Answered step by step

Verified Expert Solution

Question

1 Approved Answer

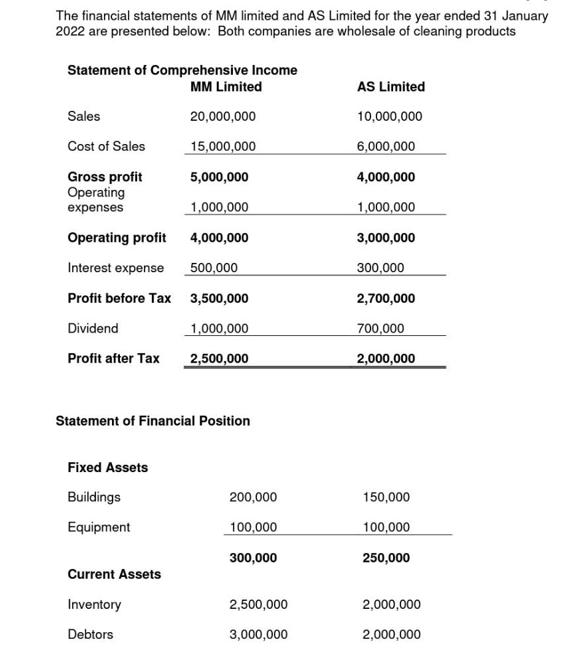

The financial statements of MM limited and AS Limited for the year ended 31 January 2022 are presented below: Both companies are wholesale of

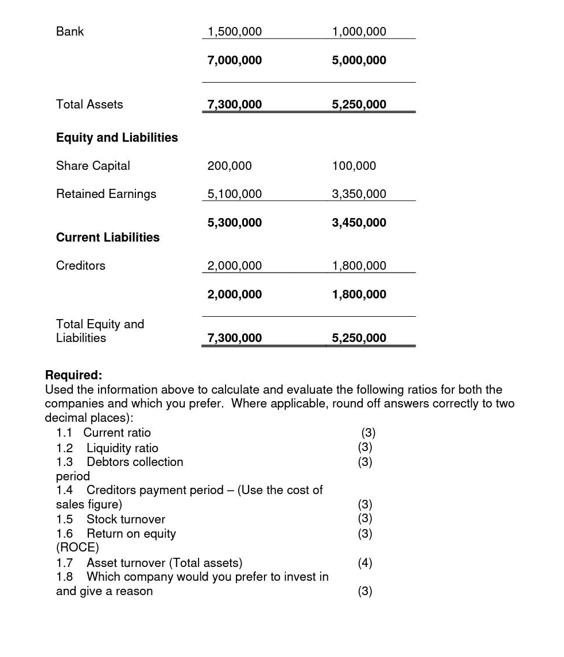

The financial statements of MM limited and AS Limited for the year ended 31 January 2022 are presented below: Both companies are wholesale of cleaning products Statement of Comprehensive Income MM Limited Sales 20,000,000 Cost of Sales 15,000,000 Gross profit 5,000,000 Operating expenses 1,000,000 Operating profit 4,000,000 Interest expense 500,000 Profit before Tax 3,500,000 Dividend 1,000,000 Profit after Tax 2,500,000 Statement of Financial Position Fixed Assets Buildings Equipment Current Assets Inventory Debtors 200,000 100,000 300,000 2,500,000 3,000,000 AS Limited 10,000,000 6,000,000 4,000,000 1,000,000 3,000,000 300,000 2,700,000 700,000 2,000,000 150,000 100,000 250,000 2,000,000 2,000,000 Bank Total Assets Equity and Liabilities Share Capital Retained Earnings Current Liabilities Creditors Total Equity and Liabilities 1,500,000 7,000,000 1.2 Liquidity ratio 1.3 Debtors collection 7,300,000 200,000 5,100,000 5,300,000 2,000,000 2,000,000 7,300,000 1,000,000 5,000,000 period 1.4 Creditors payment period - (Use the cost of sales figure) 1.5 Stock turnover 1.6 Return on equity (ROCE) 1.7 Asset turnover (Total assets) 1.8 Which company would you prefer to invest in and give a reason 5,250,000 100,000 3,350,000 3,450,000 1,800,000 1,800,000 Required: Used the information above to calculate and evaluate the following ratios for both the companies and which you prefer. Where applicable, round off answers correctly to two decimal places): 1.1 Current ratio (3) 5,250,000 (4) (3)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the ratios for both MM Limited and AS Limited well use the provided financial information Here are the calculations and evaluations for each ratio 11 Current Ratio Current Ratio Current A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started