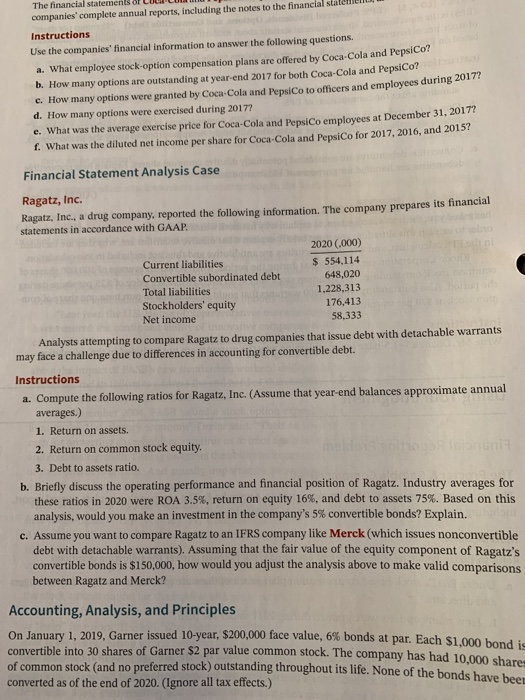

The financial statements of LLLL companies' complete annual reports, including the notes to the financial staten , Instructions Use the companies' financial information to answer the following questions. a. What employee stock option compensation plans are offered by Coca-Cola and repic b. How many options are outstanding at year-end 2017 for both Coca-Cola and Pepsicon c. How many options were granted by Coca-Cola and PepsiCo to officers and employees during on d. How many options were exercised during 2017? e. What was the average exercise price for Coca-Cola and PepsiCo employees at December 31, 2017 1. What was the diluted net income per share for Coca-Cola and PepsiCo for 2017, 2016, and 2013 Financial Statement Analysis Case Ragatz, Inc. Ragatz, Inc., a drug company reported the following information. The company prepares its financial statements in accordance with GAAP. 2020 .000) Current liabilities $ 554.114 Convertible subordinated debt 648,020 Total liabilities 1,228,313 Stockholders' equity 176,413 Net income 58,333 Analysts attempting to compare Ragatz to drug companies that issue debt with detachable warrants may face a challenge due to differences in accounting for convertible debt. Instructions a. Compute the following ratios for Ragatz, Inc. (Assume that year-end balances approximate annual averages.) 1. Return on assets. 2. Return on common stock equity. 3. Debt to assets ratio. b. Briefly discuss the operating performance and financial position of Ragatz. Industry averages for these ratios in 2020 were ROA 3.5%, return on equity 16%, and debt to assets 75%. Based on this analysis, would you make an investment in the company's 5% convertible bonds? Explain. c. Assume you want to compare Ragatz to an IFRS company like Merck (which issues nonconvertible debt with detachable warrants). Assuming that the fair value of the equity component of Ragatz's convertible bonds is $150,000, how would you adjust the analysis above to make valid comparisons between Ragatz and Merck? Accounting, Analysis, and Principles On January 1, 2019. Garner issued 10-year, $200,000 face value, 6% bonds at par. Each $1.000 hond convertible into 30 shares of Garner $2 par value common stock. The company has had 10.000 sha of common stock (and no preferred stock) outstanding throughout its life. None of the bonds have be converted as of the end of 2020. (Ignore all tax effects.)