inventories Trade Receivable Current Account - Intragroup (*) Cash and Equivalents 155,250 148,500 13,500 20,250 337,500 724,600 40,500 54,675 0 12,150 107,325 202,500 111,600 89,900 0 15,500 217,000 310,000 Equity and Liabilities 1 Common Shares General Reserve Revaluation Reserve Retained Earnings (**) 168,750 40,500 27,000 202,500 438,750 50,625 20,250 0 81,000 151,875 108,500 15,500 0 62,000 186,000 Current Liabilities Trade pavables 258.850 30.375 111.600 dom) Focus Current Liabilities Trade payables 258,850 Tax Payable 27,000 Current Account - Intragroup 0 285,850 724,600 (*) Includes 12,150 receivables from Palmer Ltd (**) Retained Earnings cover also the Earnings for the year 30,375 8,100 12,150 50,625 202,500 111,600 12,400 0 124,000 310,000 The Statements of Comprehensive Income for the year ended 31 December 2020 Grange Plc 434,760 Palmer Ltd 101,250 Bay Ltd 186,000 Sales The Statements of Comprehensive Income for the year ended 31 December 2020 Sales Cost of Sales Gross Profit Grange Plc 434,760 -239,118 195,642 Palmer Ltd 101,250 -55,688 45,563 Bay Ltd 186,000 -102,300 83,700 Administrative Expense Dividends received from the Associate Other Profit Before Tax Corporate Tax 20% Profit After Tax Surplus on Revaluation Comprehensive Income -130,428 2,232 0 67,446 -13,489 53,957 27,000 80,957 -30,375 0 0 15,188 -3,038 12,150 0 12,150 -55,800 0 0 27,900 -5,580 22,320 0 22,320 Grange Plc acquired 80% of the shares and the control of Palmer Ltd on 1 January 2018 when Palmer's Retained Earnings were 47,250 and the balance on Palmer's General Reserve was 13,500. Common Share figure has not changed since acquisition (assume that these three altogether reflect the Fair Value of Net Assets). The fair value of the non-controlling interest (NCI) in Palmer Ltd on 1 January 2018 was 30,375. NCls are to be measured using method 2 (based on Fair Value or 'Full Goodwill method under IFRS 3). Grange Plc also acquired 30% of the shares in Bay Ltd on 1 January 2019 when the balance on Bay's Retained Earnings was 21,700 and its General Reserve was 6,200. Grange Plc received 2,232 dividends from Bay Ltd in the year 2020. During the year 2020, Palmer Ltd sold inventory to Grange Plc for 30,375. The inventory's carrying amount in Palmer's records was 22,781. By 31 December 2020, Grange Plc had sold 60% of this inventory to third parties for 20,959. During the year 2020, Palmer Ltd sold inventory to Grange Plc for 30,375. The inventory's carrying amount in Palmer's records was 22,781. By 31 December 2020, Grange Plc had sold 60% of this inventory to third parties for 20,959. Total carrying amount of Palmer's assets exceeded their recoverable amounts, hence 6% goodwill impairment has become inevitable Required: a) Prepare a consolidated statement of financial position at 31 December 2020. (25 marks) b) Prepare a consolidated statement of comprehensive income for the year ending 31 December 2020 (corporate income tax rate is 20%) (15 marks) (Total: 40 marks) [END OF SECTION A] [SECTION B STARTS ON NEXT PAGE]