Question

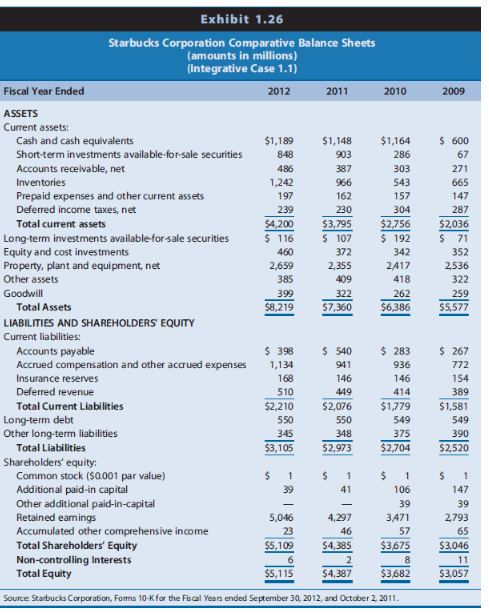

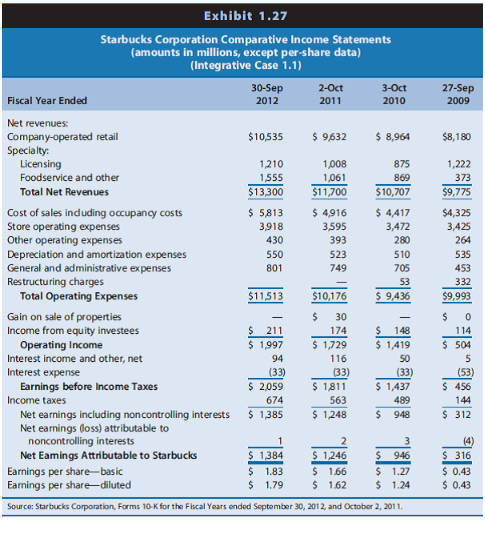

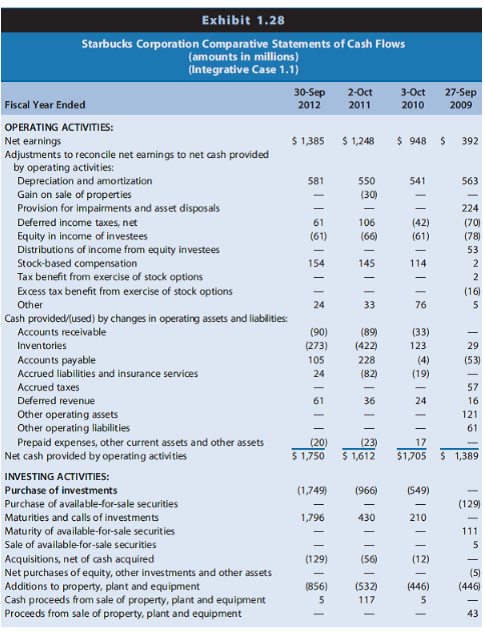

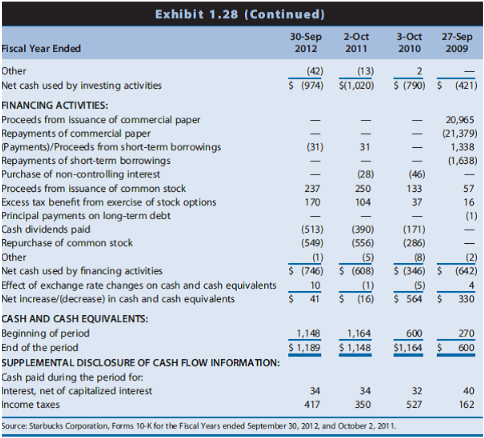

The financial statements of Starbucks Corporation are presented in exhibits 1.26-1.28. The income tax note to those financial statements reveals the information regarding income taxes

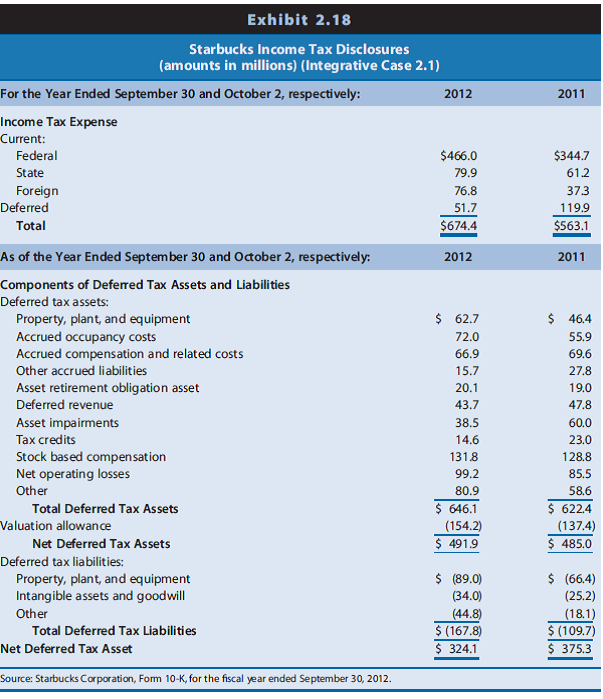

The financial statements of Starbucks Corporation are presented in exhibits 1.26-1.28. The income tax note to those financial statements reveals the information regarding income taxes shown in exhibit 2.18

.

.

C. Starbucks rents retail space for its coffee shops. It must recognize rent expense as it uses rental facilities but cannot claim an income tax deduction until it pays cash to the land-lord. Suggest the scenario that would give rise to a deferred tax asset instead of a deferred tax liability related to occupancy cost. (accrued occupancy costs)

D. Starbucks recognizes an expense related to retirement benefits as employees rendered services but cannot claim an income tax deduction until it pays cash to a retirement fund. Why do the deferred taxes for defferred compensation appear as a deferred tax asset ("Accrued compensation and related costs")? Suggest possible reasons why the deferred tax asset decreased slightly between the end of 2011 and the end of 2012.

Exhibit 1.26 Starbucks Corporation Comparative Balance Sheets (amounts in millions) (Integrative Case 1.1) Fiscal Year Ended 2012 2011 2010 ASSETS Current assets: $1,189 $1,148 $1,164 600 Cash and cash equivalents Short-term investments available for sale securities 903 67 Accounts receivable, net 387 303 271 Inventories 1,242 543 665 Prepaid expenses and other current assets 197 162 157 147 Deferred income taxes, net 287 304 $4,200 $3,795 $2,756 Total cument assets $2036 Long-term investments available forsale securities 116 107 192 71 Equity and cost investments 372 352 Property, plant and equipment, net 2,659 2,355 2A17 2536 Other assets 385 418 322 Goodwi 399 322 262 259 Total Assets $8,219 $7,360 $6.386 $5577 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: 398 540 283 267 Accounts payable Accrued compensation and other acaued expenses 1,134 941 936 772 Insurance reserves 168 146 146 154 Deferred revenue 510 449 414 389 Total Curent Liabilities $2,210 $2,076 $1,779 $1,581 Long-term debt 550 549 549 Other long-term liabilities 345 375 390 348 $3,105 $2,704 Total Liabilities $2,973 $2,520 Shareholders' equity: Common stock ($0.001 par value) Additional paid-in capital 41 106 147 other additional paid in-capital 39 39 Retained earnings 5,046 4,297 3A71 2793 Accumulated other comprehensive income 57 65 Total Shareholders' Equity $5,109 $4,385 $3675 $3046 Non-controlling interests Total Equity $5,115 $4,387 $3682 $3,057 Source Starbucks Corporation, Forms 10-K for the Fisal Years ended September 30, 2012, and October 2, 2011Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started